NEW YORK CITY — A joint venture between nonprofit developer Community Access, affordable housing developers Spatial Equity and Duvernay + Brooks, as well as neighborhood preservation organization Cooper Square Committee, has acquired the site of the former St. Emeric church in Manhattan’s East Village. According to Wikipedia, the former Roman Catholic church was originally built around 1950 and closed in 2013 when the Parish of St. Emeric merged with that of nearby St. Brigid’s Roman Catholic Church. The joint venture plans to build more than 500 affordable housing units on the site, including homes for senior New Yorkers, formerly homeless individuals and those with special needs who qualify for supportive services. The development team expects to break ground on the first phase of the redevelopment in 2026 and may also pursue rezoning through a land use review process for the second phase. Denham Wolf Real Estate Services marketed the property for sale on behalf of the parish, which is overseen by The Archdiocese of New York.

Northeast

MENDON, MASS. — A joint venture between Los Angeles-based PCCP LLC and regional developer Bluewater Property Group will develop a 205,445-square-foot industrial project in Mendon, about 45 miles southwest of Boston. The site at 23 Cape Road spans 21 acres, and the building will feature a clear height of 32 feet, 34 dock doors, 135-foot truck court depths, 206 car parking spaces and 20 excess trailer parking spaces. Construction is scheduled to begin later this month and be complete by summer 2025.

BOSTON — CBRE has brokered the sale of a 200-unit apartment complex in East Boston. Built in 2018 and known as Boston East, the six-story building houses studio, one-, two- and three-bedroom units and amenities such as a clubroom with meeting space, sky lounge and terrace, fitness center and community arts space. Simon Butler, Biria St. John, John McLaughlin and Brian Bowler of CBRE represented the seller, an affiliate of Los Angeles-based investment firm American Realty Advisors, in the transaction. CBRE also procured the buyer, Goldman Sachs Alternatives.

NEW YORK CITY — HKS Real Estate Advisors has arranged a $30 million loan for the refinancing of a 65,787-square-foot mixed-use portfolio in New York City. The portfolio consists of eight buildings in Manhattan and The Bronx that collectively total 54 multifamily units and 17 commercial units. Commercial tenants include Mr. Green Laundry, Hunter Convenience Shop, Little Amber Nails & Spa and Monster Barber Shop. Michael Lee of HKS arranged the loan through Citigroup on behalf of the undisclosed borrower.

BORDENTOWN, N.J. — A partnership between Texas-based developer Hillwood and Atlanta-based WDG Logistics Partners will build a 179,800-square-foot speculative industrial project in the Southern New Jersey community of Bordentown. Bordentown Crossroads will feature a clear height of 36 feet, 30 dock doors and parking for 94 cars and 30 trailers. Construction is scheduled to begin at the end of summer, with completion slated for spring 2025. Newmark is marketing the property for lease.

DARIEN, CONN. — Cushman & Wakefield has brokered the sale of Avalon Darien, a 189-unit apartment complex in southern coastal Connecticut. Avalon Darien offers a mix of recently renovated one-, two- and three-bedroom units and amenities such as a pool, fitness center, lounge and playground. Niko Nicolaou, Ryan Dowd, Matthew Torrance, Al Mirin and J.P. Hohl of Cushman & Wakefield, in coordination with Brian Whitmer of RePropCo., represented the seller, AvalonBay Communities, in the transaction. The team also procured the undisclosed buyer. The sales price was also not disclosed.

NEW BRUNSWICK, N.J. — JLL has arranged a $23.3 million in acquisition financing for a 206,069-square-foot industrial property in the Central New Jersey community of New Brunswick. The property consists of six buildings on a 21-acre site that feature clear heights of 19 to 31 feet and a total of 14 dock doors and 15 drive-in doors. Max Custer, Thomas Didio Jr. and Benjamin Morgenthal of JLL arranged the five-year, fixed-rate loan on behalf of the borrower, New Jersey-based investment firm B&D Holdings. The direct lender was not disclosed.

PENNSAUKEN, N.J. — Alternative investment management firm GID has acquired an 111,400-square-foot industrial building in the Southern New Jersey community of Pennsauken. The building at 8290 National Highway, which according to LoopNet Inc. was built on 4.4 acres in 1967, can accommodate one or two tenants and features a clear height of 20 feet, one drive-in door and 15 dock-high doors. The new ownership plans to implement a value-add program to the building, which is currently vacant. The seller and sales price were not disclosed.

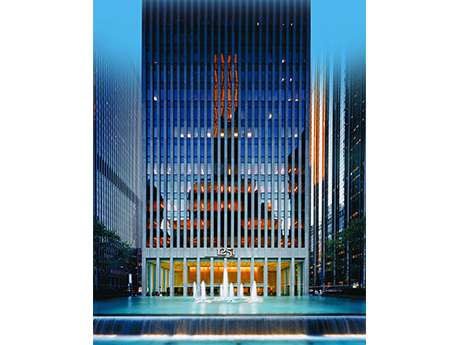

NEW YORK CITY — Daiwa Capital Markets America Inc. (DCMA) has signed a 20-year, 44,100-square-foot office lease in Midtown Manhattan. The financial services firm will occupy the entire 49th floor at 1251 Avenue of the Americas. Erik Schmall and Scott Weiss of Savills represented DCMA in the lease negotiations. David Falk and Peter Shimkin of Newmark represented the landlord, Mitsui Fudosan America. A tenant-only conference facility is under construction at the building, and the lobby was recently renovated. Three new food-and-beverage concepts are also set to open at the building in the coming weeks.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has negotiated the $2.5 million sale of an eight-unit apartment building located at 313 W. 92nd St. on Manhattan’s Upper West Side. Five of the eight units were vacant at the time of sale. Ben Khakshoor of Rosewood represented the buyer, Put Duc Huang, in the transaction. Mike Kerwin, also with Rosewood, represented the seller, the Goldberg Family, which owned the building for 85 years.