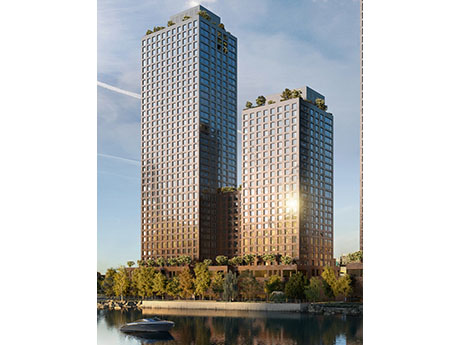

NEW YORK CITY — SCALE Lending, the debt financing arm of New York City-based Slate Property Group, has provided a $305 million construction loan for a new multifamily project in the Mott Haven area of The Bronx. The borrower is locally based development and investment firm The Beitel Group. The unnamed project will comprise two interconnected buildings that will rise 40 and 26 floors and house 755 studio, one- and two-bedroom apartments. Amenities will include an outdoor pool, large outdoor terrace, gym with sauna and steam room, pickleball court, golf simulator, coworking area, party room and children’s play room, as well as 11,500 square feet of retail space. Beitel Group bought the land at 355 Exterior St., which is situated along the Harlem River, last fall and subsequently demolished all existing structures. Prestige Construction NY is serving as the general contractor for the project, which has been vested into the city’s 421a program for inclusion of an affordable housing component. Landstone Capital Group arranged the construction loan, which carries an 18-month term with two six-month extension options, through SCALE Lending on behalf of Beitel Group. Construction is slated for a June 2026 completion. “The Mott Haven submarket of New York …

New York

WHITE PLAINS, N.Y. — A partnership between New York City-based owner-operator RXR and Korman Communities has begun leasing 5 Cottage, a 307-unit apartment building in White Plains. The building represents the second phase of a larger development known as AVE Hamilton Green that also features 515 underground parking spaces, 55,000 square feet of open space and 26,000 square feet of commercial space. Units are available in studio to three-bedroom floor plans, as well as in penthouses and live/work loft apartments. Specific residential amenities include indoor gaming areas, coworking spaces, a speakeasy bar, golf simulator, children’s playroom, private chef’s dining room, indoor pool and outdoor grilling and dining stations. RXR and Korman have also leased 85 percent of the 170 units at the first building within AVE Hamilton Green, 25 Cottage. Rents start at $2,366 per month for a studio apartment.

NEW YORK CITY — Pinterest has signed an 83,000-square-foot office lease at 11 Madison Avenue in Manhattan. The visual discovery platform will occupy the entire 13th floor of the 30-story, 2.3 million-square-foot building. Evan Margolin, Justin Haber and Michael Berg of JLL represented Pinterest in the lease negotiations. Brian Waterman, Scott Klau, Erik Harris and Brent Ozarowski of Newmark represented the landlord, SL Green.

WESTHAMPTON BEACH, N.Y. — Global investment management firm AllianceBernstein (NYSE: AB) has provided a $120 million loan for the refinancing of Hampton Business District, a 50-acre industrial park located in the Long Island community of Westhampton Beach. Developed in 2014 by a partnership between New York-based Rechler Equity Partners and Suffolk County, Hampton Business District comprises five buildings totaling 385,002 square feet that feature clear heights of 18 to 22 feet. At the time of sale, the property was 94 percent leased to 24 tenants, including Iron Mountain and United Refrigeration Solutions. Peter Rotchford, Andrew Scandalios, Tyler Peck and Doug Omstrom of JLL arranged the loan on behalf of Rechler Equity Partners.

NEW YORK CITY — Locally based developer EMP Capital Group has begun leasing a 259-unit apartment complex in Brooklyn. Designed by Isaac & Stern Architects and located at the nexus of the Clinton Hill and Prospect Heights neighborhoods, Prosper Brooklyn offers studio, one- and two-bedroom units, many of which include dedicated work-from-home spaces. Amenities include a fitness center with a sauna, pickleball court, media lounge, screening room, game room, pet spa, children’s playroom, business center and a rooftop terrace with grilling and dining stations. Ownership has tapped MNS Real Estate to market and lease Prosper Brooklyn. Rents start at $3,250 per month for a studio apartment.

GETZVILLE, N.Y. — Locally based financial intermediary Largo Capital has arranged a $41.8 million construction loan for a 246-unit multifamily project in Getzville, located just north of Buffalo. The project will feature a mix of studio, one-, two- and three-bedroom units in addition to traditional amenities. Ned Perlman of Largo Capital arranged the loan through an undisclosed regional bank. The name of the property and the developer were also not disclosed.

NEW YORK CITY — Gotham Organization and Monadnock Development have broken ground on Phase I of Innovative Urban Village, a 2,000-unit affordable housing project in Brooklyn. Designed by Practice for Architecture and Urbanism, the project is a conversion of the 10.5-acre campus of the Christian Cultural Center in the borough’s East New York area. Phase IA will feature 386 units that will be reserved for renters earning between 30 and 80 percent of the area median income, as well as 17,000 square feet of commercial space that will include a grocer. Phase IB will comprise 453 units across two buildings that will have 12,000 square feet of community facility space and 10,000 square feet of retail space. Completion of Phases IA and IB are slated for 2026 and late 2027, respectively.

NEW YORK CITY — Lument has provided a $26.8 million HUD-insured loan for the refinancing of three affordable seniors housing properties totaling 203 units in Brooklyn. West End Gardens I and II are both located in the Borough Park neighborhood, while Webster Terrace is located in the Kensington submarket. All three properties are reserved for renters aged 62 and above and mobility-impaired individuals. Paul Weissman and Andrew Nicoll of Lument originated the financing, which was structured as a scattered-site loan and carries a fixed interest rate and a fully amortized 35-year term, through HUD’s 223(f) program. The borrower was HDF Cos.

By Tom Kucharski, CEO of Invest Buffalo Niagara When Ralph Wilson selected Buffalo to be the home of the new Bills franchise in the American Football League in the 1950s, it was one of the nation’s 10 highest populated cities, making it a natural fit. However, a general shift around the country away from traditional manufacturing as a major base for economic activity, combined with a number of other factors, led to a decline in the city’s employment and population bases in the ensuing decades. Over the past 25 years, Buffalo has reversed that trend, emerging as a city on the rise. The region recently saw its first population growth in over 70 years, according to the 2020 census. That growth has been spurred by a diversification of the local economy, attracting businesses in industries such as advanced manufacturing, food processing and life sciences. Companies were especially enticed by the region’s low cost of doing business and affordable energy supplied by the nearby Niagara River. A key to maintaining that momentum has been Buffalo’s self-reinvestment, including massive redevelopment projects centered around reclaiming the city’s waterfront district. The first wave of these efforts began about a decade ago. Specifically, prior to …

LAUREL HOLLOW, N.Y. — International development and construction firm Skanska has topped out a $248 million life sciences project in Laurel Hollow, located on Long Island. The 379,500-square-foot facility is known as the Artificial Intelligence and Quantitative Biology building and is part of the initial phase of the expansion of the Cold Spring Harbor Laboratory campus. Upon completion, the facility will include neuroscience labs, an AI research center, conference center and housing for visiting scientists. Phase II of the development will feature an 81,000-square-foot research, housing and conference center and a 56,000-square-foot housing and collaborative research center for visiting scientists. Empire State Development has committed $55 million in funding to the project, substantial completion of which is expected by early 2027.