NEW YORK CITY — HKS Real Estate Advisors has arranged a $30 million loan for the refinancing of a 65,787-square-foot mixed-use portfolio in New York City. The portfolio consists of eight buildings in Manhattan and The Bronx that collectively total 54 multifamily units and 17 commercial units. Commercial tenants include Mr. Green Laundry, Hunter Convenience Shop, Little Amber Nails & Spa and Monster Barber Shop. Michael Lee of HKS arranged the loan through Citigroup on behalf of the undisclosed borrower.

New York

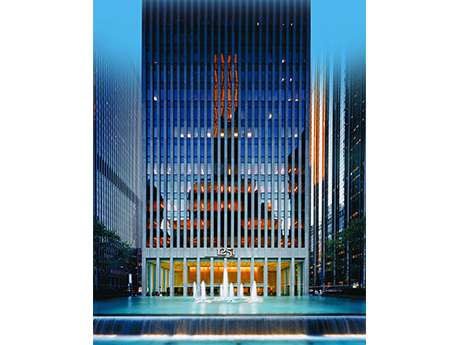

NEW YORK CITY — Daiwa Capital Markets America Inc. (DCMA) has signed a 20-year, 44,100-square-foot office lease in Midtown Manhattan. The financial services firm will occupy the entire 49th floor at 1251 Avenue of the Americas. Erik Schmall and Scott Weiss of Savills represented DCMA in the lease negotiations. David Falk and Peter Shimkin of Newmark represented the landlord, Mitsui Fudosan America. A tenant-only conference facility is under construction at the building, and the lobby was recently renovated. Three new food-and-beverage concepts are also set to open at the building in the coming weeks.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $2.5 million sale of an eight-unit apartment building located at 313 W. 92nd St. on Manhattan’s Upper West Side. Five of the eight units were vacant at the time of sale. Ben Khakshoor of Rosewood represented the buyer, Put Duc Huang, in the transaction. Mike Kerwin, also with Rosewood, represented the seller, the Goldberg Family, which owned the building for 85 years.

NEW YORK CITY — GrowthCurve Capital LP has signed a 13,350-square-foot office lease in Midtown Manhattan. The private equity firm is relocating from 1301 Avenue of the Americas to the 33rd floor of the 990,000-square-foot building at 250 W. 55th St. Peter Turchin, Caroline Merck, Arkady Smolyansky and Ali Gordon of CBRE represented the landlord, Boston Properties, in the lease negotiations. Jonathan Luttwak and James Cassidy of DHC Real Estate Services, along with Louis D’Avanzo of Cushman & Wakefield, represented the tenant.

AcquisitionsColoradoGeorgiaIllinoisMidwestMultifamilyNew YorkNortheastSoutheastTexasTop StoriesWestern

Equity Residential to Acquire 11-Property Multifamily Portfolio from Blackstone for $964M

by Katie Sloan

CHICAGO AND NEW YORK CITY — Equity Residential (NYSE: EQR) has agreed to acquire an 11-property apartment portfolio from Blackstone (NYSE: BX) for $964 million. The acquisition is the largest U.S. multifamily purchase by any public real estate investment trust in the past seven years, according to reports by The Wall Street Journal. The portfolio includes four properties totaling 1,357 units in Atlanta; four properties totaling 1,237 units in the Dallas/Fort Worth metropolitan area; and three properties totaling 978 units in Denver. Further details on the communities were not disclosed. The properties were attractive to Equity Residential — one of the largest owners of multifamily assets in the U.S. with 79,738 units across 299 properties — due to their locations in markets where the Chicago-based firm is targeting growth, as well as the properties’ appeal to high-end renters. The acquisition is expected to close in the third quarter and will include separate transactions with Blackstone Real Estate Income Trust, Blackstone Real Estate Partners and Blackstone Property Partners. Eastdil Secured, RBC Capital Markets, Santander and Sumitomo Mitsui Banking Corporation (SMBC) acted as Blackstone’s financial advisors in the transaction. Simpson Thacher & Bartlett served as Blackstone’s legal counsel. Neal Gerber & Eisenberg, Hogan …

NEW YORK CITY — Stark Office Suites has signed an 11,816-square-foot office lease in Midtown Manhattan. The provider of executive suites and virtual workspace solutions is taking a full floor at 825 Third Avenue, a 530,000-square-foot building that recently underwent a $150 million capital improvement program. Tom Bow, Ashlea Aaron, Sayo Kamara and Bailey Caliban internally represented the landlord, The Durst Organization, in the lease negotiations. Craig Lemle and Roi Shleifer of Savills represented the tenant.

NEW YORK CITY — Douglaston Development has received financing for a $190 million affordable housing project that will be located in the Bedford Park neighborhood of the Bronx. The building at 2868 Webster Ave. will rise 12 stories and house 277 units. The financing includes $83.4 million in tax-exempt bond proceeds and $17.4 million in subsidies allocated by The New York City Housing Development Corp. The New York City Department of Housing Preservation & Development also provided a $52.6 million subsidy under its Extremely Low- and Low-Income Affordability Program. Wells Fargo provided Low-Income Housing Tax Credits as well as a letter of credit for the project. Units will come in studio, one-, two- and three-bedroom floor plans and will be reserved for households earning up to 70 percent of the area median income. Sixty units will be set aside as supportive units. The project represents the second phase of a two-phase development that also includes a 188-unit seniors housing complex that opened in fall 2023. Levine Builders, the general contracting affiliate of Douglaston Development, will build the community. Construction is expected to be complete in 2027.

MONTGOMERY, N.Y. — JLL has arranged a $10 million permanent loan for an 80,260-square-foot warehouse and distribution building in Montgomery, about 75 miles north of Manhattan. The facility at 18 Leonards Drive, which was completed earlier this year and was fully leased at the time of the loan closing, features a clear height of 36 feet, 16 loading docks, two drive-in doors and parking for 50 cars and 14 trailers. Michael Klein and Max Custer of JLL originated the fixed-rate debt on behalf of the borrower, Frassetto Cos. An undisclosed life insurance company provided the loan.

NEW YORK CITY — Locally based developer BRP Cos. has completed The Monarch, a 605-unit multifamily project in the Jamaica area of Queens. The building rises 25 stories and spans 542,000 square feet. In addition to 14,000 square feet of retail space, The Monarch houses 498 one-bedroom apartments and 107-two bedroom residences, with 182 units reserved for households earning between 80 and 130 percent of the area median income. Residences are furnished with individual washers and dryers, stainless steel appliances and floor-to-ceiling windows. Amenities include indoor basketball and pickleball courts, a golf simulator, fitness center with a yoga studio, resident lounge, conference room, children’s playroom, dog run, sky lounge and multiple outdoor terraces including an amphitheater. Construction began in January 2021. Rents start at $2,330 per month for a one-bedroom apartment.

NEW YORK CITY — LoanCore Capital, a Connecticut-based asset management firm, has provided an $85 million loan for the refinancing of an industrial condo in the Jamaica area of Queens. The space in question comprises the first two floors of Terminal Logistics Center, a newly built, five-story facility located at 130-02 S. Conduit Ave. Max Herzog, Marko Kazanjian, Max Hulsh and Andrew Cohen of Institutional Property Advisors, a division of Marcus & Millichap, originated the loan. The borrower is a partnership between New York-based investment and development firm Triangle Equities and Goldman Sachs Urban Investment Group. Triangle Equities acquired the site in 2018, broke ground in 2020 and recapitalized the property with $61 million in equity from Goldman Sachs in spring 2023.