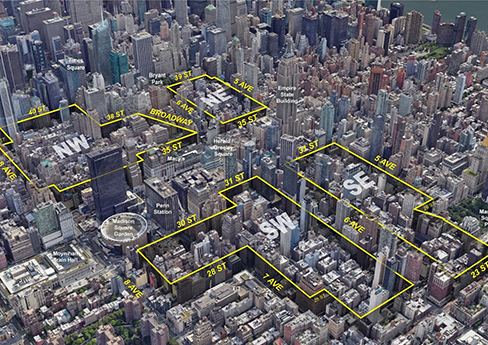

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is currently home to more than 7,000 businesses, 135,000 jobs and various public transportation hubs, but the neighborhood has struggled to rebound in the aftermath of the COVID-19 pandemic as hybrid work schedules have become more entrenched. In addition to these commercial vacancies, the submarket is subject to restrictive zoning rules that limit opportunities for New Yorkers to live near their jobs. “For far too long, outdated zoning policies have limited the potential of this well-resourced area to help address New York City’s urgent housing needs,” says Rachel Fee, executive director of the New York Housing Conference, nonprofit affordable housing policy and advocacy organization. “In the midst of a dire housing crisis, …

New York

NEW YORK CITY — The Malin, a provider of flexible workspace solutions, has opened a 32,700-square-foot space in Manhattan’s Flatiron District. The space spans two floors within 895 Broadway and opened with all 20 private offices and 36 dedicated desks fully leased. The space also features three meeting rooms, a 14-person boardroom, 21 phone booths, two libraries and a mezzanine space for events. The Malin now operates five coworking facilities in New York City and eight across the country.

NEW YORK CITY — Biotechnology firm Cresilon has signed a 55,000-square-foot life sciences lease expansion at Industry City in Brooklyn’s Sunset Park area. Cresilon, which focuses on hemostatic technologies that improve wound care, is effectively doubling its headquarters footprint at the 6 million-square-foot mixed-use development via a 10-year deal. Josh Pernice of CBRE represented the tenant in the lease negotiations. Jeff Fein internally represented the landlord, a partnership between Belvedere Capital, Jamestown and Angelo Gordon.

NEW YORK CITY — CBRE has negotiated a 15,000-square-foot office lease expansion at 299 Park Avenue in Midtown Manhattan. The tenant, investment advisory firm One William Street Capital Management, now occupies about 45,000 square feet at the 1.2 million-square-foot building. Scott Gottlieb, Andrew Sussman, Ben Friedman and Lewis Gottlieb of CBRE represented the tenant in the lease negotiations. David Falk, Peter Shimkin, Andy Sachs and Eric Cagner of Newmark, along with internal agents Marc Packman and Clark Briffel, represented the landlord, Fisher Brothers.

FARMINGDALE, N.Y. — A partnership between Empire State Development and the State University of New York (SUNY) has broken ground on a $75 million academic project in Farmingdale, located on Long Island. Designed by Urbahn Architects, the three-story, 52,000-square-foot building will be the new computer sciences facility for Farmingdale State College and will feature an 1,800-square-foot business incubator on the ground floor. The second floor will have six classrooms, a seminar room, conference room, faculty offices and administrative spaces. The third floor will include six computer labs and offices, and both the second and third floors will have student lounges that overlook the campus. Completion is slated for 2028.

NEW YORK CITY — Marcus & Millichap has brokered the $7 million sale of an 8,282-square-foot multifamily development site in Brooklyn’s Prospect Heights neighborhood. The site at 918 Atlantic Ave. currently houses a car wash and can support 59,630 buildable square feet as of right and up to 74,538 buildable square feet with inclusionary housing bonus. Andrew Bronsteen, Shaun Riney and Jason Farese of Marcus & Millichap represented the seller and procured the buyer, both of which were local private investors, in the transaction.

NEW YORK CITY — Foster Garvey PC has signed a 10-year, 11,445-square-foot office lease at One Seaport Plaza in Lower Manhattan. The law firm will relocate from 100 Wall Steet to the ninth floor of the 1.1 million-square-foot building, which is located at 199 Water St., beginning this fall. Nicholas Farmakis and Steve London of Savills represented Foster Garvey in the lease negotiations. John Cefaly, Ethan Silverstein, Stephen Bellwood and Rachel Rosenfeld of Cushman & Wakefield, along with internal agents Brett Greenberg and Adam Rappaport, represented the landlord, Jack Resnick & Sons.

NEW YORK CITY — JLL has arranged an $80 million loan for the refinancing of a 152-unit apartment building in Manhattan’s West Village neighborhood. The 10-story, freshly renovated building at 110 Horatio St. houses 87 studios, 42 one-bedroom residences,18 two-bedroom units and five penthouses. Amenities include a landscaped roof terrace, resident lounge, onsite laundry facility and a fitness center. Geoff Goldstein, Steven Klein and Chris Pratt of JLL arranged the 10-year, fixed-rate loan through investment manager AXA IM Alts on behalf of the borrower, an affiliate of Rockrose Development. The building was approximately 99 percent occupied at the time of the loan closing.

COMMACK, N.Y. — Gap Factory will open a 12,800-square-foot store in the Long Island community of Commack. The space is located within the 222,000-square-foot Mayfair Shopping Center. E.J. Moawad of Levin Management Corp. represented the undisclosed landlord in the lease negotiations. Michael Friedman of Inline Realty represented the tenant. A prospective opening date has not yet been determined.

NEW YORK CITY — Merchants Capital has arranged $231 million in financing for Eastchester Gardens, an 877-unit affordable housing community in The Bronx. The 10-building development was originally constructed in 1950 and is home to nearly 2,000 people. The bulk of the financing consists of a $221.7 million, 30-year Freddie Mac CME permanent loan, proceeds of which will be used to fund capital improvements and preserve affordability of all units for renters earning 60 percent or less of the are median income. Capital improvements will include upgrades to heating, cooling, plumbing, lighting and electrical systems, as well as new flooring, kitchens and bathrooms and upgrades to common areas and outdoor spaces. In addition, Eastchester Gardens will be listed on the National Register of Historic Places, enabling the use of federal historic tax credits to support the property’s revitalization. The project team includes MDG Design + Construction, Infinite Horizons, Wavecrest Management and the New York City Housing Authority. Construction is underway and expected to be complete in 2028.