EAST BRUNSWICK, N.J. — NAI DiLeo-Bram has brokered the $7.2 million sale of a 32,021-square-foot industrial property in the Northern New Jersey community of East Brunswick. The property at 375 Old Bridge Turnpike was built on 1.6 acres in 1971 and features clear heights of 12 to 16 feet and two exterior docks. Kyle Gerace of NAI DiLeo-Bram represented the seller, Kings Cages, and procured the buyer, Kinga Cabinet, in the transaction.

Northeast

NEW YORK CITY — Capalino, a business development consulting firm, has signed an 8,424-square-foot office lease at 730 Third Avenue in Midtown Manhattan. The tenant will occupy the entire 24th floor of the 665,110-square-foot building. David Hoffman, Robert Billingsley and Sam Hoffman of Cushman & Wakefield represented the tenant in the lease negotiations. Nuveen Real Estate owns the building.

By Pam Knudsen, senior director of tax compliance services, Avalara While the dust has scarcely settled from a landmark ruling in New York City resulting in a massive crackdown on short-term rentals (STRs), the full extent of the fallout from the decision has yet to be fully grasped by many — and perhaps even by the city itself. Under the terms of Local Law 18, a resolution that passed earlier this year, hosts and owners of short-term rentals, including Airbnb, are now subject to tighter and stricter regulations. These include limits on numbers of guests, requirements to register with the city and obligations to more closely monitor guest behavior, among other regulations. The effective ban on short-term rentals will have considerable consequences on local economies, and more than anyone, it’s small lodging businesses that stand to be impacted by the resulting wave. But to fully understand the major impact this ban has on small businesses, we must first acknowledge that STRs should rightly be considered small businesses themselves. Much like any other small business, STRs are required by most communities to be licensed, registered and compliant with tax collection and remittance. Furthermore, the hosts and managers behind STRs operate in …

Cushman & Wakefield: Manhattan’s Fifth Avenue Remains Most Expensive Street in the World for Retailers

by John Nelson

NEW YORK CITY — Fifth Avenue in Manhattan has retained its No. 1 ranking as the world’s most expensive retail destination at approximately $2,000 per square foot, which is unchanged from last year. That’s according to the 33rd edition of the Cushman & Wakefield (NYSE: CWK) Main Streets Across the World, an annual report that examines retail rental rates around the world in “high street” locations, referring to bustling, high-end retail districts. Fifth Avenue is world-renowned for its luxury offerings, including Bergdorf Goodman, Prada, Saks and Tiffany, among others. Additions to Fifth Avenue’s retail store count this year include a new store for Harry Winston and newcomers to the corridor Asics, Dyson, Skechers, Johnston & Murphy and Bandier, according to online directory Visit 5th Avenue. While on par with the rents charged last year, Fifth Avenue’s average retail rate is up 14 percent from pre-pandemic levels, making it only one of three high streets in the top 10 that have increased rates since that time span. The No. 2 retail destination in Main Streets Across the World is Milan’s Via Montenapoleone at $1,766 per square foot. The district jumped a spot into second from last year’s report by pushing rental …

HOLYOKE, MASS. — WinnDevelopment has broken ground on a $55.3 million affordable seniors housing project in the western Massachusetts city of Holyoke. The project will convert a historic mill complex into 88 affordable apartment homes for seniors ages 55 and older. The redevelopment of the Appleton Mill property in downtown Holyoke will create new loft-style apartments in three interconnected, 111-year-old industrial buildings that were once home to the Farr Alpaca Co. and have been vacant for decades. In addition, WinnDevelopment will construct a new community building and connect it to the residential space via a closed skybridge spanning nearby railroad tracks. All 88 apartments will be reserved for low- and moderate-income seniors, with 12 units reserved for households earning below 30 percent of the area median income (AMI), 63 for those below 60 percent of AMI, and 13 for households below 80 percent of AMI. Delivery is slated for spring 2025.

NEW YORK CITY — JLL has arranged the $10.2 million sale of a 62-unit apartment building located at 788 Riverside Drive in the Washington Heights area of Manhattan. The 11-story building primarily houses two- and three-bedroom units that have an average size of 1,025 square feet. Of the 62 apartments, 53 of which are rent-stabilized, five are rent-controlled and four are rented at market rates. The buyer and seller were both family offices that requested anonymity. Paul Smadbeck and Hall Oster of JLL brokered the deal.

WINDSOR, MASS. — MassHousing has provided $7.5 million in financing for Prospect Estates, a 25-unit multifamily property located in the western Massachusetts community of Windsor. The borrower, Affordable Housing & Services Collaborative, will use the proceeds to acquire and renovate the property. NEI General Contracting will handle renovations, which will include upgrades to kitchens and bathrooms, as well as building systems and exterior components. The development team will also preserve historic elements of the original structures, such as windows and wood flooring, and add a management office.

NEW YORK CITY — Law firm Scott + Scott LLP has signed a 21,365-square-foot office lease at 230 Park Avenue in Manhattan. The firm will relocate from a subleased space on the 17th floor to the entire 24th floor next summer. Erik Schmall and Scott Weiss of Savills represented the tenant in the lease negotiations. Scott Klau, Brian Waterman, Erik Harris, Zach Weil and Cole Gendels of Newmark, along with internal agents William Elder, Andrew Ackerman and Walt Rooney, represented the landlord, RXR.

OCEANPORT, N.J. — Baseline Social, a bar, restaurant and entertainment concept, has opened a 17,100-square-foot venue in Oceanport, located in Monmouth County. Situated within The Commissary at Baseline, the space features a 640-foot LED viewing wall, 38-seat platform lounge and 3,700-square-foot entertainment section with five virtual golf bays. Other tenants at the property include Birdsmouth Beer and MGT Foods. Denholtz Properties is the developer and landlord at The Commissary.

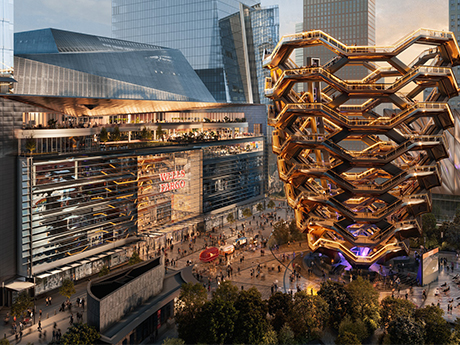

Wells Fargo Plans 400,000 SF Adaptive Reuse Office Project at Hudson Yards in Manhattan

by John Nelson

NEW YORK CITY — Wells Fargo & Co. (NYSE: WFC) has announced formal plans to expand its office footprint within Hudson Yards, a mixed-use district on Manhattan’s west side. The San Francisco-based banking giant, which already occupies space within the $25 billion Hudson Yards campus, has purchased additional space from Related Cos., the master developer behind Hudson Yards along with Oxford Properties Group. Multiple media outlets have reported that Wells Fargo purchased the space at 20 Hudson Yards, which formally housed a Neiman Marcus store, for $550 million. The bank plans to convert the 400,000 square feet of space to offices in synergy with its current 500,000-square-foot footprint at 30 Hudson Yards, according to Bloomberg News. Forbes reported that the Neiman Marcus location closed in summer 2020. Wells Fargo plans to begin moving employees from its existing office space at 150 E. 42nd St. to the new Hudson Yards office beginning in late 2026. The property is expected to house 2,300 Wells Fargo employees at full operation. The 11-story building will also include a dedicated entrance on 10th Avenue and naming rights to Wells Fargo for signage on the exterior of the property. “This investment further solidifies our longstanding commitment …