EAST BRUNSWICK, N.J. — Locally based developer AMS Acquisitions has begun leasing Summerhill Gardens, a 96-unit multifamily complex located outside of New York City in East Brunswick. Designed by Minno & Wasko Architects, the property consists of four three-story buildings that house one- and two-bedroom units, 24 of which are subject to income restrictions. Amenities include a fitness center with studio space, business center with conferencing facilities, outdoor courtyards with grilling and dining areas, playground, dog run and a resident lounge. Rents start at $2,400 per month for a one-bedroom unit.

Northeast

NEW YORK CITY — New York City-based development and investment firm Innovo Property Group (IPG) has topped out The Borden Complex, a 900,000-square-foot industrial project in the Long Island City area of Queens. The development will feature elevated truck courts and a vertical parking structure, as well as purpose-built film studio space. IPG acquired the site, which previously housed the warehouse of online grocer FreshDirect, in January 2019 with Atalaya Capital Management and Nan Fung Group for $75 million. Construction began in July 2022, and the development team is targeting a spring 2024 completion. Eastdil Secured arranged construction financing for the project through Starwood Property Trust and J.P. Morgan. Starwood also originally provided $155 million in project financing in early 2021.

WARRINGTON, PA. — JLL has brokered the sale of Creekview Center, a 134,980-square-foot shopping center in Warrington, a northern suburb of Philadelphia. The grocery-anchored property is also home to tenants such as Chipotle Mexican Grill, Bank of America and Petco. Christopher Munley, Jim Galbally and Colin Behr of JLL represented the seller, locally based investment and development firm Goodman Properties, in the transaction. The buyer was not disclosed.

TEANECK, N.J. — Commercial finance and advisory firm Axiom Capital Corp. has arranged a $2.1 million loan for the refinancing of an 11,500-square-foot retail asset in the Northern New Jersey community of Teaneck. The freestanding building sits on a three-quarter acre site and was fully leased to a single, undisclosed tenant at the time of sale. The direct lender and borrower were also not disclosed. The nonrecourse loan carried a four-year term and a fixed interest rate.

EAST RUTHERFORD, N.J. — NAI James E. Hanson has negotiated a 9,178-square-foot industrial lease in the Northern New Jersey community of East Rutherford. According to LoopNet Inc., the property at 1 Madison St. was built in 1980 and totals 65,000 square feet. Andrew Somple and Jessica Curry of NAI Hanson represented the tenant, Meadowlands Starz Cheer, and the landlord, Kelways Associates, in the lease negotiations.

NEW YORK CITY — Private aviation services provider evoJets has signed a 3,982-square-foot office lease at 220 E. 23rd St. in Manhattan’s Gramercy Park neighborhood. The 13-story building was originally constructed in 1921 and is known as the Media Arts Building. Bill Korchak, Edward DiTolla and Henry Warner of JLL represented the landlord, A. Shalom Realty & Management Co., in the lease negotiations. Peter Johnson and Leah Zafra from Avison Young represented the tenant.

NEW YORK CITY — Affiliates of Centerbridge Partners LP and GIC Real Estate Inc. have entered into an agreement to acquire INDUS Realty Trust Inc. (Nasdaq: INDT) in an all-cash transaction valued at approximately $868 million. Participating members of INDUS’ board of directors have unanimously approved the deal. Under the terms of the merger agreement, INDUS stockholders will receive $67 per share in cash. That figure represents a premium of 17 percent to the company’s closing stock price on Nov. 25, the date of Centerbridge’s initial public announcement that it intended to issue a takeover offer with GIC to acquire INDUS. “The transaction delivers immediate and significant value to our stockholders, and we believe it validates the quality of the platform and portfolio we have built over INDUS’ long history,” says Michael Gamzon, president and CEO of INDUS. INDUS, a New York City-based industrial REIT, owns 42 buildings totaling roughly 6.1 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina and Florida. The deal is expected to close this summer and is subject to customary closing conditions. Upon completion of the transaction, INDUS’ common stock will no longer be listed on Nasdaq and INDUS will become a privately held …

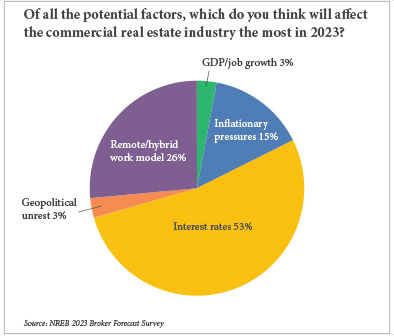

By Hayden Spiess First comes inflation, then come interest rate hikes. The fact that this sequence is a predictable one does not temper the discomfort of reckoning with it, and the commercial real estate industry is as familiar with this pain as any. This familiarity was made clear in the results of an exclusive survey by Northeast Real Estate Business, which was conducted via email toward the end of 2022. Two groups, one comprising brokers and the other consisting of developers, owners and managers, were asked to assess the state of commercial real estate in the region with both retro- and forward-looking perspectives. Of the brokers questioned, approximately 53 percent believed that interest rates would be the factor to affect their industry the most in 2023 (see chart). These individuals selected this option from a list that included other factors such as remote/hybrid work models, inflationary pressures and GDP/job growth, which received 26.5, 14.7 and 2.9 percent of the vote, respectively. The other two options — supply chain constraints and election results — received no votes. Developers likewise identified interest rates as the demographic, political or economic factor likely to cause the most disruption within the industry. An …

POUGHKEEPSIE, N.Y. — Berkshire Bank has provided $36.1 million in financing for The Shoppes at South Hills, a 512,218-square-foot shopping center located north of New York City in Poughkeepsie. Tenants at the property include grocer ShopRite, At Home, Ashley Furniture, Hobby Lobby and Christmas Tree Shops. The borrower, a partnership between Acadia Realty Trust and DLC Management, will use the proceeds to refinance and reposition the center. The nonrecourse loan carried a five-year term and a fixed interest rate. Mike Tepedino and Stephen Van Leer of JLL arranged the financing.

AMHERST, N.Y. — Locally based commercial finance and advisory firm Largo Capital has arranged a $28 million loan for the refinancing of a portfolio of eight office properties totaling 350,000 square feet in the upstate New York community of Amherst. Jack Phillips of Largo Capital originated the financing, which was structured with a 10-year term and a fixed interest rate. The name of the locally based borrower and developer was not disclosed.