BELLEVILLE, N.J. — Connecticut-based SYM Investments has purchased SilverLake Apartments, a 232-unit multifamily complex in Belleville, about 10 miles west of New York City, for $80 million. Completed in early 2022, SilverLake Apartments consists of two five-story buildings that feature studio, one- and two-bedroom floor plans. Amenities include a fitness center, dog park, game room, entertainment lounge with a kitchen, rooftop terrace, business center and package lockers, as well as 17,024 square feet of commercial space that is fully leased. Mike Oliver, Steve Simonelli, Jose Cruz, Elizabeth DeVesty and Austin Pierce of JLL represented the seller, Baltimore-based developer Klein Enterprises, in the transaction. Michael Klein, Thomas Didio Jr., Gerard Quinn and Joseph Gruber, also with JLL, originated a $56 million Freddie Mac acquisition loan on behalf of SYM Investments.

Northeast

HOLYOKE, MASS. — WinnCos. has completed a $55.3 million seniors housing redevelopment in the western Massachusetts city of Holyoke. Residences at Appleton is an adaptive reuse of a former alpaca mill complex that has been vacant since the 1970s into an affordable housing complex for residents age 55 and older. Of the property’s 88 units, 12 are reserved for seniors earning 30 percent or less of the area median income (AMI); 63 are earmarked for renters earning 60 percent of AMI; and 13 are set aside for those earning 80 percent or less of AMI. The unit mix comprises four studios, 75 one-bedroom residences and nine two-bedroom units. Amenities include a fitness center, resident lounge and an outdoor recreation area. Keith Construction served as the general contractor for the project, which was designed by The Architectural Team. VHB provided civil engineering and permitting services. Local nonprofit OneHolyoke provided gap financing for the project, and Bank of America served as the construction lender and the investor in the project’s state and federal low-income housing tax credits. MassHousing also provided tax-exempt bond financing for the development.

EAST ORANGE, N.J. — Regional brokerage firm Hudson Atlantic Realty Advisors has arranged the $9.3 million sale of a 50-unit apartment complex in East Orange, about 15 miles west of New York City. The five-story building at 22-30 S. Munn Ave. was gut-renovated in 2008 and features one-, two- and three-bedroom units with an average size of 917 square feet. Nick Favorito of Hudson Atlantic represented the seller in the transaction and collaborated with Hudson Atlantic’s Adam Zweibel to source the buyer. Both parties requested anonymity.

FARMINGVILLE, N.Y. — JLL has arranged the $190 million sale of The Arboretum, a 292-unit, newly constructed multifamily property in Farmingville, located on Long Island. The site spans 62 acres, and the development features a mix of single-family homes and garden-style apartments. Residences come in two- and three-bedroom floor plans and have an average size of 1,682 square feet, with 30 units reserved for workforce housing. The amenity package comprises a fitness center with a yoga room, pool and cabana area, clubhouse with an entertainment kitchen, courts for tennis, pickleball and bocce ball, a putting green, playground, dog run and a business center with conference rooms. Jose Cruz, Steve Simonelli, Rob Hinckley and Austin Pierce of JLL represented the seller, BRP Cos., in the transaction. The buyer was an affiliate of The Inland Real Estate Group of Cos.

MONROE TOWNSHIP, N.J. — WPT Capital Advisors has acquired a 603,092-square-foot industrial property in Monroe Township, located outside of Trenton in Central New Jersey. The two-building development at 130 Interstate Blvd., which was fully leased at the time of sale, was constructed in 1999 and expanded in 2014. Building features include clear heights of 28 to 32 feet, 66 loading doors, two drive-in doors and parking for 83 trailers and 243 cars. The seller was not disclosed. Jim Cadranell, Ryan Carroll and Caleb Henry of JLL arranged an undisclosed amount of acquisition financing for the deal through PGIM Real Estate.

BOSTON — Hudson Valley Property Group (HVPG), a New York-based affordable housing owner-operator, has purchased Boston Bay and Hope Bay, two adjacent properties totaling 133 units in the Dorchester area of Boston. The properties comprise 20 buildings that were constructed between 1890 and 1920. HVPG plans to invest about $6.4 million ($48,000 per unit) in renovations to both properties, including upgrades to kitchen and bathroom fixtures and appliances, as well as common area enhancements and upgraded security and lighting features. Capital improvements will ensure long-term affordability of both assets.

NEW YORK CITY — Fashion wholesaler Amiee Lynn Inc. has signed a 29,000-square-foot office lease extension in Manhattan’s Garment District. The lease term is five years and seven months, and the space spans the entire 10th and 11th floors of 366 Fifth Avenue, a 12-story historic building. Woody King, Noah Caspi and Todd Korren of Lee & Associates represented the tenant in the lease negotiations. Michael Joseph and Aidan Campbell of Colliers represented the landlord, Joseph P. Day Realty.

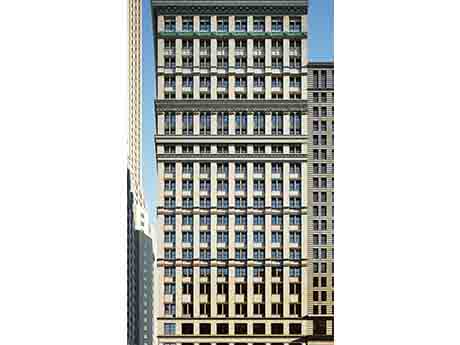

NEW YORK CITY — GFP Real Estate has received $191.5 million in financing for the office-to-residential conversion of 40 Exchange Place, a historic 300,000-square-foot building in Lower Manhattan’s Financial District. Upon completion, the 20-story converted building will include 382 affordable and market-rate apartments, as well as ground-floor retail space. In addition to the loan, the project will be backed by federal and state historic rehabilitation tax credits as well as a 35-year 457-m tax abatement, a New York City incentive designed to support office-to-residential conversions. Jordan Roeschlaub, Chris Kramer and Tim Polglase of Newmark arranged the financing through Derby Lane. A construction timeline was not announced.

COPIAGUE, N.Y. — A partnership between Atlanta-based developer The Ardent Cos. and Ironwood Development Partners has completed a 950-unit self-storage facility in Copiague, located on Long Island. Extra Space Storage will operate the facility, which spans 108,201 square feet, though it is unclear if that figure refers to gross or net rentable square footage. Park East Construction served as the general contractor for the project. Michael Sudano Architect PC designed the facility, and R&M Engineering acted as the civil engineer. A formal opening took place in mid-December.

HOBOKEN, N.J. — Los Angeles-based investment firm JRK Property Holdings has acquired 77 Park Avenue, a 301-unit apartment complex in Hoboken. Built in 2000, the property offers one-, two- and three-bedroom units that are furnished with stainless steel appliances, granite countertops, hardwood flooring, walk-in closets and private balconies. Amenities include a fitness center, sundeck, outdoor grilling stations and onsite laundry facilities. The seller was Equity Residential, and the property traded as part of a $400 million portfolio deal that was brokered by CBRE.