NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $6.7 million sale of a 22-unit multifamily property in the Pelham Bay area of The Bronx. The seven-story building offers one-, two- and three-bedroom units, includes 11 parking spots and was fully occupied at the time of sale. Daniel Mahfar, Jason Gold and Victor Sozio of Ariel Property Advisors brokered the deal. The buyer and seller were not disclosed.

Northeast

By Ben Starr, partner at Atlantic Retail As the retail real estate industry seeks to understand what may lie ahead in 2023, a study of the wild ride it took in 2022 will likely produce the best clues. As early as March of last year, it was clear that 2022 would be a year of activity like none of the prior 15. While headlines through the spring and summer emphasized a run-up in consumer prices and a recession hovering on the back of interest rate hikes, users of retail space intensified their pursuits of new opportunities, unbowed by the looming economic clouds. Everyone — traditional commodity retailers, direct-to-consumer concepts, restaurants, fitness users, medical and other services — was chasing deals. Whether small or large or in primary, secondary or tertiary markets, activity heated up with each new month. Reflecting Larger Trends With its dense middle-class demographics, close proximity to Boston and high traffic counts, Saugus has historically been in high demand among category killers as well as high-profile service and restaurant operators. Though its local mall, Square One, has struggled as larger, more regional malls rose in upscale neighboring markets, the heavily traveled Route 1 corridor has remained one of …

Arbor Realty TrustBuild-to-RentContent PartnerDevelopmentFeaturesLeasing ActivityMidwestMultifamilyNortheastSingle-Family RentalSoutheastTexasWestern

Arbor Report Finds Rental Housing Insulated from Economic Contraction, Risk Factors Endure

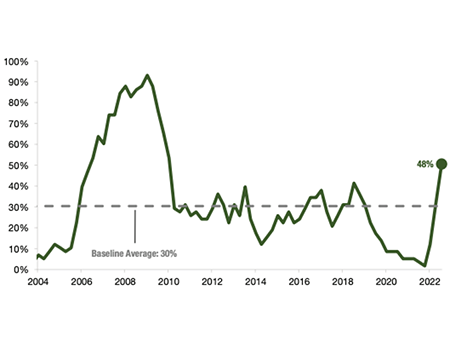

— By Ivan Kaufman, founder, chairman and CEO of Arbor Realty Trust, Inc.; and Sam Chandan, a professor of finance and director of the Chen Institute for Global Real Estate Finance at the NYU Stern School of Business Rental housing is uniquely positioned to withstand tremendous economic headwinds. Although some observers point to the slowdown in apartment rent growth as a sign of growing weakness, this trend is a cyclical feature that is not reflective of any structural change in the profile of demand or supply. It is normal to expect a period of slowing rent growth while there is uncertainty in the economic outlook. In-depth findings on these trends, plus a thorough economic outlook for 2023 and a complete breakdown of risk factors, are detailed in Arbor Realty Trust Special Report Spring 2023: Navigating a Corrective Environment, from which this article is excerpted. While no asset class is immune from the challenges of higher interest rates, the presence of amortization, which spreads out a loan into a series of fixed payments over time, makes the multifamily sector less likely to see mounting distress. All Department of Housing and Urban Development (HUD)-conforming multifamily loans are fully amortizing. Moreover, Fannie …

NEW YORK CITY — Wells Fargo has provided $288 million in financing for North Cove, a 611-unit affordable housing project in Manhattan’s Inwood neighborhood. The financing includes $155 million in debt that backs city-issued, tax-exempt bonds, as well as $133 million in equity that was generated through the purchase of tax credits. The borrower and developer is a partnership between Joy Construction Corp. and Maddd Equities. Units will be restricted to households earning between 27 and 110 percent of the area median income, and roughly 15 percent (94) of the residences will be reserved for formerly homeless residents. The development will include 60,000 square feet of commercial space and offer amenities such as outdoor picnic areas, community recreation rooms and various supportive services. Lastly, as part of the project, the city has donated an adjacent parcel for the construction of a waterfront park.

EASTAMPTON, N.J. — New York City-based development and investment firm Rockefeller Group has sold a 345,600-square-foot warehouse and distribution center in Eastampton, located east of Philadelphia, for $83 million. Building features include a clear height of 36 feet, 185-foot truck court depths, 54 dock doors, 384 car parking spaces, 96 trailer parking spaces and 4,000 square feet of office space. Glendale Warehouse & Distribution Corp. purchased the facility and will use it to store and distribute spices and other food products. Tom Monahan, Gerard Monahan, Stephen D’Amato, Larry Schiffenhaus, Lauren Hageman and Ana Lazarides of CBRE represented Rockefeller Group in the transaction. Chuck Fern of Cushman & Wakefield represented the buyer.

WESTBOROUGH, MASS. — Locally based investment firm Grossman Development Group has purchased Bay State Commons, a 261,672-square-foot shopping center in Westborough, a western suburb of Boston. Grocer Roche Bros. anchors the center, and other tenants include Boston Interiors, Reliant Medical, Boston Ski & Tennis, Ted’s Montana Grill and Panera Bread. The new ownership plans to upgrade the property’s landscaping, signage and sidewalks. The seller and sales price were not disclosed.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $8.6 million sale of The St. Ann’s Portfolio, a collection of six multifamily buildings in The Bronx. The buildings total 82 residential units and four commercial spaces and are located in the Mott Haven neighborhood. Heritage Affordable Communities purchased the portfolio from Castellan Real Estate Partners. Victor Sozio, Shimon Shkury, Jason Gold and Daniel Mahfar of Ariel Property Advisors brokered the deal.

WOODBURY, N.Y. — Marcus & Millichap has brokered the $11.3 million sale of a 4,875-square-foot retail property in the Long Island community of Woodbury that is net leased to Chase Bank. The newly constructed building is located at 7920 Jericho Turnpike. Alan Lipsky and Barry Wolfe of Marcus & Millichap represented the seller, an entity doing business as 7940 Woodbury Partners LLC, in the transaction. The buyer was KIT Realty Inc. John Horowitz of Marcus & Millichap assisted in closing the deal as the broker of record.

NEW YORK CITY — Samson’s Stages, which provides studio rental services for the TV and movie industries, is underway on construction of a $400 million facility in the Red Hook neighborhood of Brooklyn. The site at 744 Clinton St. currently houses the operations of Sunshine Lighting. Designed by BIG-Bjarke Ingels Group, Samson’s Stages Red Hook will total 330,000 square feet and comprise eight stages, green terraces, onsite parking, a lobby and a café. The project will also include the redevelopment of a portion of the waterfront and the construction of a new public park. A tentative completion date was not disclosed.

VINELAND, N.J. — Marcus & Millichap has brokered the $19.3 million sale of Maintree Shopping Center, a 138,445-square-foot retail center located in the Southern New Jersey community of Vineland. Grocer Acme anchors the center, which was originally built in 1996. Other tenants include Boston Market, Burger King, Pizza Hut, Sino Wok and Primo Hoagies. Joseph French Jr., Kodi Traver and Thomas Dalzell of Marcus & Millichap represented the seller, a New Jersey-based limited liability company, in the deal. French also procured the buyer, a California-based private investor.