NEW YORK CITY — JLL has brokered the sale of The Vitagraph, a 302-unit apartment community located in the Midwood neighborhood of Brooklyn. Constructed in 2019, the eight-story building features one-, two- and three-bedroom apartments with high-end finishes, in-unit washers and dryers and private terraces. Amenities include an indoor and outdoor kids’ play area, courtyard, 24-hour doorman service, business center, fitness center and a rooftop patio. Jeffrey Julien, Steven Rutman, Ethan Stanton, Rob Hinckley, Brendan Maddigan and Stephen Palmese of JLL represented the seller, New York City-based developer Northlink Capital, in the transaction. The buyer was a partnership between The Dermot Co., Principal Real Estate Investors and Dutch pension fund PGGM.

New York

NEW YORK CITY — Avison Young has negotiated a 41,937-square-foot office sublease at 195 Broadway in downtown Manhattan. Lattice, a consulting firm focused on improving company cultures, will sublease the space at the 11-story building from Namely, a provider of human resources software. Brooks Hauf, Peter Johnson and Leah Zafra of Avison Young, along with Bryan Emanuel and John Diepenbrock of Raise Commercial Real Estate, represented the sublessee in the negotiations. Steve Rotter, Brett Harvey, Justin Haber and Kyle Riker of JLL represented the sublessor.

NEW YORK CITY — MetLife Investment Management has provided a $70 million permanent loan for the refinancing of 21 West Street, a 33-story apartment tower in Manhattan’s Financial District. The pet-friendly property offers 293 units in one-, two- and three-bedroom formats and amenities such as a fitness center, rooftop deck, community lounge with a playroom and catering kitchen and a 24-hour lobby attendant. Jonathan Schwartz, Adam Schwartz, Aaron Appel, Keith Kurland, Michael Ianno and Triston Stegal of Walker & Dunlop arranged the financing on behalf of the borrower, locally based owner-operator Rose Associates. The 12-year loan was structured with a fixed rate and interest-only payments for the entire term.

WOODBURY, N.Y. — New Jersey-based Cronheim Mortgage has arranged a $13 million loan for the refinancing of a 55,000-square-foot retail property on Long Island. Located along the Jericho Turnpike in the community of Woodbury, the property is fully occupied by grocer Stop & Shop. Andrew Stewart and Dev Morris of Cronheim Mortgage arranged the 10-year, nonrecourse loan, which carried a fixed interest rate and four years of interest-only payments. The borrower was full-service firm Woodpath Associates LLC. Texas-based Aurora National Life Assurance Co. provided the loan.

LYNBROOK, N.Y. — Breslin Realty Development Corp. will build The Langdon, a 201-unit multifamily project that will be located in the Long Island community of Lynbrook. Located at 47 Broadway, the new development will replace the former Mangrove Feather factory, which has been vacant for 15 years. The Langdon will consist of 55 studios, 111 one-bedroom units and 35 two-bedroom apartments, as well as 2,000 square feet of ground-floor retail space and onsite parking for 205 vehicles. Construction is expected to begin within 60 days and to be complete in summer 2023. Lee Spiegelman, Mark DeLillo, Marc Schulder and Felipe Marin of BlueGate Partners arranged construction financing for the project, which carries a total price tag of $109 million, according to the debt placement team.

NEW YORK CITY — The Museum of Women will open a 25,000-square-foot venue at 480 Broadway in Manhattan’s SoHo neighborhood. The museum will offer 14 interactive exhibits, as well as a commissary and gift shop. The short-term lease agreement will expire in January 2023. Richard Skulnik, Lindsay Zegans and Ben Sabin of RIPCO Real Estate represented the landlord, KPG Funds, in the lease negotiations. Josh Berger of Norman Bobrow & Co. represented the tenant.

LINDENHURST, N.Y. — JLL has negotiated the $146 million sale of The Wel, a 260-unit apartment community located in the Long Island community of Lindenhurst. Built in 2021, The Wel offers studio, one-, two- and three-bedroom units with an average size of 916 square feet. Residences are furnished with stainless steel appliances, stone countertops and individual washers and dryers. Amenities include a pool, fitness center, coworking space, game room, rooftop lounge, fire pits, a dog wash station and landscaped courtyards. Jose Cruz, Steve Simonelli, Andrew Scandalios, Michael Oliver, Kevin O’Hearn and Jason Lundy of JLL represented the seller, a joint venture between Tritec Real Estate Co. and an affiliate of Rockwood Capital, in the transaction. The buyer was Fairfield Properties.

NEW YORK CITY — Storage Post, an Atlanta-based self-storage owner-operator, has acquired a newly built facility located at 600 Richmond Terrace on Staten Island. The number of units was not disclosed, but the property spans approximately 148,000 square feet of net rentable climate-controlled space. The seller and sales price were also not disclosed.

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

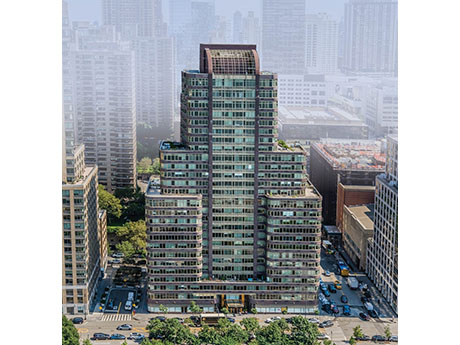

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

NEW YORK CITY — Locally based firm Ekstein Tolbert Development is underway on construction of a $76 million multifamily project located at 1333 Broadway in Brooklyn’s Bushwick neighborhood. The 20-story, 107-unit building will ultimately house three levels of commercial space and a unit mix that comprises 30 percent affordable units and 70 percent market-rate apartments. Amenities will include a gym, package handling room and onsite laundry facilities. JLL arranged an undisclosed amount of construction financing through Santander Bank on behalf of Ekstein Tolbert. In addition, JLL negotiated the sale of a majority equity stake in the project to private equity firm Standard Real Estate Investments.