IRVINGTON, N.J. — Locally based brokerage firm The Kislak Co. Inc. has arranged the sale of a portfolio of seven multifamily properties totaling 190 units in the Northern New Jersey community of Irvington. The buildings within the portfolio range in size from 11 units to 37 units and have six retail spaces across them. Joni Sweetwood of Kislak represented the seller, a publicly traded Canadian investment firm, in the transaction and procured the buyer. Both parties requested anonymity.

Northeast

WINDSOR, CONN. — First National Realty Partners (FNRP) has acquired Windsor Court, a 78,500-square-foot shopping center located roughly 10 miles outside Hartford. A 64,195-square-foot Stop & Shop grocery store anchors the property. Other tenants include AT&T, Windsor Court Wine, Great Clips and Edible Arrangements. Paul Penman and Johnathan Martin of Newmark represented the undisclosed seller in the transaction.

BOSTON — Marcus & Millichap has brokered the $5.3 million sale of a 12-unit apartment building located in Boston’s Jamaica Plain neighborhood. According to LoopNet Inc., the four-story property at 81 Amory St. was built in 2017. Evan Griffith and Tony Pepdjonovic of Marcus & Millichap represented the seller, a limited liability company, in the transaction. The duo also procured the buyer, an individual/personal trust.

SAYREVILLE, N.J. — JLL has arranged an undisclosed amount of acquisition financing and joint venture equity for a 10-acre industrial outdoor storage property located in the Central New Jersey community of Sayreville. The site at 700 Jernee Mill Road houses a 28,500-square-foot warehouse with clear heights ranging from 24 to 28 feet and 14 drive-in doors, as well as 6.5 acres of truck parking and additional outdoor storage space. Michael Klein, Matthew Pizzolato and Benjamin Morgenthal of JLL arranged the financing on behalf of the borrower, a partnership between Ridgecut Road and Brennan Investment Group. An undisclosed regional bank provided the loan.

NEW YORK CITY — California-based owner-operator SecureSpace Self Storage has opened a new facility at 131-21 14th Ave. in the College Point area of Queens. The number of units was not disclosed. The facility spans 131,691 net rentable square feet of climate-controlled space. Units range in size from 5 feet by 5 feet to 10 feet by 30 feet. The facility also features a leasing office and AI-enabled cameras and sensors that provide security and monitoring.

CROTON-ON-HUDSON, N.Y. — View Living has sold an 82-unit multifamily property located in the Westchester County community of Croton-on-Hudson for $14.4 million. The three-building property was originally built in 1963 and offers one- and two-bedroom units. Aaron Jungreis of Rosewood Realty Group and Joe Brecher of Gebroe-Hammer Associates represented View Living the transaction. Alan Soclof and Michael Schattner, also with Rosewood Realty, represented the buyer, New York-based owner-operator Unppg Management LLC.

SHIPPENSBURG, PA. — Scope Commercial Real Estate Services has brokered the $13.3 million sale of Maverick Apartments, a 480-bed student housing community located near Shippensburg University in southern-central Pennsylvania. The 10-building community recently underwent $1.5 million in capital improvements. The property offers 120 four-bedroom units in standard and loft configurations. Fahd Malik of SCOPE represented the seller, Maverick Apartments LLC, in the transaction. Clark Finney of Matthews Real Estate Investments arranged a $9.5 million acquisition loan on behalf of the undisclosed buyer.

WALLINGFORD, CONN. — Locally based brokerage firm OR&L Commercial has negotiated the $3.3 million sale of a 45,320-square-foot industrial property in Wallingford, located just north of New Haven. The building, which sits on 3.6 acres and features four loading docks, was roughly 45 percent leased at the time of sale to a single tenant. Frank Hird of OR&L represented the seller, Founders Associates LLC, in the transaction and procured the buyer, NEC Advisors. Hird is also representing the new ownership in leasing the available space.

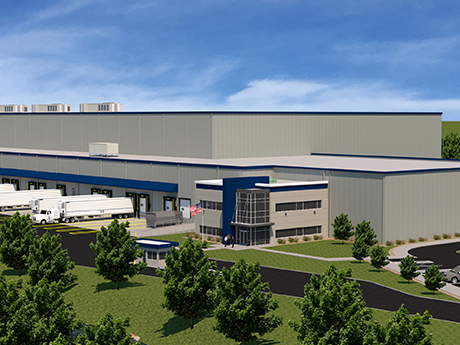

CLAYMONT, DEL. — Georgia-based owner-operator Agile Cold Storage will open a 275,000-square-foot facility in Claymont, Del., about 25 miles southwest of Philadelphia. The site is located within First State Crossing, an industrial park that is a redevelopment of a former steel mill. Agile Cold Claymont is expected to create 130 new jobs and involve capital investment of more than $170 million over the next five years.

BOSTON — JLL has arranged the $41 million sale of 7 Post Office Square, a 64,246-square-foot office building in Boston’s Financial District. The seven-story building was 91 percent leased to eight tenants at the time of sale, with Fidelity Investments serving as the anchor tenant. Chris Angelone, Coleman Benedict, Scott Carpenter, Scott Tully Jr., Brooke Howard and Rachel Bliss of JLL represented the seller, Nuveen Real Estate, in the transaction. The team also procured the buyer, Azora Exan Capital.