NEW YORK CITY — A partnership between affiliates of Cantor Fitzgerald and Silverstein Properties has received $165 million in construction financing for 44-01 Northern Boulevard, a multifamily project in the Astoria neighborhood of Queens. The 63,000-square-foot development site is located within an opportunity zone, and has received investment from the Cantor Silverstein Opportunity Zone Trust. Banco Inbursa provided the latest round of financing for the project, which is scheduled for completion in spring 2024. The community is set to offer 354 units in a mix of one- and two-bedroom configurations, 25 percent of which will be priced affordably. The property will also feature 25,000 square feet of retail, 20,000 square feet of amenity space and 200 parking spots. Hill West Architects designed 44-01 Northern Boulevard to pay homage to the borough’s industrial past through the use of masonry and blackened metal. Planned amenities include cascading gardens and an expansive gathering lawn; fitness and yoga studios; a children’s play room; resident lounge; and a 10th-floor amenity space with a co-working lounge, library, chef’s kitchen and rooftop deck offering panoramic views of the Manhattan skyline. The Cantor Silverstein Opportunity Zone Trust was created in 2019 with a focus on acquiring and developing real …

Northeast

MIDDLETON, MASS. — Nashville-based brokerage firm Matthews Real Estate Investment Services has negotiated the $7.7 million sale of a 14,440-square-foot retail property that is net leased to Walgreens in Middleton, a northern suburb of Boston. Grant Korn and Maxx Bauman of Matthews Real Estate represented the locally based seller, Newport Property Corp., in the transaction. A New York-based private investor acquired the asset via a 1031 exchange.

CARLISLE, PA. — Largo Capital, a commercial intermediary based in upstate New York, has arranged a $6.7 million acquisition loan for a 120-unit multifamily property in Carlisle, a western suburb of Harrisburg. The property consists of 15 buildings that house 88 one-bedroom units with an average size of 598 square feet and 32 two-bedroom units with an average size of 828 square feet. Neal Colligan of Largo Capital originated the financing. The borrower and direct lender were not disclosed.

CLINTON, N.J. — Marcus & Millichap has brokered the $6.2 million sale of Hunterdon Shopping Center, a 26,176-square-foot retail property in Clinton, about 60 miles west of New York City. The property was built on 2.4 acres in 1957 and was fully leased at the time of sale. Walgreens anchors the center and recently signed a 10-year lease extension. Brent Hyldahl and Alan Cafiero of Marcus & Millichap represented the seller, a limited partnership, and procured the buyer, a New Jersey-based private investor, in the deal.

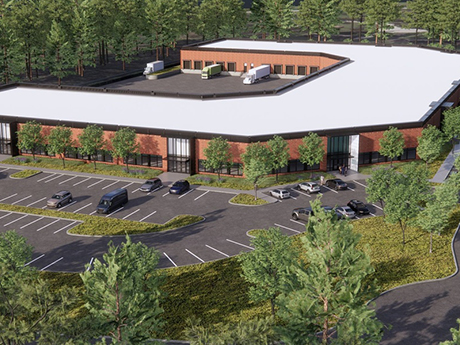

EXTON, PA. — Swiss manufacturer Früh Packaging has signed a 63,480-square-foot, full-building industrial lease in Exton, about 35 miles west of Philadelphia. According to LoopNet Inc., the property was built on 26.5 acres in 2023, totals 113,000 square feet and features a clear height of 16 feet, 40 dock doors and 128-foot truck court depths. Mike Adams and Sarah Finney Miller of NAI Summit represented the tenant in the site selection and lease negotiations. Locally based developer Hankin Group owns the property.

EAST RUTHERFORD, N.J. — Asian-American grocer H Mart has opened a 38,000-square-foot store within American Dream, a megamall and entertainment destination located within the Meadowlands sports complex in Northern New Jersey. Chuck Lanyard of The Goldstein Group and Jeff Chaus of Chaus Realty represented H Mart, which now operates more than 100 stores worldwide, in the lease negotiations. Canadian conglomerate Triple Five Group owns American Dream.

WEEHAWKEN, N.J. — JLL has arranged the sale of a 372-room, Marriott-branded hotel portfolio in the Northern New Jersey community of Weehawken. The portfolio comprises the 208-key EnVue Autograph Collection Port Imperial and the 164-key Residence Inn Port Imperial. Both hotels opened within the last five years and are situated along the Hudson River, offering guests ferry access to Manhattan. JLL represented the seller, Veris Residential, in the transaction. Navika Capital Group purchased the portfolio for an undisclosed price.

PISCATAWAY, N.J. — Electronics manufacturer RCF USA has signed a 30,000-square-foot, full-building industrial lease in the Northern New Jersey community of Piscataway. The building at 101 Circle Drive N. is situated within the 570,000-square-foot Rutgers Industrial Center and features a clear height of 35 feet, six dock doors and 38 parking stalls. Chuck Fern of Cushman & Wakefield represented the tenant in the lease negotiations. Jason Barton, also with Cushman & Wakefield, represented the landlord.

JAMESBURG, N.J. — Lee & Associates has brokered the $4.4 million sale of Forsgate Commons, a 26,295-square-foot office building in Jamesburg, a northeastern suburb of Trenton. The building was originally constructed in 1930 as Jamesburg High School and converted to multi-tenant office use in the 1980s. Beth Chezmar of Lee & Associates represented the seller in the transaction, and Dan De Palma of North American Realty represented the buyer. Both parties requested anonymity.

NEW YORK CITY — Tishman Speyer has inked deals with chef Gabriel Kreuther and his business partners to open two new restaurants at The Spiral, the locally based real estate giant’s 65-story office tower in Manhattan’s Hudson Yards district. One concept will be a 5,700-square-foot full-service restaurant serving lunch and dinner that will be located on the corner of 34th Street and Hudson Boulevard. On the corner of 35th Street and Hudson Boulevard, the team will launch an all-day café serving breakfast and lunch. Both openings are slated for 2024.