CAMBRIDGE, MASS. — MassHousing has provided $41.6 million in financing for a 106-unit affordable housing project that will be located at 52 New St. in Cambridge. The majority of the financing consists of a $15.4 million permanent loan and $24.7 million in tax credit equity bridge financing. Units will come in one-, two- and three-bedroom formats and will be reserved for households earning 30, 60 and 80 percent of the area median income. The six-story building will also include 3,500 square feet of commercial space. The borrower is social services provider Just A Start.

Northeast

MANCHESTER, N.H. — Colliers has arranged the sale of an industrial building located at 299 Pepsi Road in Manchester, located near the Massachusetts-New Hampshire border. According to LoopNet Inc., the property was built on an 18.9-acre site in 1997 as a food processing facility and totals 51,216 square feet. Bob Rohrer and Doug Martin of Colliers represented the seller in the transaction. Ellen Garthoff of Stubblebine Co. represented the buyer, an affiliate of Lilly’s Fresh Pasta.

WESTFIELD, N.J. — Locally based developer Adoni Property Group has completed The Franklin Westfield, a 40-unit apartment building in Northern New Jersey. The property offers one-, two- and three-bedroom units ranging in size from 750 to 2,650 square feet. Amenities include a pool, fitness center, resident lounge, outdoor grilling and dining stations, business center, library and a pet park. Coldwell Banker Realty began the leasing campaign in February, at which times rents started at $4,300 per month for a one-bedroom apartment.

EAST CAMBRIDGE, MASS. — Three tenants have signed leases totaling approximately 35,000 square feet at One Canal, a 112,000-square-foot life sciences property located across the Charles River from Boston in East Cambridge. The tenants are Larkspur Biosciences, Incendia Therapeutics and Deep Genomics. The square footages of the spaces were not disclosed. Breakthrough Properties, a joint venture between global real estate owner Tishman Speyer and biotechnology investment firm Bellco Capital, owns One Canal.

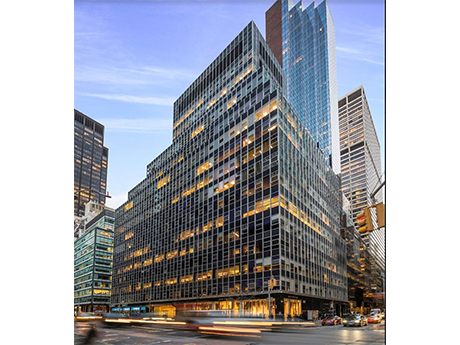

NEW YORK CITY — A partnership between locally based investment firm Waterman Interests and global asset manager HPS Investment Partners will redevelop 850 Third Avenue, a 605,000-square-foot office building in Midtown Manhattan. The 21-story building was originally constructed in 1961. According to the partnership, 850 Third Avenue offers the largest block of available space in Midtown East — more than 400,000 square feet — and will be repositioned to support build-to-suit headquarters deals. A construction timeline was not disclosed.

BOSTON — MassDevelopment has provided $21.8 million in tax-exempt bond financing for a 63-unit affordable housing project that will be located in Boston’s Hyde Park neighborhood. The property will consist entirely of one-bedroom units that will be reserved for households earning 30, 50 or 60 percent or less of the area median income. The borrower and developer is an affiliate of B’nai B’rith Housing of New England. Eastern Bank purchased the bond. The Massachusetts Executive Office of Housing & Livable Communities also provided $16.1 million in tax credit equity for the project.

BEACON FALLS, CONN. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the sale of Beacon Mill Village, a 185-unit multifamily property in Beacon Falls, located just northwest of New Haven. Built in 1988, the property offers one- and two-bedroom units with an average size of 809 square feet. Amenities include a pool, fitness center, sauna, tennis court and a dog park. Victor Nolletti, Eric Pentore and Wes Klockner of IPA represented the seller, Navarino Capital Management, in the transaction. The trio also procured the buyer, an entity doing business as Beacon Mill Holdings II LLC.

NORTH KINGSTOWN, R.I. — CBRE has brokered the sale of Mill Creek Townhomes, a 140-unit apartment complex located south of Providence in North Kingstown. Built in 1968 and expanded in 2006, the property offers two-, three- and four-bedroom units with an average size of 1,126 square feet on a 47-acre site. Simon Butler, Biria St. John, John McLaughlin and Brian Bowler of CBRE represented the seller, an affiliate of Massachusetts-based investment firm The Grossman Cos., in the transaction. The team also procured the buyer, Landings Real Estate Group, a private investment group based in Newport, R.I.

MOUNT OLIVE, N.J. — Locally based brokerage firm R.J. Brunelli & Co. has negotiated a 16,400-square-foot retail lease at The Gardens, a 373,612-square-foot shopping center in the Northern New Jersey community of Mount Olive. The tenant, Fitness Factory, will backfill a space formerly occupied by Bed Bath & Beyond. A recently opened Boot Barn occupies the other portion of the space. The opening is scheduled for June. Danielle Brunelli of R.J. Brunelli & Co. represented the undisclosed landlord in the lease negotiations.

MOUNT OLIVE, N.J. — JLL has arranged $93 million in financing for Matrix Logistics Park, a two-building, 781,748-square-foot industrial project that is under construction in the Northern New Jersey community of Mount Olive. The site at 2000 International Drive spans 13.6 acres, and that building will total 196,748 square feet and feature a clear height of 36 feet, 34 loading docks, two drive-in doors and parking for 110 cars and 43 trailers. The site at 3000 Continental Drive formerly housed the U.S. headquarters of German chemical manufacturer BASF. That building will span 585,000 square feet and feature a clear height of 40 feet, 107 loading doors, four drive-in doors and parking for 306 cars and 142 trailers. Thomas Didio, Jim Cadranell, Thomas Didio Jr., Michael Lachs and Olivia Doody of JLL arranged the loan through Bank OZK on behalf of the borrower, Matrix Development Group.