NEW YORK CITY — Cushman & Wakefield has negotiated a 20,000-square-foot office lease at 41 Flatbush Ave. in Brooklyn. The 10-story, 269,530-square-foot structure is known locally as The Pioneer Building and recently underwent a capital improvement program. Jason Kroeger and Frank Liantonio of Cushman & Wakefield represented the tenant, nonprofit organization Safe Horizon, which will occupy part of the sixth floor, in the lease negotiations. The name and representative of the landlord were not disclosed.

New York

NEW YORK CITY — The Joyce Theater Foundation has acquired a civic building located at 287 E. 10th St. in Manhattan’s East Village for $16 million. The seven-story, 58,000-square-foot building formerly housed a Boys & Girls Club facility, and the Joyce Theater plans to use the space for rehearsal, performance and administrative purposes. Paul Wolf of nonprofit advisory firm Denham Wolf Real Estate Services negotiated the sale of the building. The seller was not disclosed.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $4.5 million sale of a 39,130-square-foot multifamily development site in the Bedford Park area of The Bronx. The site at 3165 Villa Ave. is approved for up to 57 units of residential development. Victor Sozio, Benjamin Vago, Daniel Mahfar and Jason Gold of Ariel Property Advisors brokered the deal. The buyer and seller were not disclosed.

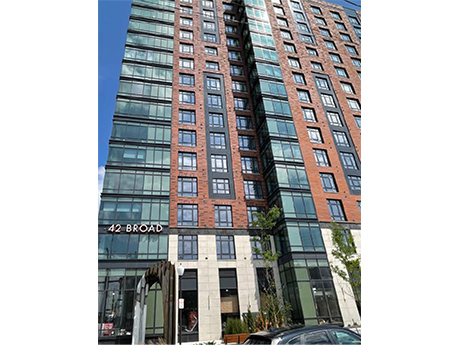

MOUNT VERNON, N.Y. — Canadian institutional investment firm Otera Capital has provided a $93 million loan for the refinancing of a 249-unit multifamily property in Mount Vernon, about 20 miles north of Manhattan. The 16-story building at 42 W. Broad St. houses studio, one-, two- and three-bedroom units. Amenities include a pool, fitness center, game room, entertainment kitchen, outdoor dining areas, coworking spaces, library and a courtyard garden. Kellogg Gaines and Geoff Goldstein of JLL arranged the financing. The borrower is a joint venture between two New York City-based firms, Alexander Development Group and The Bluestone Organization, and institutional investors advised by JP Morgan Asset Management.

ITHACA, N.Y. — Largo Capital, a financial intermediary based in the Buffalo area, has arranged a $40.5 million loan for the refinancing of a 64,500-square-foot medical office building in downtown Ithaca. The newly developed building is located on the Cayuga Park healthcare campus and houses a walk-in clinic, specialized care for complex illnesses, diagnostic imaging facility, outpatient clinic and a comprehensive women’s health center. Ned Perlman of Largo Capital arranged the debt. The borrower and direct lender were not disclosed.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $5.2 million sale of a 27,000-square-foot warehouse located in the Mount Eden area of The Bronx that was originally built in 1920, according to propertyshark.com. The site at 1419 Inwood Ave. can support up to 87,000 square feet of development. Jason Gold and Daniel Mahfar of Ariel represented the undisclosed seller in the transaction. The buyer was also not disclosed.

NEW YORK CITY — Dwight Mortgage Trust, the affiliate REIT of locally based lender Dwight Capital, has provided $100 million in bridge financing for a 168-unit apartment building located at 224 W. 124th St. in West Harlem. The 19-story building was completed earlier this year and offers one-, two- and three-bedroom units, as well as townhomes and penthouse suites. Roughly 30 percent (51) of the residences are reserved as affordable housing. Amenities include a fitness center, children’s playroom, business lounge and a rooftop deck. The borrower and developer, Carthage Real Estate Advisors, will use the proceeds to refinance existing construction debt and fund lease-up of the property and other capital expenditures.

HOLBROOK, N.Y. — Regency Centers has begun the redevelopment of the 280,000-square-foot former SunVet Mall in the Long Island community of Holbrook. Regency has rebranded the 50-year-old property as The Shops at SunVet and plans to reposition it as a 168,000-square-foot, open-air shopping center with six outparcels. Whole Foods Market will anchor the center. Demolition of the existing structure is underway, and new construction is scheduled to begin in spring 2024. SBLM Architects is the lead architect on the project.

MOUNT SINAI, N.Y. — CBRE has negotiated the sale of Sutton Landing at Mount Sinai, a 225-unit active adult property located in the Long Island community of Mount Sinai. Built in 2021 by Long Island-based B2K Development, Sutton Landing at Mount Sinai features apartments and single-family rentals for residents age 55 and over. Amenities include a pool, pickleball courts, putting greens, fitness center with yoga and Pilates studios, massage room, game room, a lounge area with a sports bar, catering kitchen and outdoor grilling and dining stations. Aron Will, John Sweeny and Scott Bray of CBRE represented B2K Development and its partner, Chicago-based Harrison Street, in the transaction and procured the buyer, New York-based Fairfield Properties. A CBRE team of Shawn Rosenthal, Jason Gaccione, Jake Salkovitz, Aron Will, Matthew Kuronen and Michael Cregan arranged Freddie Mac acquisition financing for the deal.

NEW YORK CITY — Marcus & Millichap has brokered the $48 million sale of Fannwood Estates, a 312-unit apartment complex in Queens. The six-story, rent-stabilized building occupies a full city block within the borough’s Rego Park neighborhood. Shaun Riney, Seth Glasser, Joe Koicim, Louis Zarif and Sean Fopeano of Marcus & Millichap represented the seller and procured the buyer in the transaction. Both parties were private investors that requested anonymity.