TRURO, MASS. — The Community Builders (TCB) has broken ground on Cloverleaf, a 43-unit affordable housing project in Truro, located on Cape Cod. The majority (39) of residences will be restricted to households earning between 30 and 100 percent of the area median income, and the other four will be rented at market rates. Units will come in one-, two- and three-bedroom formats and will be spread across 10 buildings. TCB is developing Cloverleaf in partnership with Community Housing Resource Inc. and the Town of Truro.

Northeast

PHILADELPHIA — Fine Wine & Good Spirits has opened an approximately 4,300-square-foot store at Schuylkill Yards, a mixed-use development in the University City area of Philadelphia. The store at 315 Market St. is the company’s 48th in Philadelphia. Tim Arizin and Larry Steinberg from Colliers represented the tenant in the lease negotiations. Brandywine Realty Trust owns Schuylkill Yards.

Affordable HousingContent PartnerFeaturesLoansMidwestMultifamilyNortheastRegions Real Estate Capital MarketsSoutheastTexasWestern

Looking to Finance Your Multifamily Property? Compare Fannie Mae, Freddie Mac Small Balance Loan Options

By Ann Atkinson, Regions Real Estate Capital Markets Finance options for owner/operators of multifamily properties are consistently available via Fannie Mae and Freddie Mac. Both government-sponsored entities (GSEs), are governed by the Federal Housing Finance Agency (FHFA) and share a clear mission to support the health of the country’s housing market and its existing multifamily supply by providing financing options to borrowers. Loans Accessible for Affordable, Workforce Properties The support provided by both Fannie Mae and Freddie Mac to multifamily housing notably extends beyond market-rate rental properties, with both agencies dedicated to the availability of affordable and workforce housing units to low-income renters. Thus, Fannie Mae and Freddie Mac offer good loan options to consider for owner/operators active in these multifamily subsets. Let’s compare their offerings specific to small balance loans, as these are often the appropriate solutions for this range of multifamily properties. Both Fannie Mae and Freddie Mac programs offer financing for the acquisition or refinance of stabilized multifamily properties. The properties must include five or more residential units and be stabilized. The agencies define stabilized as 90 percent occupancy for 90 days. In addition, both programs offer the following product features for small loans: Let’s now …

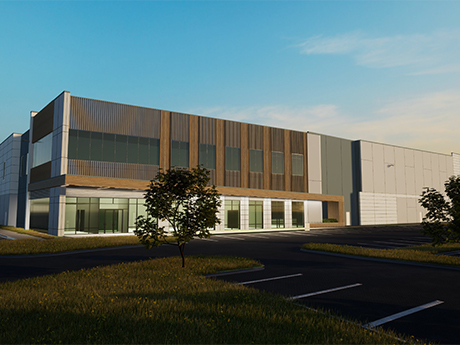

SILVER SPRING, PA. — A joint venture between New York City-based Rockefeller Group and MBK Real Estate, a subsidiary of Japanese conglomerate Mitsui & Co., will develop a 2 million-square-foot industrial park in Silver Spring, located just west of Harrisburg. Silver Spring Logistics Park will be situated on a 182-acre site that is located about three miles from I-81 and is part of the former 451-acre Hempt Farm. The development will consist of three buildings that will total 892,620, 803,520 and 318,060 square feet and will feature clear heights of 40 feet and 185-foot truck court depths. The two larger buildings will have cross-dock configurations. CBRE has been tapped as the leasing agent and also brokered the land deal on behalf of the seller, HSS Investors LLC. Other project partners include Margulies Hoelzli Architecture, civil engineer Alpha Consulting and general contractor Penntex Construction.

TOMS RIVER, N.J. — Dwight Mortgage Trust, the affiliate REIT of New York City-based Dwight Capital, has provided a $50 million bridge loan for the acquisition of Silverwoods, a 313-unit multifamily property located in the coastal New Jersey community of Toms River. The 55-acre, age-restricted property consists of 46 one-story buildings that house seven studios, 41 one-bedroom units and 265 two-bedroom units. Amenities include a pool, fitness center and a clubhouse. Moshe Feiner of Sevenstone Capital arranged the debt on behalf of the borrowers, Mathias Deutsch and Isidore Bleier. In addition to financing the purchase, ownership will use the loan proceeds to establish an interest reserve, cover transaction costs and purchase an interest rate cap.

NEW YORK CITY — Cushman & Wakefield has arranged a loan of an undisclosed amount for the refinancing of a 352-unit apartment building located at 88 Leonard St. in Manhattan’s Tribeca area. The 21-story, doorman-served building offers studio, one-, two- and three-bedroom units and amenities such as a rooftop terrace, outdoor pool and lounge area and a pet play area, as well as 11,365 square feet of retail space. John Alascio, Alexander Hernandez, Meredith Donovan and Gideon Gil of Cushman & Wakefield arranged the loan through an undisclosed European bank on behalf of the borrower, Jamestown.

TARRYTOWN, N.Y. — The DSF Group, an investment firm with offices in Boston and Washington D.C., has sold Halstead Tarrytown, a 300-unit asset located about 30 miles north of New York City. Built in 1998, the property consists of 11 two-story buildings offering a mix of one- and two-bedroom apartments. Steve Simonelli led the JLL team that represented the seller and procured the undisclosed buyer in the transaction. The new ownership plans to implement a value-add program.

NEW YORK CITY — Gordon Rees Scully Mansukhani (GRSM) has signed an 11-year, 22,409-square-foot office lease renewal in Lower Manhattan. The law firm will remain on the 28th floor at One Battery Park Plaza, a 35-story, 870,000-square-foot building that was originally constructed in 1971. Chris Mongeluzo, Hal Stein and Adam Weinblatt of Newmark represented GRSM in the lease negotiations. Thomas Keating and Kevin Daly represented the landlord, Rudin, on an internal basis.

Cushman & Wakefield Brokers Sale of Two Industrial Properties Totaling 1.1 MSF in Central New Jersey

MONROE TOWNSHIP, N.J. — Cushman & Wakefield has brokered the sale of two industrial properties totaling approximately 1.1 million square feet in Monroe Township, located just outside of Trenton in Central New Jersey. The property at 201 Middlesex Center Blvd. is a 600,000-square-foot cross-dock facility that was built in 2008 and features a clear height of 36 feet, 66 dock doors and 176 trailer parking spaces. The property at 773 Cranbury South River Road is a 488,884-square-foot building that sits on a 34.7-acre site and was completed in 2017 via a 50-year ground lease. Gary Gabriel, Kyle Schmidt, Ryan Larkin and Seth Zuidema of Cushman & Wakefield represented the seller and procured the buyer, both of which requested anonymity, in the transaction. The Cushman & Wakefield team of Stan Danzig, Jules Nissim, Steve Elman, Kimberly Bach and Eric Schlett also advised the seller in the deal.

WALTHAM, MASS. — Locally based owner-operator Hobbs Brook Real Estate is underway on the renovation of a 384,841-square-foot office and life sciences facility located at 404 Wyman St. in the western Boston suburb of Waltham. The building is part of an 11-building campus that is home to tenants such as Dassault Systems, FM Global, Commonwealth Financial Network and ZoomInfo. Renovations will include the addition of a new fitness center, a remodeling of lobby and upgrading of the conference center and café. In addition, Hobbs Brook will develop expansive outdoor spaces with seating areas, fire pits and new landscaping. Completion is slated for early next year.