BOSTON — Locally based firm WS Development has unveiled plans for the redevelopment of The Street, a retail property in Boston’s Chestnut Hill neighborhood. The centerpiece of the project will involve the repositioning of the three-story, 90,000-square-foot building at 27 Boylston St. to house new retailers and restaurants, as well as office space and outdoor communal areas. The project team will also upgrade the existing landscaping, architecture and public spaces. WS Development is designing the project in partnership with global architecture firm Sasaki. Completion is slated for 2023.

Northeast

NORTH HAVEN, CONN. — New Jersey-based financial intermediary Cronheim Mortgage has arranged a $23.5 million permanent loan for North Haven Pavilion, a 148,277-square-foot shopping center located north of New Haven. Tenants at North Haven Pavilion include Michaels, Wendy’s and Hartford Healthcare. Dev Morris, David Poncia, Allison Villamagna and Andrew Stewart of Cronheim Mortgage arranged the financing on behalf of the borrower, a subsidiary of National Realty & Development Corp., which originally developed the center in 2004. The loan carried a 10-year term and a 30-year amortization schedule.

PATERSON, N.J. — New York-based investment firm Timberline Real Estate Ventures has purchased a 66,000-square-foot light industrial building in the Northern New Jersey community of Paterson. At the time of sale, the property, which includes nearly a full acre of outdoor storage space, was fully leased to building materials provider Kamco Supply. Michael Klein, Alex Staikos and Michael Lachs of JLL arranged an undisclosed amount of nonrecourse, fixed-rate acquisition financing for the deal through Blue Foundry Bank. The seller was not disclosed.

PARSIPPANY, N.J. — Siemens Corp. has signed a 43,138-square-foot office lease in the Northern New Jersey community of Parsippany. The German conglomerate and industrial manufacturer will occupy space at Two Gatehall Plaza, a 389,298-square-foot building that was originally constructed in 1985 and recently renovated. Jeff Schotz, Kevin Murphy, Sumner Putnam and Peter Kasparian of Newmark represented the landlord, New York-based Silverman Realty Group Inc., in the lease negotiations. Jeff Babikian and Conor Dolan of CBRE represented the tenant.

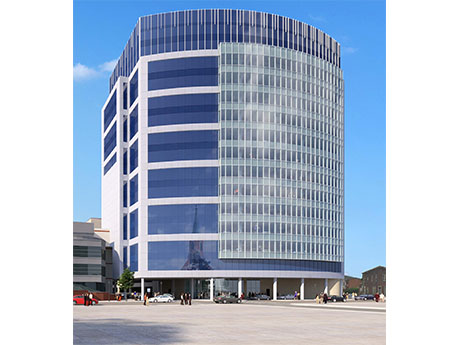

Newmark Arranges $514M Construction Loan for BioMed Realty’s Life Sciences Tower in Somerville, Massachusetts

by John Nelson

SOMERVILLE, MASS. — Newmark has arranged $514 million in construction financing for Phase I of Assembly Innovation Park, a life sciences tower spanning 485,000 square feet in the Boston suburb of Somerville. BioMed Realty, a San Diego-based subsidiary of Blackstone that focuses on life sciences real estate, is developing the 12-story tower and accompanying parking garage. The tower will be situated at the intersection of Middlesex Avenue and Foley Street, with visibility along I-93. According to the property website, Phase I of Assembly Innovation Park will feature an even split between office and laboratory space. Future phases of the three-building campus will include a cafe, conference center and a food hall. David Douvadjian Sr., Timothy O’Donnell, Brian Butler, David Douvadjian Jr. and Conor Reenstierna of Newmark’s Boston office arranged the financing on behalf of BioMed Realty. The direct lender was not disclosed. Harrison Zucco of Cushman & Wakefield provided supporting financial analysis for the deal. Phase I of Assembly Innovation Park will incorporate tech-enabled sustainable features, including a high-performance curtain wall, high-efficiency chilled water and exhaust air systems and a rooftop photovoltaic array. BioMed Realty is aiming to achieve LEED Gold and WELL certifications at the property. The San Diego-based …

SOMERSET AND WARREN, N.J. — Newmark has negotiated the approximately $100 million sale of a portfolio of light industrial properties totaling 650,000 square feet in Northern New Jersey. An institutional investor acquired 50 & 100 Randolph Road, two assets in Somerset totaling 236,000 square feet that were 91 percent leased at the time of sale. The buyer(s) of the other four properties in Warren were not disclosed. Kevin Welsh, Brian Schulz, Maria Betancourt, Steven Schultz, Dan Reider, Kyle Eaton and Chris Koeck of Newmark represented the seller, a joint venture between Ivy Realty and Waterfall Asset Management, in the deal.

NEW BRUNSWICK, N.J. — New Jersey-based developer AST has topped out a 229,000-square-foot healthcare project in the Central New Jersey community of New Brunswick. The 15-story ambulatory medical pavilion is situated within the Robert Wood Johnson University Hospital campus. Upon completion, which is scheduled for the second quarter of 2023, the facility’s outpatient access to care and clinical experts supporting existing RWJBarnabas Health hospital services will be expanded.

BAY SHORE, N.Y. — New York City-based Rockefeller Group is underway on construction of a 172,622-square-foot speculative distribution center in the Long Island community of Bay Shore. The property at 55 Paradise Lane will feature a clear height of 36 feet, 40 dock doors, 270 car parking spaces, 40 trailer parking stalls and 7,317 square feet of mezzanine-level office space. Manhattan-based KSS Architects designed the project, and Aurora Contractors is handling construction. Completion is slated for the first quarter of next year.

PITTSBURGH — Chicago-based investment firm Syndicated Equities has sold Plaza at the Pointe, a 149,973-square-foot shopping center in Pittsburgh. At the time of sale, the property was leased to tenants such as Bed Bath & Beyond, La-Z-Boy, Party City, Old Navy, Dress Barn and Bob’s Discount Furniture. The buyer was not disclosed. Syndicated Equities originally acquired the property in partnership with Chicago-based owner-operator M & J Wilkow in 2016 for $24.5 million.

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has arranged the $5 million sale of a 38-unit apartment building in Brooklyn’s Bedford-Stuyvesant neighborhood. The 35,000-square-foot building at 575 Herkimer St. was originally constructed in 1965. Ben Khakshoor of Rosewood Realty represented the buyer, Gilman Management, in the transaction. Aaron Jungreis, also with Rosewood, represented the seller, a private family.