NORWALK, CONN. — Newmark has negotiated a 20,586-square-foot office lease in the southern coastal Connecticut city of Norwalk. The building at 45 Glover Ave. is located within the Towers at Merritt River development and features a café with indoor and outdoor seating, conference space and a fitness center. Bill Levitsky, James Ritman and Benjamin Goldstein of Newmark represented the tenant, Verition Fund Management, in the lease negotiations. Leslie Whatley internally represented the landlord, Building & Land Technology.

Northeast

By Elliott Pollack, Esq., Pullman & Comley LLC Although COVID-19 resulted in the pumping of significant dollars from the federal government into municipal and county budgets, generally speaking, property tax assessment offices remain understaffed and undertrained. Many assessors recognize these realities and are successful in convincing local leaders to appropriate funds to retain independent contractors to perform various assessment and collection functions. The theory is that these expenditures are non-recurring and are preferable to staffing assessment offices on a full-time permanent basis. As an example, Connecticut assessors almost always contract with certified revaluation companies to perform statutorily required, community-wide revaluations every five years. They contract with these companies because they simply lack the personnel to do the work themselves. In addition, reliance on outside contractors can, to some degree, insulate municipal staff from angry property owners who are unhappy with their new assessments. Another perhaps unplanned benefit to retaining outside contractors is that unless communications with the contractors can be made promptly after new assessments are published, at least in Connecticut, property owners are compelled to resort to judicial remedies to challenge their values. Since court proceedings tend not to conclude for a year or even more, localities obtain the …

SOMERVILLE, MASS. — BioMed Realty, a San Diego-based subsidiary of Blackstone, has topped out Phase I of Assembly Innovation Park, a project in the Boston suburb of Somerville that will add 497,000 square feet of life sciences and office space to the local supply. The development will ultimately consist of three buildings and include retail space and open green space. Perkins & Will designed Assembly Innovation Park, and John Moriarty & Associates is serving as the general contractor. Vertical construction on the $514 million first phase began in August of last year, and full completion is scheduled for next year.

NEWTON, MASS. — Benchmark Senior Living will undertake a $13 million renovation project at Evans Park at Newton Corner, a seniors housing property located on the western outskirts of Boston. The assisted living and memory care community was originally built in the early 1990s. Bechtel Frank Erickson designed the project, and South Coast Improvement will serve as general contractor. All spaces will feature interior design by Boston-based Stefura Associates. Completion is slated for early 2024.

HACKENSACK, N.J. — Valley Bank has provided an $11 million loan for the refinancing of 211-215 South Newman Street, an 81,000-square-foot industrial property located in the Northern New Jersey community of Hackensack. The multi-building facility features a clear height of 15 feet, three drive-in doors, 11 docks and ample car and trailer parking. The borrower was locally based investment firm The STRO Cos. Tenants at the property include Diaz Wholesale, Mittera Group and John Mini Distinctive Landscapes.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has arranged the $8.8 million sale of a 24-unit apartment building located at 109 Ludlow St. on Manhattan’s Lower East Side. The six-story building houses one-, two- and three-bedroom units, as well as two retail spaces. Michael Tortorici and Shimon Shkury of Ariel Property Advisors represented the buyer in the transaction. Michael DeCheser and Bryan Hurley of Cushman & Wakefield represented the seller. Both parties requested anonymity.

UNION, N.J. — Barnes & Noble will open a 15,000-square-foot bookstore at Union Plaza Shopping Center in Northern New Jersey. Chuck Lanyard and Marc Palestina of The Goldstein Group represented Barnes & Noble in the lease negotiations. Peter Robbins of Robbins Agency represented the landlord. Other tenants at Union Plaza Shopping Center include grocer ShopRite, Best Buy, Designer Shoe Warehouse and Marshalls.

After massive bank runs earlier this month, the Federal Deposit Insurance Corp. (FDIC) took the reins at two regional banks, Silicon Valley Bank based in Northern California and New York City-based Signature Bank. First Citizens Bank has since agreed to acquire the assets of Silicon Valley Bank. According to the FDIC, 2023 already represents the largest year in bank failures in terms of total assets ($319.4 billion combined between the two banks) since 2008, when 25 banks failed (representing $373.6 billion in total assets). “In a very short timeframe, we’ve now seen two of the biggest bank failures on record, the biggest one of course being Washington Mutual back in September 2008,” said Matt Anderson, managing director of Trepp, a New York-based data analytics firm. “We are in a very fraught period right now. Nerves are very frayed at the moment seeing two large bank failures in quick succession.” The comments came during a Trepp-hosted webinar titled “Bank Turmoil and What it Means for CRE & Capital Markets” on Friday, March 24. The three-person webinar featured panelists Anderson and Dr. Stephen Buschbom, research director at Trepp. Lonnie Hendry, the firm’s senior vice president and head of commercial real estate and …

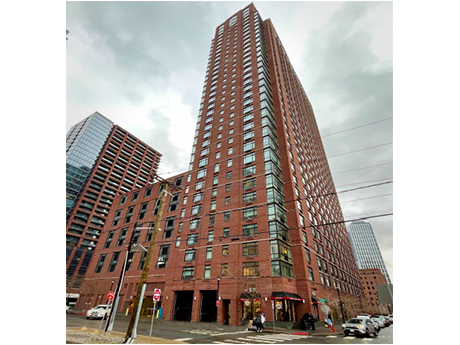

JERSEY CITY, N.J. — NewPoint Real Estate Capital has provided a $153.6 million Freddie Mac loan for the refinancing of The One, a 35-story apartment tower located in Jersey City’s waterfront district. Built in 2015, The One features 451 units in studio, one-, two- and three-bedroom formats, with 10 percent of the units reserved as affordable housing. Residences are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a pool, fitness center, children’s playroom, theater room, golf simulator, game room and a dog park. Carol Shelby and Eric Schleif of Meridian Capital Group placed the loan, which carried a seven-year term and a 35-year amortization schedule, with NewPoint on behalf of the borrower and developer, BLDG Management. The One was 98 percent occupied at the time of the loan closing.

BOSTON — Atlantic Capital Partners, a division of Boston-based Atlantic Realty, has negotiated the $70 million sale of a portfolio of four grocery-anchored retail assets in Massachusetts and Rhode Island. The properties, all of which are master-leased to regional operator Stop & Shop, total 272,542 square feet and are located in the Massachusetts communities of Framingham, Malden and Swampscott, with the fourth in Bristol, R.I. Justin Smith, Chris Peterson and Sam Koonce of Atlantic Capital Partners represented the buyer and seller, both of which requested anonymity, in the transaction.