PENNSYLVANIA — Evans Senior Investments (ESI) has arranged the $39 million sale of a portfolio of three seniors housing properties in Pennsylvania. The properties, the specific names and locations of which were not disclosed, total 395 skilled nursing beds and 32 units of private-pay seniors housing. The portfolio was approximately 64 percent occupied at the time of sale. The buyer was a regional owner-operator, and the seller was not disclosed.

Northeast

NEW YORK CITY — JLL has negotiated a 45,000-square-foot, 20-year office lease at 2100 Bartow Ave. in The Bronx. The 180,000-square-foot building was constructed in 1988. Al Gutierrez and Ian Ceppos of JLL represented the landlord, Prestige Properties, in the lease negotiations. Mark Boisi and Stephen Bellwood of Cushman & Wakefield, along with Neil Lipinski of Lipinski Real Estate represented the tenant, United Federation of Teachers. The tenant plans to take occupancy of its new space this fall.

PARAMUS, N.J. — The Hospital for Special Surgery (HSS) has signed a 40,062-square-foot healthcare lease at Nexus 17, a two-building complex located in the Northern New Jersey community of Paramus. Brian Given, Bryn Cinque and James Bailey of Colliers represented HSS in the lease negotiations. David DeMatteis, Benjamin Brenner and Mark Zaziski of Cushman & Wakefield represented the landlord, The Birch Group. The building is now 96 percent leased.

WOONSOCKET, R.I., AND CHICAGO — CVS Health (NYSE: CVS) has agreed to acquire Oak Street Health (NYSE: OSH) in an all-cash transaction at $39 per share, representing a total purchase price of roughly $10.6 billion. The price represents a premium of approximately 11.9 percent over Oak Street’s opening price per share this morning. Chicago-based Oak Street Health is a network of primary care centers for adults on Medicare. The company employs approximately 600 primary care providers and maintains 169 medical centers across 21 states. By 2026, Oak Street Health plans to grow to more than 300 centers. Oak Street Health’s technology solution, Canopy, is fully integrated with its operations and utilized when determining the appropriate type and level of care for each patient. That care will be enhanced by CVS Health’s community, home and digital offerings, according to the companies. Bringing CVS Health and Oak Street Health together can significantly benefit patients’ long-term health by reducing care costs and improving outcomes, particularly for those in underserved communities, according to a news release. Oak Street Health centers are located where healthcare services are needed most; more than 50 percent of Oak Street Health’s patients have a housing, food or isolation risk …

NEW YORK CITY — A joint venture between Hawkins Way Capital and Vardë Partners has acquired a 655-room hotel located at 525 Lexington Ave. in Manhattan’s Midtown East neighborhood. The 35-story, 406,261-square-foot building, which was shuttered at the time of sale, was originally constructed in 1922 and most recently housed a Marriott-branded operation. Jeffrey Davis, Gilda Perez-Alvarado, Stephany Chen and Bob Knakal of JLL represented the seller, global investment firm Deka Immobilien, in the transaction.

BUFFALO, N.Y. — Largo Capital, a locally based commercial finance and advisory firm, has arranged a $30 million loan for the refinancing of a portfolio of 11 multifamily properties totaling 789 units in Buffalo. The portfolio was 99 percent occupied at the time of sale. Ned Perlman of Largo Capital originated the financing. The borrower and direct lender were not disclosed.

JERSEY CITY, N.J. — Coldwell Banker has begun leasing Aspira, a 60-unit apartment complex located in Journal Square neighborhood of Jersey City. The six-story building offers studio and one-bedroom units that are furnished with stainless steel appliances, quartz countertops and individual washers and dryers. Amenities include a package handling room, bike storage space and a rooftop deck/garden. Rents start at $1,850 per month for a studio. The owner/developer was not disclosed.

NORWALK, CONN. — Locally based brokerage firm Angel Commercial has negotiated the $6 million sale of a 34,583-square-foot mixed-use building in Norwalk, located in the southern coastal part of Connecticut. The property at 430 Main Ave. comprises 14 retail and office units and nine apartments. Brett Sherman of Angel Commercial represented the seller, an entity doing business as C&H Lew LLC, in the off-market transaction. Sherman also procured the undisclosed buyer.

JERSEY CITY, N.J. — Business management consulting firm EXL has signed a 17,712-square-foot office lease renewal at 10 Exchange Place, a 30-story, 740,354-square-foot building in Jersey City. David DeMatteis, Nicholas Dysenchuk and Robert Lowe of Cushman & Wakefield represented the landlord, an affiliate of Canadian insurance and financial services giant Manulife, in the lease negotiations. Scott Bogetti and Meghan Marchini of Savills represented the tenant.

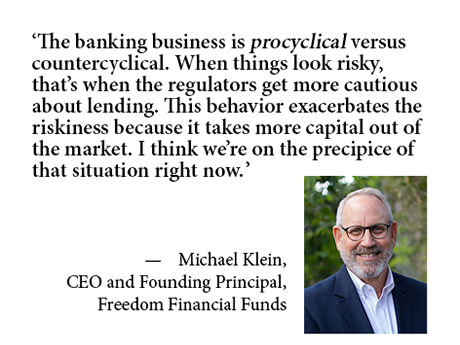

Prospective investors can finance acquisitions even when equity is scarce, explains Michael Klein, CEO and founding principal of Freedom Financial Funds. “The scarcity of equity is an old phenomenon; it’s a relatively new phenomenon that made equity plentiful. For most of history, it was hard work to find equity. However, even in a tight market, if there’s a compelling case for a project to result in success and there are multiple ways of protecting the equity and the debt, that deal will get done.” This is the outlook Klein brings to the 2023 MBA Commercial/Multifamily Finance Convention & Expo. Klein’s company, Freedom Financial Funds, LLC is a private REIT based in Los Angeles and operating in the western United States. The REIT specializes in providing capital to real estate professionals adding value to projects. Debt, Equity and Protecting Value Klein explains that with any type of financing, whether it be debt or equity, it is key to have a compelling story and facts to indicate that the borrower is going to provide a fair amount of value. “Protecting the investor from potential downside risks is an essential part of financing,” explains Klein. This sort of forethought requires thorough due diligence …