LAWRENCE, MASS. — MassHousing has provided $25.9 million in financing for an affordable housing redevelopment project in Lawrence, a northern suburb of Boston. The project will convert a 177-year-old structure that originally housed a stone mill into a complex with one-, two- and three-bedroom units. Of the 86 units, 11 will be rented to households earning 30 percent or less of the area median income (AMI); 58 will be reserved for renters earning up to 60 percent of AMI; and the other 17 will be rented at market rates. WinnCos. is the developer of the project. The financing package comprised a $4.6 million tax-exempt permanent loan, a $20.4 million bridge loan and $900,000 from the Capital Magnet Fund, an initiative designed to attract private capital to affordable housing projects in economically distressed areas.

Northeast

HADLEY, MASS. — Boston-based brokerage firm Atlantic Capital Partners has arranged the sale of Campus Plaza, a 150,984-square-foot shopping center in Hadley, located north of Springfield in the western part of the state. Anchored by a 71,494-square-foot Stop & Shop grocery store, Campus Plaza was 91 percent leased to 10 tenants at the time of sale. Justin Smith, Chris Peterson, Sam Koonce and Cole Van Gelder of Atlantic Capital Partners represented the buyer and seller, both of which requested anonymity, in the transaction.

CAMBRIDGE, MASS. — General contractor Nauset Construction has broken ground on 605 Concord, a 49-unit multifamily project that will be located across the Charles River from Boston in Cambridge. Designed by Piatt Associates, the six-story project will include 2,500 square feet of street-level retail space. Floor plans will come in studio, one-, two- and three-bedroom formats, and 15 percent of the units will be designated as affordable housing. Completion is slated for summer 2024.

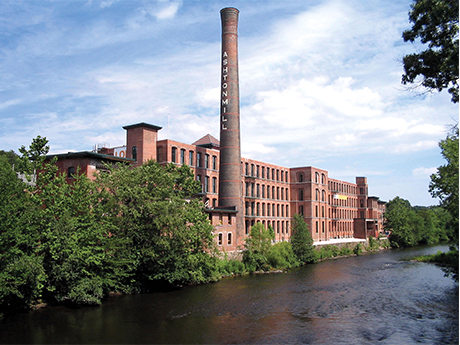

NEW HAVEN AND STRATFORD, CONN. — Illinois-based investment firm B3 Holdings LLC has acquired three multifamily properties in Connecticut and Rhode Island totaling 481 units units for $117 million. Winchester Lofts is a 158-unit complex in New Haven, and the second property is a 128-unit asset in Stratford, both of which are located in the southern coastal part of Connecticut. The third asset is River Lofts at Ashton Mills, a 195-unit community in Cumberland, R.I. Victor Nolletti, Eric Pentore and Wes Klockner of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, Brookfield Asset Management, in the transaction. The trio also procured B3 Holdings as the buyer.

SALEM, N.H. — Boston-based brokerage firm Atlantic Capital Partners has arranged the sale of a 233,008-square-foot retail building formerly occupied by Sears in Salem, located in the southeastern part of the Granite State. The building is situated within the 1 million-square-foot Rockingham Park Mall and currently houses a Cinemark Theatres and a Dick’s Sporting Goods, which have backfilled 53 percent of the space. Justin Smith, Sam Koonce and Cole Van Gelder of Atlantic Capital Partners represented the seller in the transaction. Additional terms of sale were not disclosed.

SPRINGFIELD, MASS. — An affiliate of The Dolben Co., a multifamily owner-operator based in metro Boston, has sold Stockbridge Court, a 233-unit property located in the western Massachusetts city of Springfield. The sales price was $42.6 million. Converted to residential use in 1979, the four-building property offers studio, one- and two-bedroom units with an average size of 729 square feet. Simon Butler, Biria St. John and John McLaughlin of CBRE represented The Dolben Co. and procured the buyer, an affiliate of Stockbridge Ventures, in the transaction.

ROCKLAND, MAINE — Metro Boston-based brokerage firm Horvath & Tremblay has negotiated the $13.5 million sale of Harbor Plaza, a 169,079-square-foot shopping center in Rockland, located roughly midway between Portland and Bangor. Anchored by grocer Shaw’s, the center was roughly 93 percent leased at the time of sale to tenants such as T.J. Maxx, HomeGoods, Staples, Olympia Sports, H&R Block and The UPS Store. Bob Horvath and Todd Tremblay of Horvath & Tremblay represented the buyer and seller, both of which requested anonymity, in the deal.

WHARTON, N.J. — New Jersey-based developer Diversified Properties has broken ground on a 60-unit multifamily project in the Northern New Jersey community of Wharton. Irondale at Wharton will feature studio, one- and two-bedroom apartments that will be furnished with stainless steel appliances, quartz countertops and full-sized washers and dryers, as well as a gym and underground parking. Construction is expected to be complete in late 2023.

PHILADELPHIA — A partnership between National Real Estate Development (NRED) and New Jersey-based Kushner Real Estate Group has broken ground on 200 Spring Garden, a 360-unit multifamily project in Philadelphia’s Northern Liberties neighborhood. Designed by Handel Architects, the 13-story building will house Class A amenities, including a pool and a two-story fitness center, as well as retail and public green space. A tentative completion date was not disclosed.

WILTON, CONN. — CBRE has brokered the sale of a 161,222-square-foot office building in Wilton, located in Fairfield County. The property, which is located within a larger, four-building office park, was 42 percent leased at the time of sale. Amenities include a fitness center, basketball and tennis courts, café and a conference center. Jeffrey Dunne, Steven Bardsley and Travis Langer of CBRE represented the seller, an entity doing business as Wilton 40/60 LLC, in the transaction. The team also procured the buyer, an entity managed by Northpath Investments, which acquired the asset for an undisclosed price.