UNION, N.J. — JLL has arranged a $31 million loan for the refinancing of Liberty Hall Center I, a 210,000-square-foot office building located in the Northern New Jersey community of Union. The five-story building was originally designed in 1988 to house the headquarters of regional energy provider Elizabethtown Gas and features amenities such as a cafeteria, conference center and outdoor lounge areas. Jon Mikula, Max Custer and Michael Lachs of JLL arranged the loan through Knighthead Funding. The borrower, an entity doing business as Liberty Hall Joint Venture LLC, will use a portion of the proceeds to fund capital improvements.

Northeast

HARTFORD, CONN. — Institutional Property Advisors (IPA), a division of Marcus & Millichap, has negotiated the sale of Capitol View Apartment Homes, a 264-unit multifamily complex in downtown Hartford. Built in 1955 and renovated between 2002 and 2013, the 10-story building houses units with an average size of 542 square feet and offers amenities such as a lounge, fitness center and concierge service. Victor Nolletti, Wes Klockner and Eric Pentore of IPA represented the seller, an entity doing business as MATP LLC, in the transaction. The trio also procured the buyer, EOM Equity LLC.

FALL RIVER, MASS. — Greystone has provided a $15.3 million Fannie Mae loan for the refinancing of a historic, 103-unit multifamily asset in Fall River, located near the Massachusetts-Rhode Island border. Commonwealth Landing was originally built in the 1880s as a cotton mill and was converted into a multifamily complex with one-, two- and three-bedroom units in 2016. Shana Daby of Greystone originated the fixed-rate, nonrecourse loan, which features three years of interest-only payments, on behalf of the borrower, an entity doing business as Mechanics Mill Two LLC. Michael Corso of Kingston Capital provided debt advisory services.

NEW YORK CITY — U.S. audit, tax and advisory firm KPMG has unveiled plans to relocate its headquarters to Two Manhattan West, a new office building under construction in Midtown Manhattan’s West Side neighborhood. The 58-story tower is part of Brookfield Properties’ 7 million-square-foot Manhattan West mixed-use development. KPMG’s new space at Two Manhattan West is slated for completion in late 2025. The firm will relocate its roughly 5,500 New York-based employees and lease approximately 450,000 square feet. The new lease signing represents a more than 40 percent decrease in KPMG’s existing New York office space, according to The Wall Street Journal. The newspaper reports that KPMG is pursuing a hybrid work strategy where employees are expected to gather at company or client offices on some days. The firm is following suit of a number of companies that have downsized office footprints in exchange for nicer space following the pandemic. KPMG currently occupies space at 345 Park Ave., its headquarters, as well as 560 Lexington Ave. and 1350 Sixth Ave. The firm has been based in New York City since its inception in 1897. “As we celebrate our 125th anniversary and think about our firm’s future, this is an incredible …

Arbor Realty TrustContent PartnerFeaturesLeasing ActivityMidwestMultifamilyNortheastSoutheastTexasWestern

Arbor: Multifamily Market Well-Positioned to Withstand Economic Headwinds

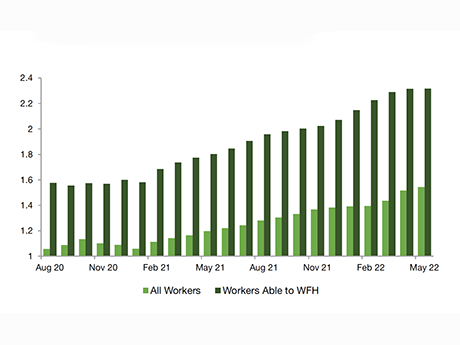

While rising interest rates, inflation and economic volatility have hurt many sectors of the economy, the rental housing market has maintained solid footing, according to Arbor Realty Trust’s Summer 2022 Special Report: Rental Housing Market Exhibits Cyclical Stability, Contains Structural Questions. The report was written by Ivan Kaufman, Arbor’s chairman and CEO, and Sam Chandan, founder of Chandan Economics. In a time of economic uncertainty, renting has become more appealing. Households seeking an affordable place to live, those who are delaying homeownership and others who prefer the flexibility and amenities associated with multifamily units all add to the increasing numbers of potential renters. Less traditional factors may also increase interest in renting, especially outside of tier-one markets. The expansion of work-from-home (WFH) culture is likely to be another reason rental demand is high right now. Meanwhile, the flexibility to work where the cost of living is lower and space is at less of a premium is pushing some renters who work remotely to explore living outside traditional hotspots. Economic Uncertainty Spreads as Interest Rate, Inflation Rise The Arbor Realty Trust report highlights a host of factors that are leading to economic uncertainty. Inflation (and its secondary effects) are contributing to …

WORCESTER, MASS. — Shawmut Design & Construction has topped out a $325 million academic building that will be part of the UMass Chan Medical School in Worcester. The nine-story, 350,000-square-foot building will primarily be used to house and conduct biomedical research. Construction originally began in November 2020 and is slated to be complete in 2024.

CONSHOHOCKEN, PA. — LCOR, a developer with three offices in the Mid-Atlantic region, has begun leasing The Birch, a 304-unit apartment community located in the northern Philadelphia suburb of Conshohocken. The property offers studio, one- and two-bedroom units and 17,000 square feet of amenity space that houses a pool, fitness center, lounges and a golf simulator. Rents start at $1,755 per month for a studio apartment. The first move-ins will begin on Sept. 1.

ALLENTOWN, PA. — Bellwether Enterprise Real Estate Capital has arranged a $20 million loan for the renovation and construction of Cityplace North & South, a 204-unit apartment complex in the Lehigh Valley city of Allentown. The North Building is a conversion of a hotel into apartments that opened in early 2020, and the South Building is ground-up construction. An undisclosed life insurance company provided the loan. The borrower was also not disclosed.

CHERRY HILL, N.J. — Pennsylvania Real Estate Investment Trust (PREIT) has welcomed several new tenants to Cherry Mill Mall in metro Philadelphia. Apparel brands Psycho Bunny and Levi’s have signed leases for 2,390 and 3,000 square feet with plans to open in mid-2023 and late 2022, respectively. Seafood restaurant Eddie V’s has also committed to 8,685 square feet and is targeting a spring 2023 opening. Laura Pomerantz of Cushman & Wakefield represented Levi’s in the lease negotiations. Steve Gartner and Drew Schaul of CBRE represented Psycho Bunny, and David Orkin, also with CBRE, represented Eddie V’s.

HOLMDEL, N.J. — LT Apparel, a manufacturer of children’s clothing, has opened a 13,086-square-foot office within Campus, a 72,000-square-foot flexible workspace located within the Bell Works mixed-use development in the Central New Jersey community of Holmdel. Jeff Garibaldi, Tara Keating and Lindsey Florio of The Garibaldi Group represented the landlord, Inspired by Somerset Development, in the lease negotiations. Global cloud communications firm Vonage has also committed to an undisclosed amount of space at Campus, which houses breakout rooms and conference facilities.