HAMILTON, N.J. — Cushman & Wakefield has arranged the sale of a 48-acre industrial development site in the Central New Jersey community of Hamilton that is approved for the construction of up to 420,000 square feet of space. The site at 861 Sloan Ave. offers proximity to both interstates 95 and 295. Robert Rudin, Gary Gabriel, Kyle Schmidt, David Bernhaut and Seth Zuidema of Cushman & Wakefield represented the seller, an entity doing business as Manchester 270 Development Inc., in the transaction. The team also procured the buyer, a partnership between Lincoln Equities Group and PGIM.

Northeast

NEW YORK CITY — Mulligan Security has signed a 15,788-square-foot office lease renewal and expansion at 7 Penn Plaza in Midtown Manhattan. The private security and fire safety contracting firm now occupies 24,788 square feet across the entire second floor. The renewal term is 12 years. David Hollander and David Katz of CBRE represented the tenant in the lease negotiations. Andrew Wiener, David Turino and Henry Korzec represented the landlord, The Feil Organization, on an internal basis.

WOBURN, MASS. — Boston Sports & Shoulder Center will open a 6,100-square-foot clinic in Woburn, located on the northern outskirts of the state capital. The clinic, which is slated to open this spring, will be the provider’s fifth in Massachusetts. Mary Burnieika and John Boyle of Cushman & Wakefield, in conjunction with internal agents Steve Cusano and John Halsey, represented the landlord, Cummings Properties, in the lease negotiations. The tenant representative was not disclosed.

JERSEY CITY, N.J. — Bank of America has signed a 550,000-square-foot office lease at Newport Tower in Jersey City. Newport Tower is a 36-story, 1.1 million-square-foot waterfront building that recently underwent a multimillion-dollar renovation and connects via skybridge to the 1 million-square-foot Newport Centre Mall. Building amenities include eight onsite dining options, a fitness center, game room, tenant lounge, coworking spaces and meeting rooms. Robert Rudin, David DeMatteis, Mina Shehata, Dirk Hrobsky, Karl Helgessen, Jan Randall Dausend and Christina Magill of Cushman & Wakefield represented the landlord, BentallGreenOak, in the lease negotiations. Bob Alexander, Ryan Alexander and Taylor Callaghan of CBRE represented Bank of America.

DUNELLEN, N.J. — Locally based developer Prism Capital Partners has received $53.9 million in financing for The Nell, a 252-unit multifamily property in the Central New Jersey community of Dunellen. Designed by Spiezle Architectural Group, the transit-oriented, newly built property offers one- and two-bedroom units and includes 3,700 square feet of retail space. The amenity package comprises a pool, fitness center, resident lounge, community kitchen, meeting rooms, an outdoor bar with TVs and grilling and dining areas. Rodney Sherman and Greg Halvorson of KeyBank Real Estate Capital arranged the seven-year loan, which provides fixed-rate takeout financing, through New York Life Real Estate Investors on behalf of Prism Capital Partners.

MERRIMACK, N.H. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has arranged the $16.6 million sale of Merrimack Village Center, an 82,292-square-foot shopping center located near the Massachusetts-New Hampshire border. Built on 10 acres in 2006, the center was 99 percent leased at the time of sale, with grocer Shaw’s serving as the anchor tenant. Other users include Dental Designs of New England, KT Cleaners, Supercuts and Subway. Jim Koury led the IPA team that represented the buyer and seller, both of which were limited liability companies, in the transaction.

HAMILTON, N.J. — Fennelly Associates has signed a 19,008-square-foot office lease at a 47,464-square-foot building located at 200 Horizon Drive in the Central New Jersey community of Hamilton. The tenant, Micro-Air, a designer and manufacturer of air conditioning control systems for boats and RVs, is relocating from a 7,850-square-foot space in nearby Allentown. Jerry Fennelly of Fennelly Associates represented the landlord, Cammeby’s Management, in the lease negotiations. Micro-Air was self-represented.

PHILADELPHIA — Dave’s Hot Chicken will open three restaurants at properties owned by Federal Realty Investment Trust in the Philadelphia metro area. Scheduled to open this month, the first store will span 2,995 square feet at Northeast Shopping Center in Philadelphia. Dave’s will also open restaurants at Ellisburg Shopping Center in Cherry Hill, New Jersey, and Willow Grove Shopping Center in Willow Grove, Pennsylvania, in the spring and fall of this year. Those stores will span 3,086 and 2,825 square feet, respectively.

AcquisitionsContent PartnerFeaturesLoansMidwestMultifamilyNAINortheastOfficeRetailSoutheastTexasWestern

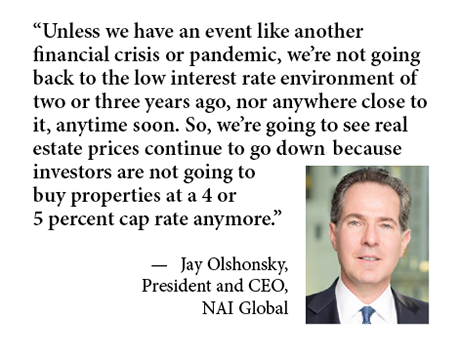

Previous Year’s Challenges Shape 2024 Outlook for Cap Rates, Investment Activity, Distressed Properties

If NAI Global president and CEO Jay Olshonsky had to use one word to sum up the 2023 commercial real estate market, it would be “inactive.” The interest rate-fueled bid-ask spread stifled investment sales of all property types, and in the office sector especially, tenants avoided making any space decisions if they didn’t have to. One month into 2024, not much has changed. From an investment sales perspective, Olshonsky still sees properties offered at capitalization rates between 4 and 5 percent while interest rates are 6 percent or higher, which is prolonging the disconnect between buyers and sellers. Meanwhile, robust job creation well beyond today’s levels is needed to create the leasing demand that will reverse the office sector’s troubles in the new era of hybrid work. But that’s not likely to happen in 2024 as the tech sector, in particular, continues to lay off workers. “I’ve been in the real estate business a long time, and this is a cycle unlike most others,” says Olshonsky. “The biggest problem we have right now is mainly record-high office vacancy just about everywhere — certainly in the large cities — which we’ve never really seen before. On the investment side, lenders cannot …

BRIDGEPORT, CONN. — A partnership between two developers, Indianapolis-based Flaherty & Collins Properties and locally based firm RCI Group, has broken ground on The August at Steelpointe Harbor, a $190 million multifamily project in Bridgeport. The property will comprise 420 units in one-, two- and three-bedroom floor plans on a 6.5-acre site within the 52-acre Steelpointe Harbor master-planned community. Amenities will include a pool, fitness center, coworking lounge, pet park, outdoor kitchens and a pickleball court, as well as 10,000 square feet of retail space. Cupkovic Architecture designed the project, and KBE Building Corp. is serving as the general contractor. Old National Bank provided a $111 million senior construction loan for the project, with a myriad of private institutions and public agencies also contributing to the financing. Completion is slated for August 2025.