NEW YORK CITY — JLL has negotiated the $104.5 million sale of a 204-unit apartment building located in Manhattan’s Gramercy Park neighborhood. The seven-story building at 210-220 E. 22nd St. comprises 82 studios, 75 one-bedroom units, 39 two-bedroom residences and eight three-bedroom apartments. Amenities include a fitness center, resident lounge and onsite laundry facilities. Andrew Scandalios, Jeffrey Julien, Rob Hinckley and Steven Rutman of JLL represented the undisclosed seller in the transaction. The team also procured the buyer, a joint venture between New York-based Canvas Property Group, Declaration Partners and Tokyu Land US Corp. The property was 95 percent occupied at the time of sale.

New York

CARMEL, N.Y. — Diamond Point Development has broken ground on an 800-unit self-storage facility in Carmel, about 60 miles north of New York City in the Hudson Valley region. The multi-story facility will comprise 81,000 net rentable square feet of climate-controlled space. Diamond Point is developing the facility in partnership with Dallas-based Rosewood Property Co. Extra Space Storage will manage the property, which is expected to be complete in late 2025.

NEW YORK CITY — Mirae Asset Securities has signed a 34,640-square-foot office lease expansion and extension in Midtown Manhattan. The financial institution renewed its existing 17,320-square-foot lease that covers the entire 37th floor at 810 Seventh Avenue for an additional 10 years and took another 17,320 square feet across the entire 38th floor. Neil Goldmacher and John Moran of Newmark represented the tenant in the lease negotiations. Harry Blair, Tara Stacom, Barry Zeller, Justin Royce and Pierce Hance of Cushman & Wakefield represented the landlord, SL Green.

NEW YORK CITY — Private equity firm Kriss Capital and New York-based investment group Corigin have provided $205 million in construction financing for a multifamily project that will be located at 26 E. 35th St. in Manhattan’s Nomad neighborhood. The building will rise 18 stories and house 137 condos. The financing consists of a $180 million senior loan from Kriss Capital and its Israeli partner, Klirmark Capital, and a $25 million mezzanine loan from Corigin. Max Hulsh, Max Herzog, Marko Kazanjian and Andrew Cohen of Institutional Property Advisors, a division of Marcus & Millichap, arranged the financing on behalf of the borrower, The Continuum Co. Completion is slated for 2027.

MELVILLE, N.Y. — Northwell Health, the state’s largest provider, has signed a 19,162- square-foot office and healthcare lease in the Long Island community of Melville. Northwell plans to operate a pharmacy center and administrative offices within the 55,686-square-foot building at 40 Melville Park Road, which is owned by locally based firm Simone Development Cos. Darren Leiderman of Colliers represented Northwell in the lease negotiations. Simone Development was self-represented.

NEW YORK CITY — A partnership between multifamily owner-operator Asland Capital Partners and locally based investment firm Pembroke Residential Holdings has completed Park Lane Senior Apartments in The Bronx. The 154-unit, age-restricted development is located in the borough’s Soundview neighborhood, and about a third (53) of the residences are reserved for households earning 50 percent or less of the area median income. In addition, 30 percent of the units are set aside for seniors who were formerly homeless. Amenities include a tenant lounge and indoor/outdoor recreational spaces.

HAWTHORNE, N.Y. — Locally based developer Robert Martin Co. has broken ground on a 71,098-square-foot industrial flex project in Hawthorne, located north of New York City in Westchester County. The site at 14-16 Skyline Drive is located within Mid-Westchester Executive Park, and the development will consist of two buildings totaling 34,738 and 36,360 square feet. Completion is scheduled for the third quarter of 2025.

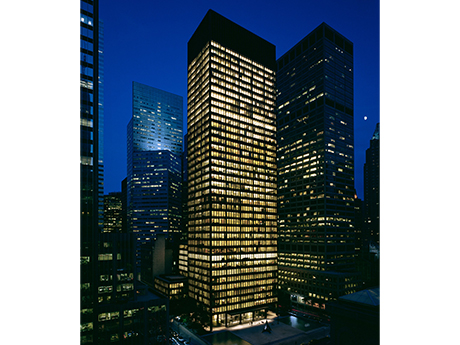

NEW YORK CITY — Blue Owl Capital has signed a 238,673-square-foot office lease extension and expansion at 375 Park Avenue in Midtown Manhattan. The global alternative asset manager first committed to 375 Park Avenue, which is known locally as The Seagram Building, in 2022 with a 137,600-square-foot lease across floors two through five. In 2023, Blue Owl added 31,597 square feet to its footprint via occupancy of the entire sixth floor. The latest lease expansion totals 70,076 square feet across floors 16 through 19. Mark Weiss of Cushman & Wakefield represented the tenant in the lease negotiations. A.J. Camhi and Paul Milunec represented the landlord, RFR Realty, on an internal basis.

ITHACA, N.Y. — Ohio-based investment firm Chase Properties has purchased Creekside Plaza, a 180,000-square-foot shopping center located in the upstate New York community of Ithaca. The property was built in 2001 and was 95 percent leased at the time of sale to tenants such as Dick’s Sporting Goods, HomeGoods, Barnes & Noble and O’Reilly Auto Parts. The seller and sales price were not disclosed. Chase Properties acquired Creekside Plaza in conjunction with Waynesboro Town Center, a 170,810-square-foot shopping center in Virginia’s Shenandoah Valley region.

NEW YORK CITY — Rabina, along with general contractor Suffolk Construction, has topped out 520 Fifth Avenue, an approximately 1,000-foot-tall high-rise development situated at the intersection of Fifth Avenue and West 43rd Street in the Midtown neighborhood of Manhattan. Once completed in 2025, the tower will rise 88 stories and feature 100 condominiums and 25 floors of office space, as well as a social club called Moss. In March 2022, Rabina secured $540 million in construction financing for 520 Fifth Avenue that comprised a $410 million senior loan from Bank OZK and $130 million in mezzanine financing from Carlyle. The residential component of the project is called Five Twenty Fifth Residences. Condos will come in one- through four-bedroom layouts. Residents will have access to amenities such as a library, game room with billiards, private dining rooms and a solarium. Seventy percent of the condos have already been sold since sales launched in April. The mixed-use tower will also offer office space from floors 10 to 34. Office spaces will range from 500 to 12,000 square feet and feature 12-foot tall ceilings, private terraces and open-air covered corridors. The office component has been dubbed 520 Offices. Corcoran Sunshine Marketing Group is …