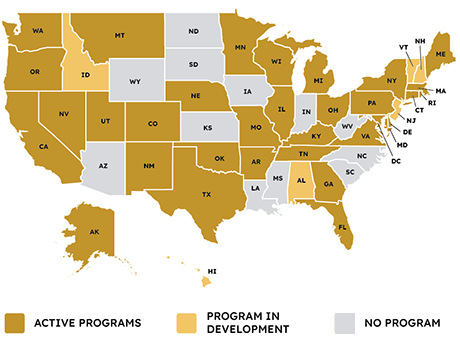

It may have taken more than a decade, but after starting out as a niche financing vehicle to create more energy-efficient and resilient buildings, the commercial property assessed clean energy (C-PACE) program has arguably achieved mainstream acceptance. Roughly 40 states and Washington, D.C., now either offer or are developing C-PACE programs. Over the last year alone, Georgia, Hawaii, New Mexico, Minnesota and Idaho passed legislation enabling or substantially improving the financing tool, points out Rafi Golberstein, CEO of PACE Loan Group, a direct lender of C-PACE headquartered in Minneapolis, Minn. What’s more, he adds, New Jersey and North Carolina are among states that in the coming months are expected to advance bills authorizing the use of C-PACE, or PACE for short. Given the current partisanship within the country, one of the most revealing characteristics of PACE’s growing appeal has been its ability to cross the political aisle, Golberstein observed. PACE’s popularity in particular has ascended over the last several months as developers have sought fresh capital to enhance their financial flexibility in a rising interest rate environment. “PACE is really turning out to be a bipartisan issue, as many state lawmakers are realizing that it is a great financing tool …

Northeast

DARIEN, CONN. — JLL has arranged $165 million in construction financing for Phase II of The Corbin District, a six-acre mixed-use project located in the southern coastal Connecticut city of Darien. The project is part of a larger initiative to redevelop the downtown area. Upon completion, the development will feature 11 new buildings with 78,810 square feet of retail space, 105,968 square feet of office space and 112 apartments. The financing consists of a $102 million construction loan from Barings and $63 million in C-PACE financing from Counterpointe SRE. Michael Gigliotti, Evan Pariser and Robert Tonnessen of JLL arranged the debt on behalf of the sponsor, locally based developer Baywater Properties.

PHILADELPHIA — Pennsylvania-based multifamily developer Toll Brothers Inc. (NYSE: TOL) has completed Broad + Noble, a 344-unit apartment community in Philadelphia’s Center City District. The 19-story building includes underground parking spaces and street-level commercial space. Amenities include music, media and podcast rooms, conservatory and private dining rooms, a fitness center with yoga and spin studios and a sky lounge with an outdoor deck area. Barton Partners served as the project architect, and O’Donnell & Naccarato handled engineering initiatives. Wells Fargo provided construction financing for the project, which Toll Brothers developed in partnership with Utah-based investment firm Sundance Bay.

ATLANTIC CITY, N.J. — New Jersey-based brokerage firm The Kislak Co. has negotiated the $20.5 million sale of a portfolio of three multifamily properties totaling 258 units in Atlantic City. The portfolio includes Atlantic Venice Park Apartments (112 units); Venice Park Condominiums (78 units operated as rentals); and Hamilton Venice Apartments (68 units). The properties were all built in 1970 and comprise 33 buildings that house 237 two-bedroom units and 21 one-bedroom units. Joni Sweetwood of Kislak represented the undisclosed seller, which disposed of the properties via three separate limited liability companies, in the transaction. Sweetwood also procured the undisclosed buyer.

STAMFORD, CONN. — Three retailers have signed leases at Atlantic Station, a mixed-use development located in Stamford. Lovesac, Golf Lounge 18 and Fresh & Co. will occupy 28,000, 9,000 and 3,000 square feet, respectively. RXR owns the property, which features 650 residences and 82,000 square feet of retail space. Brian Scruton of Cushman & Wakefield represented Lovesac in the lease negotiations; Tim Rorick and Janey Steinmetz of Newmark represented the landlord in conjunction with internal agents. Tyler Lyman of True Commercial represented both parties in the Golf Lounge 18 deal. Lyman also represented the landlord in lease negotiations with Fresh & Co., with Sabre representing the tenant.

NEW YORK CITY — ENT and Allergy Associates (ENTA) has opened a 10,000-square-foot healthcare clinic in the Flushing area of Queens. In February, ENTA signed a long-term lease expansion and renewal at the property, expanding its medical footprint from 1,800 square feet. Jonathan Serko of Cushman & Wakefield represented the tenant in the lease negotiations. Miles Mahony of RIPCO Real Estate represented the landlord, Simone Development Cos.

JERSEY CITY, N.J. — West Side Square Development Fund, which is a partnership between LanTree Developments, Altree Developments Inc., Lanterra Developments Inc. and Westdale Properties, has received a $169 million construction loan for a 477-unit multifamily project in Jersey City. Bravo Property Trust provided the debt. West Side Square will be located in the Journal Square area and will house studio, one- and two-bedroom units, as well as 9,841 square feet of retail space. Amenities will include an outdoor deck with a pool and grilling stations, fitness center, coworking space, a community room and a dog run. Marchetto Higgins Stieve is the project architect, with Childs Dreyfus Group handling interior design. Construction began last December, and completion is slated for 2026.

STATE COLLEGE, PA. — Berkadia has arranged the $24.5 million sale of Blue Course Commons, a 276-bed student housing property that serves students at Penn State University in State College. The 92-unit property was fully occupied at the time of sale. Matthew Stefanski, Zachary Pierce, Maura Spellman, Kevin Larimer and Brandon Buell of Berkadia represented the seller, Pennsylvania-based College Town Communities, in the transaction. The buyer was Pennsbury Capital.

LANCASTER, MASS. — MassHousing has provided $8 million in financing for a 32-unit mixed-income housing project in Lancaster, about 45 miles west of Boston. MCO Cottage Rentals will be situated on an 18-acre site and feature 20 two-bedroom units and 12 three-bedroom units, eight of which will be reserved for households earning 80 percent or less of the area median income. The other 24 units will be rented at market rates. The borrower is MCO & Associates. Completion is slated for October.

FLEMINGTON, N.J. — Marcus & Millichap has brokered the $7.5 million sale of a 7,388-square-foot retail strip center in Flemington, about 60 miles southwest of Manhattan. The center was renovated in 2023 and is home to Aspen Dental and City MD Urgent Care. Dean Zang, David Crotts, Alan Cafiero and Brent Hyldahl of Marcus & Millichap represented the seller, New Jersey-based investment firm Paramount Realty, in the transaction. Tom Georges of Northmarq represented the buyer, a local private investor.