NEW YORK CITY — Newmark has arranged a $61.2 million acquisition loan for a portfolio of three multifamily properties totaling 94 units in Manhattan’s Chelsea neighborhood. The pre-war buildings are located at 301 W. 22nd St., 300 W. 21st St. and 229 W. 20th St. Dustin Stolly, Jordan Roeschlaub, Daniel Fromm, Dan Morin and Andrew Harwood of Newmark arranged the loan through Slate Asset Management on behalf of the borrower, Slate Property Group. The new ownership plans to upgrade unit interiors and modernize the buildings’ façades, lobbies and common areas.

New York

NEW YORK CITY — German discount grocer Lidl will open a 35,000-square-foot grocery store at Queens Place Mall, located in the borough’s Elmhurst neighborhood. The grocer will backfill a space previously occupied by Designer Shoe Warehouse, whose lease expires in August. Diana Boutross, Ian Lerner and Alan Schmerzler of Cushman & Wakefield represented the landlord, Madison International Realty, in the lease negotiations. Kenneth Schuckman of Schuckman Realty represented Lidl, which plans to open its store within the 440,000-square-foot mall in the first quarter of 2024.

NEW YORK CITY — A joint venture between two New York City-based firms, DRA Advisors and KPR Centers, has sold 16 grocery-anchored shopping centers totaling roughly 1.5 million square feet that are located throughout the Northeast and Mid-Atlantic region. The sale occurred in conjunction with the joint venture’s acquisition of 33 grocery-anchored shopping centers throughout the region from Cedar Realty Trust for $879 million. The centers were sold to Baltimore-based Klein Enterprises, Kimco Realty Trust and an affiliate of KPR Centers for undisclosed amounts. Chris Angelone of JLL represented the seller in this transaction. The joint venture intends to hold and manage the remaining centers acquired from Cedar Realty Trust, which currently have a collective occupancy rate of 93 percent.

WEST HAVERSTRAW, N.Y. — An affiliate of locally based investment and management firm Northeast Capital Group has purchased Samsondale Plaza, a 156,185-square-foot shopping center in West Haverstraw, about 35 miles north of New York City, for $26.5 million. Anchored by grocer Stop & Shop, the property also houses tenants such as Dollar Tree, Advance Auto, Sports Clips and Sally Beauty Supply. Jose Cruz, J.B. Bruno, Steve Simonelli, Michael Oliver, Kevin O’Hearn, Austin Pierce and Andrew Scandalios of JLL represented the seller, a joint venture between investment and development firm Mark Holdings and Connecticut-based Paragon Realty Group, in the transaction.

NEW YORK CITY — JLL has negotiated a 60,000-square-foot office headquarters lease at 825 Seventh Ave. in Midtown Manhattan. Owned by a partnership between Edward J. Minskoff Equities and Vornado Realty Trust (NYSE: VNO), the building spans 196,616 square feet. Matthew Astrachan, Ellen Herman and Hale King of JLL represented the tenant, New Alternatives for Children, in the lease negotiations. Edward Riguardi of Vornado and Jeffrey Sussman of Edward J. Minskoff represented building ownership in conjunction with John Ryan III of Avison Young.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the $5.2 million sale of two multifamily buildings totaling 37 units in Brooklyn’s Sunset Park neighborhood. The rent-stabilized buildings offer a mix of one-, two- and three-bedroom units. Victor Sozio, Stephen Vorvolakos, Sean Kelly and Benjamin Vago of Ariel Property Advisors brokered the sale. The buyer and seller were not disclosed.

NEW YORK CITY — Multifamily development and investment firm Beachwold Residential has signed a 12,637-square-foot office lease at 257 Park Avenue South in Manhattan’s Flatiron District. The 20-story building was constructed in 1912 and spans 226,000 square feet. Jared Stern of Savills represented the tenant in the lease negotiations. Rob Fisher represented the landlord, The Feil Organization, on an internal basis.

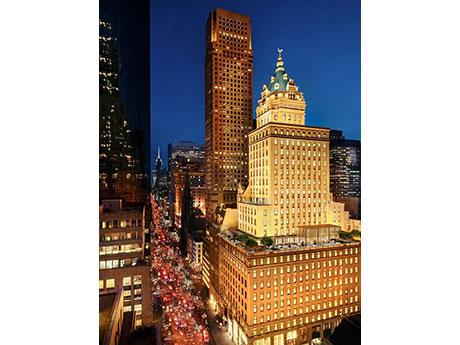

NEW YORK CITY — Walker & Dunlop Inc. has arranged $754 million in financing for Aman New York, a luxury hotel and condo development in Midtown Manhattan. Aman New York occupies the top 20 floors of the 100-year-old Crown Building at the corner of 57th Street and Fifth Avenue, across the street from Trump Tower. OKO Group was the developer. The 95,000-square-foot residential portion includes 22 units, while the 117,000-square-foot hotel section contains 83 guest rooms and suites. The rooms are among New York’s largest, and the hotel is the only one in New York to offer working fireplaces in each room. The lower floors of the building remain retail space. The hotel portion is scheduled to open on Tuesday, Aug. 2. Reservations will be available beginning Monday, July 25. The development is Aman’s first U.S. urban residence project and provides special features for owners such as private entrances, plus access to three dining venues, a jazz club, wine room and 25,000-square-foot Aman Spa. Nearly all of the condos are pre-sold, with one of the units selling for $55 million, marking one of the priciest residential transactions in New York so far this year. Originally built in 1921, the Crown …

PORT WASHINGTON, N.Y. — Cedar Realty Trust (NYSE: CDR) has sold a portfolio of 33 grocery-anchored shopping centers for $879 million, inclusive of existing debt. The names and addresses of the centers were not disclosed, but the properties are primarily located in high-density markets throughout the Northeast and Mid-Atlantic regions. The buyer was a joint venture between two New York City-based firms, DRA Advisors and KPR Centers. The sale, which was first announced in March, comes as part of the New York-based REIT’s plan to divest of its assets prior to being acquired by Virginia-based Wheeler REIT (NASDAQ: WHLR).

NEW YORK CITY — Lument has provided a $117.4 million Freddie Mac loan for the refinancing of Hope Gardens, a 949-unit affordable housing community in Brooklyn’s Bushwick neighborhood. Built between 1980 and 1987, the garden-style property comprises 60 buildings totaling 1,321 units that are all subsidized by Section 8 contracts and includes a daycare and two senior centers. The loan, which carries a fixed interest rate, 30-year term and 40-year amortization schedule, retires the construction debt attached to 47 of the buildings that house 949 units. Josh Reiss of Lument originated the loan for the sponsor, a joint venture between Pennrose Holdings, Acacia Real Estate Development and an affiliate of The New York City Housing Authority (NYCHA).