PHILADELPHIA — Affinius Capital has provided a $170 million construction loan for a 431-unit multifamily project that will be located in Philadelphia’s Northern Liberties neighborhood. The project represents Phase II of a larger development known as Piazza Alta and will consist of two buildings that will rise eight and 16 stories. Units will come in studio, one-, two- and three-bedroom floor plans and will be furnished with stainless steel appliances and individual washers and dryers. Amenities will include a rooftop lap and lounge pool, grilling stations, fire pits, a fitness center with a yoga studio and coworking spaces. Russell Schildkraut of Ackman-Ziff arranged the loan on behalf of the borrower, locally based developer Post Brothers.

Northeast

STATE COLLEGE, PA. — A joint venture between Georgia-based developer Landmark Properties and Liberty Mutual Investments will develop The Mark State College, a 515-bed student housing project for students at Penn State University. Designed by Cube3 Architects, The Mark State College will be a 12-story building that will be located on East College Avenue, adjacent to campus. Amenities will include a sky deck, rooftop pool and hot tub, fitness center and sauna, clubhouse, grilling area, sports simulator, study lounge, café, computer lab and fire pits. TSB Capital Advisors arranged construction financing for the project. A tentative development timeline was not announced.

BOSTON — Global private equity firm KKR has signed a 15-year, 132,529-square-foot office lease at Two International Place in downtown Boston. International Place is a 1.8 million-square-foot complex that was built in phases between 1987 and 1992 and is currently in the midst of a $100 million renovation. JLL and Cushman & Wakefield co-represented KKR in the lease negotiations. Newmark represented the landlord, The Chiofaro Co., which owns International Place in partnership with PGIM.

CLEMENTON, N.J. — Marcus & Millichap has brokered the $6.7 million sale of Chews Landing Commons, a 44,500-square-foot medical office complex in Clementon, located in Southern New Jersey’s Camden County. The complex consists of seven buildings on a 6.1-acre site and was 96 percent leased at the time of sale to tenants such as NovaCare Rehabilitation Center, Victory Bay Recovery Center and Harmony Bay Wellness. Brent Hyldahl and Alan Cafiero of Marcus & Millichap represented the seller in the transaction.

LIVINGSTON, N.J. — Local brokerage firm The Kislak Co. Inc. has negotiated the $2.5 million sale of an 8,100-square-foot retail strip center located in the Northern New Jersey community of Livingston. The center at 25 W. Northfield Ave. was originally built in 1954. Matt Weilheimer and Scott Davidovic of Kislak brokered the deal. The buyer and seller were not disclosed.

BOSTON — A joint venture between BXP (NYSE: BXP), formerly Boston Properties, and Delaware North, a privately owned hospitality and entertainment company, has received a $465 million loan for the refinancing of a portion of The Hub on Causeway. The 1.5 million-square-foot mixed-use development is located in the West End neighborhood of Boston. Situated on the site of the former Boston Garden arena, the original home arena of the Boston Bruins and Boston Celtics, The Hub on Causeway is now a transit-oriented development that features 811,000 square feet of office space and 440 luxury apartments, as well as 250,000 square feet of retail space and a 60,000-square-foot Star Market grocery store. An affiliate of Verizon Communications anchors the development on a 20-year lease. Wells Fargo Bank, Morgan Stanley Bank and Bank of America provided the loan to BXP and Delaware North. The joint venture refinanced The Hub on Causeway’s office tower and “podium,” which is the lower section that houses a food hall, creative office space and a movie theater. “We are pleased to complete this financing, which not only enhances the strength and flexibility of our balance sheet, but also demonstrates our access to attractively priced capital in the secured …

BOSTON — Walker & Dunlop has provided a $356.4 million Freddie Mac loan for the refinancing of a portfolio of four multifamily properties totaling 1,817 units in New England. The portfolio comprises Royal Crest Marlboro, a 473-unit property located west of Boston; Royal Crest Warwick, a 492-unit community in Rhode Island; Waterford Village, a 588-unit asset located south of Boston; and Wexford Village, a 264-unit complex in Worcester. The properties were all built between 1970 and 1974. Craig West led the Walker & Dunlop team that originated the financing on behalf of the borrower, an affiliate of Harbor Group International.

FAIRFIELD, CONN. — Cleveland-based commercial finance firm BWE has funded a $35.3 million Freddie Mac permanent loan for Sturges Ridge of Fairfield, a 99-bed seniors housing complex located in southern coastal Connecticut. The property opened in 2018, houses 88 units and offers assisted living and memory care services. Amenities include game/activity lounges, a fitness and wellness center, private dining room, library with computer stations, full-service salons and a pet therapy program. Taylor Mokris and Ryan Stoll of BWE originated the 10-year, fixed-rate loan on behalf of the undisclosed borrower.

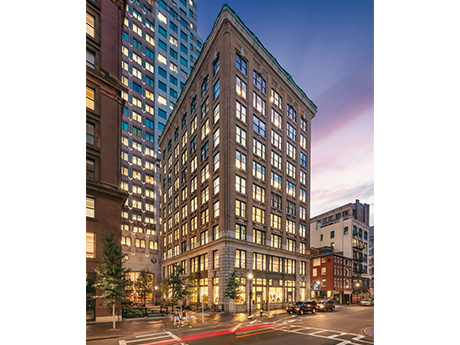

BOSTON — JLL has arranged $8 million in financing for a 75,000-square-foot office building located at 15 Broad St. in downtown Boston. The 10-story building was originally constructed in 1910. Amy Lousararian and Hugh Doherty of JLL arranged the five-year, fixed-rate loan through MountainOne Bank. The borrower, local owner-operator Broder, plans to use proceeds to fund capital improvements, including a redesign of the lobby, upgrading of common areas and the introduction of a new amenity package.

DANBURY, CONN. — Marcus & Millichap has brokered the sale of the 112-room Comfort Inn & Suites hotel in Danbury, located in southern Connecticut’s Fairfield County. The hotel, which was previously operated as a Holiday Inn, was built in 1973 and offers amenities such as a fitness center, outdoor pool, business center and onsite laundry facilities. Jerry Swon of Marcus & Millichap represented the buyer and seller, both of which were private hotel operators that requested anonymity, in the transaction.