JOHNSTON, R.I. — Marcus & Millichap has brokered the $10.2 million sale of a 20,560-square-foot civic building in Johnston, a western suburb of Providence. The building houses offices of the U.S. Citizenship & Immigration Services. Laurie Ann Drinkwater and Seth Richard of Marcus & Millichap represented the seller, a private investment group, in the transaction. Additional terms of sale were not disclosed.

Northeast

CRANSTON, R.I. — Topgolf will open a 68,000-square-foot venue at 100 Sockanosset Cross Road in Cranston. Locally based firm Carpionato Group owns the site and is leading the development of the multi-level facility, which will be the first in Rhode Island for the Dallas-based entertainment concept. Construction is underway and expected to be complete before the end of 2023. Carpionato is also working with Rhode Island Department of Transportation on infrastructural improvements associated with the project, such as the reconstruction of the eastern section of Route 37, which included a frontage road from Route 37 at Pontiac Avenue. Carpionato Group originally acquired the site in 1997.

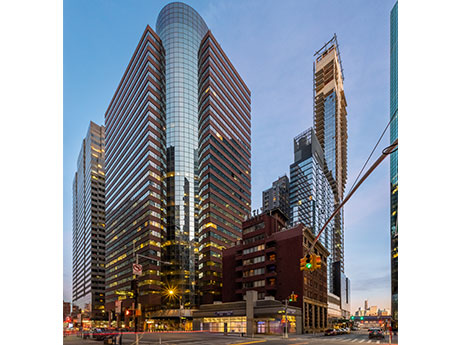

NEW YORK CITY — MGM Studios has signed a 50,462-square-foot office lease at 260 Madison Avenue, a 570,000-square-foot building in Midtown Manhattan. Peter Turchin, Gregg Rothkin, Tim Freydberg, Hayden Pascal and Jared London of CBRE represented the landlord, The Sapir Organization, in the lease negotiations. The representative of the tenant was not disclosed.

EAST HANOVER, N.J. — JLL has arranged a $33 million construction loan for Bridge Point East Hanover, a 314,413-square-foot industrial project in Northern New Jersey. The warehouse and distribution center will feature a clear height of 32 feet, 62 dock-high doors, 60 trailer parking spaces and 100 car parking spaces. Michael Klein, Jon Mikula and Ryan Carroll of JLL arranged the four-year, floating-rate loan through Hartford Investment Management Co. on behalf of the borrower, Bridge Industrial LLC.

NORRISTOWN, PA. — CBRE has brokered the $7.4 million sale of a 25,150-square-foot veterinary clinic in Norristown, a northwestern suburb of Philadelphia. Metropolitan Veterinary Associates occupies the facility, which was originally built in 1987 and renovated in 2019, on a triple-net basis. Michael Shover, Matthew Gorman, Thomas Finnegan and Rob Thompson of CBRE represented the seller, an entity doing business as LMP Van Buren LLC, in the transaction. The team also procured the buyer, a Nashville-based limited liability company.

Bellwether Enterprise Provides $6.5M Refinancing of Affordable Seniors Housing Property Near Buffalo

KENMORE, N.Y. — Bellwether Enterprise has provided a $6.5 million HUD-insured loan for the refinancing of Ken-Ton Presbyterian Village, a 150-unit affordable seniors housing property located near Buffalo in the upstate New York community of Kenmore. The borrower was Beechwood Continuing Care. Lundat Kassa and Anthea Martin led the transaction for Bellwether Enterprise.

NEW YORK CITY — Locally based brokerage firm Ariel Property Advisors has negotiated the $5.5 million sale of an eight-unit apartment building located in the Park Slope area of Brooklyn. According to StreetEasy.com, the four-story building was originally built in 1920. Benjamin Vago, Stephen Vorvolakos and Sean Kelly of Ariel Property Advisors brokered the deal. Both the buyer and seller requested anonymity. The deal traded at a cap rate of 4.8 percent.

TEANECK, N.J. — Locally based owner and developer Alfred Sanzari Enterprises will open Marketplace, a 3,350-square-foot food hall in the Northern New Jersey community of Teaneck. Located within the firm’s 670,000-square-foot Glenpointe campus, Marketplace has already received commitments from concepts such as kosher deli Ma’adan, Colombian coffee shop Coffeecol, French-inspired Balthazar Bakery and ice cream maker Sip N Swirl. Marketplace will officially open this Friday, Oct. 21. White Lodging will manage the venue.

NEW YORK CITY — JLL has arranged the $252 million sale of the former AIG global headquarters to 99c LLC, a real estate firm specializing in adaptive reuse development in urban markets. The 31-story property is located at 175 Water St. in Lower Manhattan’s Seaport submarket and comprises 684,500 square feet of rentable space. Vanbarton Group was the seller. The purchase represents 99c’s entry into the New York market following a focus on London, where it acquired millions of square feet of commercial office space. The firm is currently one year into a four-year plan to do the same in New York. 175 Water St. features 12-foot ceilings, 24,000-square-foot floor plates, center-core configuration and an efficient design. The building’s flexibility also includes an unused ground floor, which is being primed for a reimagined lobby along with two usable rooftop terraces with amenities. The building is completely vacant, following AIG’s move to a new location in 2021. Andrew Scandalios, David Giancola, Vickram Jambu, Marion Jones, Steven Rutman and Alexander Riguardi led JLL’s capital markets investment sales advisory team representing the seller. “175 Water St. received a generous amount of investor interest given the nature of the building, which provided a blank canvas …

NEW JERSEY — French investment bank Natixis has provided an $89.1 million loan for the refinancing of the Crossings Industrial Portfolio, a collection of 25 buildings totaling roughly 1.2 million square feet that are located throughout Southern New Jersey and Bucks County, Pennsylvania. Specifically, the properties are located in Delran, Bridgeport, Evesham, Cinnaminson and Mount Laurel, New Jersey, and Bristol, Pennsylvania. John Alascio, Chuck Kohaut and T.J. Sullivan of Cushman & Wakefield arranged the debt. The borrower was Camber Real Estate Partners, an investment firm based in Northern New Jersey.