PEABODY, MASS. — Locally based brokerage firm Atlantic Capital Partners has negotiated the sale of a 95,886-square-foot, single-tenant retail building in the northern Boston suburb of Peabody that is fully leased to Texas-based home improvement retailer At Home. The property is located just west of North Shore Mall and adjacent to a grocery-anchored shopping center. Justin Smith, Chris Peterson, Sam Koonce and Cole Van Gelder of Atlantic Capital Partners represented the buyer and seller, both of which requested anonymity, in the transaction.

Northeast

PITTSBURGH — Austin, Texas-based Whole Foods Market has opened a 54,667-square-foot store at 5700 Penn Ave. in Pittsburgh’s East Liberty neighborhood. The store will feature full-service meat and seafood counters, an artisanal cheesemaking department, coffee bar, prepared foods section and a selection of more than 250 craft beers and 700 wines. The store, which is a relocation of a market at 5880 Centre Ave. that served the community for more than 20 years, officially opened on Wednesday, Aug. 10.

BOSTON — Electra America Hospitality Group (EAHG) has acquired the 225-room Loews Boston Hotel in the heart of Boston’s Back Bay neighborhood. The purchase price was undisclosed. The buyer plans to rebrand the upscale asset as Hotel AKA Back Bay, marking hospitality operator AKA’s debut in the city. Built in 1925 and located at 154 Berkeley St., the historic stone and masonry building served as the headquarters of the Boston Police Department from 1926 to 1990. The property is situated near many of Boston’s cultural attractions as well as its colleges and universities. The new owner plans to invest roughly $20 million in design upgrades and renovations, which will be undertaken while the hotel remains open. The 222 guestrooms, two suites and penthouse suite will undergo a soft design update. The lobby will feature a library with an intimate seating area. Additional enhancements include a second-floor fitness center, spa, theater and a newly imagined rooftop. Renovations will also be made to the hotel’s restaurant, Precinct Kitchen+Bar, which serves classic American dishes and New England seafood. The restaurant will feature a whiskey cellar, wine tasting room and a new private dining room with a spiral staircase. The acquisition marks EAHG’s sixth …

SOMERVILLE, MASS. — JLL has arranged a $230 million construction loan for 15 McGrath Highway, a 262,000-square-foot life sciences project that will be located in the northern Boston suburb of Somerville. The nine-story, transit-served facility will include commercial space and below-grade parking. Completion is slated for late 2024. Brett Paulsrud, Henry Schaffer and Mike Shepard of JLL arranged the nonrecourse loan on behalf of the borrower, a partnership between DLJ Real Estate Capital Partners, Leggat McCall Properties and Deutsche Finance America. Oxford Properties Group provided the financing.

MANCHESTER, N.H. — An affiliate of Boston-based DSF Group has sold Halstead Manchester, a 640-unit apartment community located in the southern part of The Granite State, for $164.6 million. Originally built between 1981 and 1985, the market-rate property comprises 16 three-story buildings and two single-story amenity buildings on a 41-acre site. According to Apartments.com, Halstead Manchester offers one- and two-bedroom units that range in size from 650 to 1,100 square feet. Biria St. John, Simon Butler and John McLaughlin of CBRE represented DSF Group in the transaction. The buyer was not disclosed.

WESTBOROUGH, MASS. — New Jersey-based investment and development firm Atlantic Management has received $96.5 million in financing for two industrial properties that are located in Westborough, about 35 miles west of Boston. The company received a $70.5 million loan for the refinancing of 50 Otis Street, a 406,437-square-foot building that was renovated and expanded in 2021. In addition, Atlantic Management received a $26 million construction loan for 54 Otis Street, a 100,000-square-foot development that will be a build-to-suit for an undisclosed e-commerce user that also fully occupies 50 Otis Street. Completion of 54 Otis Street is slated for mid-2023. Robert Griffin, David Douvadjian Sr., Timothy O’Donnell, Brian Butler, David Douvadjian Jr. and Conor Reenstierna of Newmark arranged the loans. The direct lender was not disclosed.

TEANECK, N.J. — Minnesota Life Insurance Co. has provided a $32 million loan for the refinancing of Glenpointe Centre East and Atrium at Glenpointe, two office buildings totaling 320,000 square feet that are located in the Northern New Jersey community of Teaneck. Glenpointe Centre East totals 240,000 square feet, and Atrium at Glenpointe spans 80,000 square feet. Tenants at both buildings, which were built in 1982 and were 94 percent leased at the time of the loan closing, have access to a 26,000-square-foot health club and both structured and surface parking areas. Thomas Didio Sr., Thomas Didio Jr. and Salvatore Buzzerio of JLL arranged the loan on behalf of the borrower, New Jersey-based Alfred Sanzari Enterprises. The debt was structured with a 10-year term and a fixed interest rate.

LAWRENCE, MASS. — Locally based design-build firm Dacon Corp. has completed a 97,000-square-foot industrial expansion project in Lawrence, a northern suburb of Boston, for commercial linen and uniform service provider Unitex. The project represents the second phase of Unitex’s redevelopment of the former headquarters of global food and beverage manufacturer Crown Holdings into a facility with laundry processing and office space. The first phase of the project comprised 90,000 square feet.

Content PartnerFeaturesLeasing ActivityLoansMidwestMultifamilyNortheastSoutheastTexasWalker & DunlopWestern

How to Maintain Multifamily Investment Momentum in the Face of Rising Interest Rates

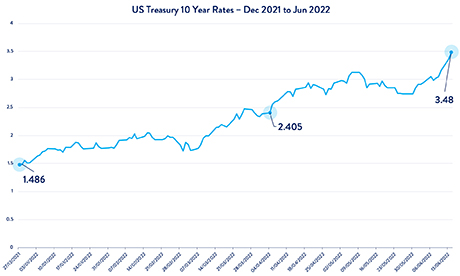

By Melissa Jahnke, associate director of operations, Walker & Dunlop The Federal Reserve raised interest rates by 75 basis points in June and then another 75 basis points in July, sending shockwaves across the commercial real estate industry. Fortunately, there are opportunities and solutions to bypass these potential roadblocks. Specifically, investors in a segment of multifamily housing known as small balance lending (SBL), encompassing five- to 150-unit properties, have several options to realize their aspirations for financing multifamily portfolios. View a higher resolution version of the timeline above here. During a recent webcast “Financing Amid Rising Rates: Best Approaches for $1M-$15M Multifamily Loans,” Walker & Dunlop’s market experts spoke about navigating today’s financing landscape. The expert panel included Allison Williams, senior vice president and chief production officer; Allison Herrera, senior director of SBL; and Tim Cotter, director of capital markets. These experienced professionals have found ways to make deals happen in a wide variety of financing environments and have shared their perspectives and guidance. If you are an owner of five- to 150-unit properties that require loans between $1 million to $15 million, the following will help you navigate today’s financial environment and build your momentum. Step 1: Consider the …

WOODLAND PARK, N.J. — City National Bank has provided a $60 million loan for the refinancing of a 205,000-square-foot industrial building located in the Northern New Jersey community of Woodland Park. The property at 1150 McBride Ave. features a clear height of 36 feet, two drive-in doors and ample trailer and employee parking. The borrower was a partnership between two New Jersey-based firms, The STRO Cos. and KRE Group.