NEW YORK CITY — A joint venture between Turnbridge Equities, Dune Real Estate Partners and Sterling Project Development has completed Bronx Logistics Center, a 1.3 million-square-foot speculative industrial project on the borough’s south side. The site at 980 E. 149th St. is an assemblage of five parcels and spans 14.2 acres. The multi-story facility offers a clear height of 32 feet and more than 1,500 parking spaces. ARCO Design/Build provided architectural and general contracting services for the project. The project was first announced in September 2020.

New York

NEW YORK CITY — An affiliate of international lender White Oak Global Advisors and California-based Thorofare Capital have provided a $21.5 million loan for a self-storage conversion project in Manhattan’s Tribeca neighborhood. The borrower, CSP Properties LLC, will use the proceeds to acquire the site at 78 Walker St., which currently houses a vacant office and industrial building, and convert the property into a 300-unit self-storage facility. Public Storage will operate the facility, which will span 30,540 net rentable square feet.

NEW YORK CITY — ERG Commercial Real Estate has arranged a $16.5 million loan for the refinancing of two office and retail buildings in Manhattan’s SoHo neighborhood. The adjacent buildings at 65-67 Greene St. total 21,321 square feet and were fully leased at the time of sale to tenants such as outdoor apparel and equipment retailer Norrona and PatBo clothing store. Ryan Lewis of ERG Commercial originated the debt. The borrower and direct lender were not disclosed.

MELVILLE, N.Y. — Estée Lauder has signed a 43,000-square-foot office lease in the Long Island community of Melville. The beauty and cosmetics provider is taking space at 2 Corporate Center Drive, a 291,230-square-foot building that is currently undergoing a capital improvement program. Phil D’Avanzo of Cushman & Wakefield represented the landlord, Princeton International Properties, in the lease negotiations. Jeff Nemshin of Paragon Group represented Estée Lauder.

NEW YORK CITY — Cushman & Wakefield has negotiated a 16,749-square-foot, 16-year office lease renewal at 250 Hudson St. in Lower Manhattan. The tenant, Writers Guild of America East Inc., will remain in its space on the seventh floor of the 400,000-square-foot building, which it has occupied since 2010. David Hoffman and Sam Hoffman of Cushman & Wakefield represented the tenant in the lease negotiations. Adam Rappaport and Brett Greenberg represented the landlord, Jack Resnick & Sons, on an internal basis.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the sale of a development site located at 240 W. 54th St. in Midtown Manhattan. The site can support up to 75,000 square feet of buildable space, and the zoning allows for either residential or commercial product. Christoffer Brodhead, Howard Raber and Nikola Cosic of Ariel represented the undisclosed seller in the transaction. The buyer was also not disclosed.

EAST FISHKILL, N.Y. — A global automotive manufacturer has preleased the entirety of Hudson Valley Logistics Center, a 540,688-square-foot industrial project that is under construction in East Fishkill, about 60 miles north of New York City. The name of the tenant was not disclosed, but local publication Mid Hudson News reports that the company is Stellantis, a multinational manufacturer based in The Netherlands. The building, which is slated for a third-quarter delivery, features a clear height of 36 feet, 120 dock positions, three drive-in doors and parking for 134 trailers and 212 cars. A joint venture between Bluewater Property Group and Affinius Capital owns Hudson Valley Logistics Center. Rob Kossar, David Knee, James Panczykowski, Dave MacDonald and Charlotte Belling of JLL negotiated the deal on behalf of both parties.

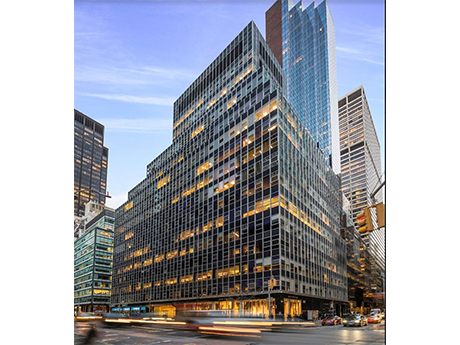

NEW YORK CITY — A partnership between locally based investment firm Waterman Interests and global asset manager HPS Investment Partners will redevelop 850 Third Avenue, a 605,000-square-foot office building in Midtown Manhattan. The 21-story building was originally constructed in 1961. According to the partnership, 850 Third Avenue offers the largest block of available space in Midtown East — more than 400,000 square feet — and will be repositioned to support build-to-suit headquarters deals. A construction timeline was not disclosed.

NEW YORK CITY — First Citizens Bank has provided a $74 million loan for the refinancing of a 160-unit apartment building in downtown Brooklyn. The 23-story building at 310 Livingston St. features one- and two-bedroom units and amenities such as a fitness center, outdoor grilling and dining stations, a recreation room, speakeasy, library, private dining room and a sky lounge. The property also includes ground-floor retail and restaurant space. The borrower was locally based developer Lonicera Partners.

NEW YORK CITY — Cushman & Wakefield has negotiated a 12,847-square-foot office lease renewal in Manhattan’s Plaza District. The building at 600 Lexington Ave. rises 36 stories and spans 305,472 square feet. Harry Blair, Connor Daugstrup and Bianca DiMauro of Cushman & Wakefield represented the landlord, Lex NY Equities LLC, in the lease negotiations. Daniel Posy and Jason Roberts of JLL represented the tenant, GLC Advisors, an independent investment advisory firm.