NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $6.8 million sale of a five-story building in Brooklyn’s Borough Park neighborhood that comprises four four-bedroom apartments and 6,611 square feet of retail space. Aaron Jungreis, Ben Khakshoor and Alex Fuchs of Rosewood Realty represented both private investors involved in the deal, which traded at a cap rate of 4.9 percent. The building was originally constructed in 1930.

New York

By Jason Penighetti, attorney, Koeppel Martone & Leistman LLC In a far-reaching decision, New York’s highest court has affirmed the rights of tenants under a commercial net lease to protest assessments and reduce their real property tax burden. The ruling reversed a State Supreme Court dismissal of a petition on the grounds that only a property’s owner can file an administrative grievance with the Board of Assessment Review. In a net lease, the tenant is responsible for paying real estate taxes and other expenses stated in the lease. In the matter of DCH Auto vs. Town of Mamaroneck, the Court of Appeals in June 2022 published a unanimous decision stating that tenants contractually obligated to pay real estate taxes and authorized to protest assessments may file tax appeals even when they do not hold title to the underlying real estate. Restoring a Precedent DCH Auto operated a car dealership in a net leased property in Mamaroneck, New York. Its lease with the owner required DCH to pay the property’s real estate taxes in addition to rent. Commercial tenants with this type of lease commonly file tax appeals to correct excessive tax bills and mitigate operating costs. These occupiers include retailers …

NEW YORK CITY — New York-based general contractor EW Howell Construction Group has completed PS 464, an elementary school in Manhattan’s Financial District. The school occupies 92,000 square feet across the first nine floors within 42 Trinity Place, a 40-story residential building, and serves students in grades pre-K through 5. In addition, the school’s south wing comprises four stories in the Robert & Anne Dickey House, a renovated historical building. In addition to new classrooms, the school features a science lab, art and music room, gymnasium, cafeteria and two outdoor playgrounds.

NEW YORK CITY — Five Iron Golf will open a 30,000-square-foot entertainment center at 101 Park Ave. in Manhattan. The space will house the concept’s signature golf simulators, widescreen TVs, leisure games and a full-service restaurant and bar. Anthony Dattoma of CBRE and Jason Goode of Compass Real Estate represented Five Iron Golf in the lease negotiations. John Cefaly and Nicholas Dysenchuk of Cushman & Wakefield represented the landlord, H.J. Kalikow & Co. A tentative opening date was not disclosed.

NEW YORK CITY — Carlyle has signed a 40,542-square-foot office lease at 340 Madison Avenue in Midtown Manhattan. The global investment and financial services firm has leased the entire eighth floor of the 745,312-square-foot building, which was originally constructed in 1928, for 10 years. Steve Rotter and Joe Messina of JLL represented the tenant in the lease negotiations. Paul Glickman, Matthew Astrachan, Cynthia Wasserberger and Dan Turkewitz, also with JLL, represented the landlord, RXR.

EAST GREENBUSH, N.Y. — Commercial finance and advisory firm Axiom Capital Corp. has arranged a $13.3 million permanent loan for the refinancing of a retail center in East Greenbush, roughly six miles southeast of Albany. The 301,894-square-foot property comprises six separate buildings and was leased to 16 tenants at the time of the loan closing. The names of the borrower, a development and management firm, and direct lender, a local bank, were not disclosed.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $6 million sale of an 18-unit apartment building in Harlem. The four-story building at 61-63 E. 125th St. was originally constructed in 1930. Aaron Jungreis, Ben Khakshoor and Alex Fuchs of Rosewood Realty represented the buyer, Sapphire Investments, and the seller, Madison Realty Capital, in the transaction. The deal traded at a cap rate of 5.5 percent.

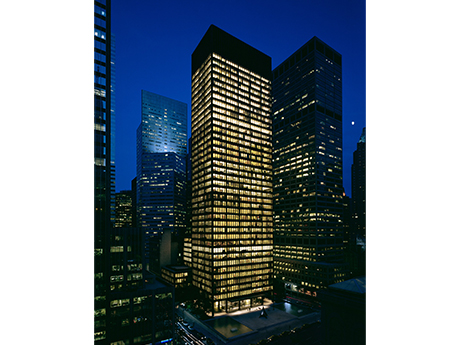

NEW YORK CITY — Global alternative asset manager Blue Owl Capital has signed a 137,660-square-foot office lease at 375 Park Avenue, a 38-story building in Manhattan. Known as The Seagram Building, 375 Park Avenue’s crowning amenity is a $25 million wellness center known as The Playground that houses an array of fitness facilities. Mark Weiss of Cushman & Wakefield represented the tenant in the lease negotiations. Peter Riguardi, Paul Glickman, Cynthia Wasserberger and Ben Bass of JLL represented the landlord, RFR Realty.

FRANKLIN SQUARE, N.Y. — Locally based grocer and caterer Holiday Farms Supermarket has opened a 20,000-square-foot store in the Long Island community of Franklin Square. Holiday Farms, which now operates six stores, occupies a space at Franklin Plaza that was previously leased to grocer King Kullen. Other tenants at the center include Rite Aid, Greek Xpress, Baskin-Robbins, Memory Nails and Olivetto Pizzeria. Cary Fabrikant of Breslin Realty represented the tenant in the lease negotiations. Robert Delavale, also with Breslin Realty, represented the undisclosed landlord.

NEW YORK CITY — Kimmerle Group, a New Jersey-based design-build firm, has completed a 175,000-square-foot office and showroom renovation project at 11 Penn Plaza in Manhattan. The project is a build-to-suit for SPARC Group, a provider of apparel and accessories whose brands include Brooks Brothers, Eddie Bauer and Forever 21. Specialty areas include mock stores for national retail buildout models, showrooms to support the wholesale business and designer workshops.