NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged a $6.5 million acquisition loan for a 12,500-square-foot retail building in the Bedford-Stuyvesant area of Brooklyn. The building formerly housed a Rite Aid store. Matthew Dzbanek and Matt Swerdlow of Ariel arranged the five-year bank loan, which carried an interest rate of 6.25 percent. The borrower is an owner and operator of stores of regional grocer Foodtown.

Northeast

NATICK, MASS. — Local developer Stonegate Group has delivered a 46-unit multifamily project in Natick, a western suburb of Boston. In addition to the apartments, which come in one-, two- and three-bedroom floor plans, the four-story building features four for-sale duplexes and 12,000 square feet of retail space. Finegold Alexander Architects designed the project, and Nauset Construction served as the general contractor. Rents start at $3,200 per month for a one-bedroom, market-rate apartment.

JERSEY CITY — Locally based investment and development firm GN Management has acquired a multifamily development site in Jersey City with plans to construct a 57-story tower. The waterfront site is known as Harborside 9 and is approved for the development of 579 units, as well as 14,800 square feet of retail space and a 555-space parking garage. Fifteen percent (87 residences) will be set aside as affordable housing. Information on floor plans and amenities was not disclosed. Jim Pompa of Coldwell Banker brokered the sale of the site from Panepinto Properties, which recently closed on financing for a 678-unit multifamily project at Harborside, to GN Management. Construction is targeted for a 2027 commencement.

NEW YORK CITY — Walker & Dunlop has arranged a $163.4 million loan for the refinancing of 122 Fifth Avenue, a 278,000-square-foot office building in Manhattan’s Flatiron District. Microsoft and Chime anchor the building, which recently underwent a $107 million capital improvement program, under long-term leases. Aaron Appel, Jonathan Schwartz, Keith Kurland, Adam Schwartz, Jordan Casella, Christopher de Raet and Jack Krentzman of Walker & Dunlop arranged the fixed-rate, interest-only financing through Helaba Bank and Deka-Bank. The borrower is Bromley Cos.

BURLINGTON, MASS. — Newmark has arranged the $84.5 million sale of the 431,233-square-foot campus of Keurig Dr Pepper in Burlington, located north of Boston. The two-building campus was constructed in 2014 and consists of a 280,560-square-foot office building and a 150,673-square-foot research-and-development/manufacturing facility. Robert Griffin, Edward Maher, Matthew Pullen, James Tribble, Samantha Hallowell and William Sleeper of Newmark represented the seller, Peakstone Realty Trust, in the transaction. The team also procured the buyer, Montana Avenue Capital Partners.

NEW YORK CITY — Bloomberg LP has signed an 11-year, 495,753-square-foot office lease extension at 120 Park Avenue, a 26-story building in Midtown Manhattan. The business media giant, which has been a tenant at 120 Park Avenue since 2011, has committed to occupying 20 floors, as well as lower-level spaces, through 2040. Howard Fiddle, Chris Mansfield and Zachary Weil of CBRE represented Bloomberg in the lease negotiations. Paul Glickman and Diana Biasotti of JLL, along with internal agents Chris Roth, Craig Panzirer and Alex Radmin, represented the landlord, Global Holdings.

NEW YORK CITY — McGuireWoods has extended and expanded its office lease in Midtown Manhattan. The national law firm now occupies 75,000 square feet across the 20th and 21st floors at 1251 Avenue of the Americas, a 54-story tower that recently underwent a repositioning. David Falk, Pete Shimkin, Eric Cagner and Claire Koeppel of Newmark represented the landlord, Mitsui Fudosan America Inc., in lease negotiations. McGuireWoods was self-represented.

NEW YORK CITY — A joint venture between nonprofit Breaking Ground Housing Development Fund Corp. and New York City-based Douglaston Development has finalized plans for the first phase of Sparrow Square, a $1 billion affordable housing development project in the Brooklyn borough of New York City. The $242 million phase will comprise two 10-story residential buildings. Totaling 262 units of affordable housing, the buildings will feature 117 units designated as supportive housing. Amenities at the property will include a fully equipped gym, bike storage and private terraces. Supportive services will also be available onsite. Additionally, Phase I will feature an 8,000-square-foot community facility for the Brooklyn Ballet, which will support arts programming and community engagement. Project work will also include the addition of a new private drive (dubbed Sparrow Way) to integrate the residential buildings and community facility into the surrounding street grid. Each building in Phase I will be designed to Passive House standards and offer all-electric utilities. The development will also feature electric vehicle charging, sustainable stormwater management practices, solar panels and green roofing. Financing for Phase I includes state tax-exempt bonds, a subsidy from New York State’s (NYS) Supportive Housing Opportunity Program and 4 percent Low-Income Housing Tax …

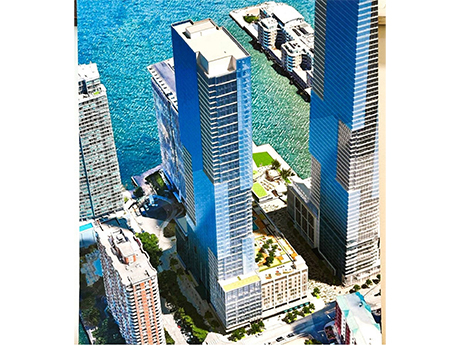

JERSEY CITY, N.J. — JLL has arranged $384 million in financing for the land purchase and vertical construction of Harborside 8, a 678-unit multifamily project in Jersey City. The borrower is a partnership between Panepinto Properties and AJD Construction. The financing consists of a $306 million, floating-rate senior loan from Kennedy Wilson and a $78 million preferred equity investment from Affinius Capital. Harborside 8 will be a 65-story waterfront building with studio, one-, two- and three-bedroom apartments. Amenities will include a fitness center, indoor pool, golf simulator, rooftop terraces, coworking rooms and a wine bar. Thomas Didio, Thomas Didio Jr., Ryan Robertson, Gerard Quinn and John Cumming led the transaction for JLL. Construction is scheduled to begin early next year, with stabilization targeted for early 2030.

MAHWAH AND FAIRFIELD, N.J. — Cushman & Wakefield has brokered the sale of a portfolio of two industrial buildings totaling 123,821 square feet in Northern New Jersey. The first building is a 67,170-square-foot structure in Mahwah that was fully leased at the time of sale to Beacon Roofing Supply. The second building is a 56,651-square-foot facility in Fairfield that houses the headquarters of Precision Textiles. Gary Gabriel, Kyle Schmidt, Ryan Larkin and Seth Zuidema of Cushman & Wakefield represented the seller, Alexander Properties Group, in the transaction. The buyer was Faropoint.