NEW YORK CITY — American Lions, which is a joint venture between locally based developers Fetner Properties and Lions Group, has received a $111 million bridge loan for the refinancing of The Bold, a 164-unit apartment building in Queens. Designed by SLCE Architects, the 28-story building is located at 2701 Jackson Ave. in the borough’s Long Island City area and includes 50 affordable housing residences. Units come in studio, one-, two- and three-bedroom floor plans. The amenity package consists of a coworking lounge, gym with a climbing wall, party room with a bar and kitchen, clubhouse lounge, media room and a golf simulator room. Christopher Peck, Nicco Lupo, Michael Shmuely, Alex Staikos and Adam Dietrich of JLL arranged the loan through PGIM Real Estate.

New York

NEW YORK CITY — RillaVoice Inc. has signed a 57,350-square-foot office lease in Brooklyn’s Williamsburg district. The AI-powered communications firm has committed to the entire eighth floor at 25 Kent, a 500,000-square-foot building, for a 10-year term. Cooper Weisman and Ryan Gessin of Newmark represented RillaVoice in the lease negotiations. Jordan Gosin, Will Grover and Drew Wiley, also with Newmark, along with internal agents Craig Panzirer and Alex Radmin, represented the landlord, Global Holdings.

FLORIDA, N.Y. — Amazon has purchased a 143-acre industrial development site in Florida, located about 65 miles northwest of New York City near the New York-New Jersey border. The fully entitled site is located along State Highway 5 and has all major utilities already in place. Amazon did not announce specific development plans for the site, but the facility will be known as Mohawk Valley Industrial Center. Jim Panczykowski of JLL led a team that marketed the site on behalf of the seller, regional investment and development firm Winstanley Enterprises.

NEW YORK CITY — Largo Capital, a financial intermediary based in upstate New York, has arranged $76 million in construction-to-permanent financing for an office-to-residential conversion project in Lower Manhattan. The project will redevelop the historic, 21-story office building at 2 Wall St. into a 211-unit apartment complex. Jack Phillips of Largo Capital structured the debt. The direct lender was not disclosed. The borrower was also not disclosed, but the building is listed on the website of local landlord George Comfort & Sons.

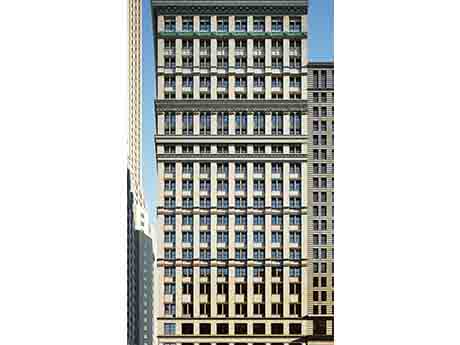

NEW YORK CITY — Purple has signed a 24,000-square-foot office lease in Manhattan’s NoMad district. The global communications firm is relocating from 322 Eighth Avenue to the entire fourth floor of 16 Madison Square West, a 12-story building that was originally constructed in 1914. Jeff Buslik and Ben Levy represented the landlord, Adams & Co., in the lease negotiations on an internal basis. Simon Landmann, Harrison Potter and Graham Jameson of JLL represented Purple.

NEW YORK CITY — JLL has negotiated the $53 million sale of a mixed-use development site in Lower Manhattan’s Financial District. The site at 75–83 Nassau St. offers approximately 275,000 square feet of permitted zoning floor area, including 225,000 square feet of residential space that could yield as many as 265 units. Andrew Scandalios, Ethan Stanton, Jonathan Hageman and Michael Mazzara of JLL represented the seller, New York-based investment firm Lexin Capital, in the transaction. The buyer, a partnership between Fulltime Management and Montgomery Street Partners, plans to develop a residential building with ground-floor retail and second-floor commercial space.

NEW YORK CITY — JLL has arranged the $129 million sale of Henry Hall, a 33-story multifamily building located at 515 W. 38th St. in Manhattan’s Hudson Yards district. Completed in 2017, Henry Hall houses 225 units in studio, one- and two-bedroom floor plans, in addition to 12,500 square feet of ground-floor retail space. Amenities include a fitness center, landscaped terrace and a “jam room” with professional music recording equipment. Jeffrey Julien, Rob Hinckley, Steven Binswanger, Steven Rutman and Devon Warren of JLL represented the seller, a joint venture between Shorenstein Investment Advisers and Dreamscape Cos., in the transaction. Geoff Goldstein and Christopher Pratt, also with JLL, arranged a $71 million acquisition loan for the deal through U.S. Bank on behalf of the buyer, Amstar Group.

FARMINGVILLE, N.Y. — JLL has arranged the $190 million sale of The Arboretum, a 292-unit, newly constructed multifamily property in Farmingville, located on Long Island. The site spans 62 acres, and the development features a mix of single-family homes and garden-style apartments. Residences come in two- and three-bedroom floor plans and have an average size of 1,682 square feet, with 30 units reserved for workforce housing. The amenity package comprises a fitness center with a yoga room, pool and cabana area, clubhouse with an entertainment kitchen, courts for tennis, pickleball and bocce ball, a putting green, playground, dog run and a business center with conference rooms. Jose Cruz, Steve Simonelli, Rob Hinckley and Austin Pierce of JLL represented the seller, BRP Cos., in the transaction. The buyer was an affiliate of The Inland Real Estate Group of Cos.

NEW YORK CITY — Fashion wholesaler Amiee Lynn Inc. has signed a 29,000-square-foot office lease extension in Manhattan’s Garment District. The lease term is five years and seven months, and the space spans the entire 10th and 11th floors of 366 Fifth Avenue, a 12-story historic building. Woody King, Noah Caspi and Todd Korren of Lee & Associates represented the tenant in the lease negotiations. Michael Joseph and Aidan Campbell of Colliers represented the landlord, Joseph P. Day Realty.

NEW YORK CITY — GFP Real Estate has received $191.5 million in financing for the office-to-residential conversion of 40 Exchange Place, a historic 300,000-square-foot building in Lower Manhattan’s Financial District. Upon completion, the 20-story converted building will include 382 affordable and market-rate apartments, as well as ground-floor retail space. In addition to the loan, the project will be backed by federal and state historic rehabilitation tax credits as well as a 35-year 457-m tax abatement, a New York City incentive designed to support office-to-residential conversions. Jordan Roeschlaub, Chris Kramer and Tim Polglase of Newmark arranged the financing through Derby Lane. A construction timeline was not announced.

Newer Posts