By Brent Glodowski, director, capital markets group, Avison Young Conditions are looking up for retail real estate investment in New York City. In one sense, “up” is the only way to go for a sector that has been bumping along the bottom of a trough. But with inflation tempering investors’ recent fascination with multifamily and industrial properties, retail also offers opportunities to acquire price-corrected assets when those other property types hover near cyclical peaks. Retail’s Head Start New York’s retail real estate market was already suffering from changing consumer tendencies when COVID-19 arrived and thrust many retailers and their landlords into a full-blown crisis. Even when government-ordered shutdowns eased, remote work policies drained office buildings of the customer bases that had supported swaths of restaurants, shops and entertainment businesses. Home-bound workers became a redistributed daytime population, shifting demand for meal delivery and other retail to new areas. Hundreds of small businesses went under, leaving vacant storefronts in their wake. Some retailers altered business plans to serve shifting customer bases that had developed new, pandemic-influenced consumption practices. Landlords with vacancies to fill turned to traditional strategies, such as relocating tenants from out-of-the-way spaces to fill their most visible storefronts. Property owners …

Northeast

BOSTON — JLL has arranged a $585 million construction loan for Allston LabWorks, a 580,905-square-foot life sciences, retail and multifamily project in the Allston neighborhood of Boston. The borrower and developer is a joint venture between Boston-based King Street Properties, Brookfield and Mugar Enterprises. Allston LabWorks will feature 534,000 square feet of lab space, 20,000 square feet of retail space and 35 multifamily units, about 25 percent of which will be reserved as affordable housing. The development will also house a 5,000-square-foot outdoor event area and a 668-space parking garage. The site, which spans 4.3 acres at 305 Western Ave., is situated adjacent to Harvard University’s 350-acre Allston campus, which is home to the newly opened John A. Paulson School of Engineering & Applied Sciences. The area is also near the campuses of Boston University and Boston College, with multiple MBTA Green Line stops nearby. Greg LaBine and Amy Lousararian of JLL arranged the four-year, floating-rate loan through an undisclosed institutional debt fund. Construction of the project is underway, but a timeline for completion was not disclosed. “The fact that we were able to move quickly on this loan in today’s market conditions speaks to the level of interest and …

PARSIPPANY, N.J. — JLL has negotiated the $82.5 million sale of The Mark Parsippany, a 212-unit apartment complex in Northern new Jersey. The property offers one- and two-bedroom units with an average size of 911 square feet that are furnished with stainless steel appliances, quartz countertops, kitchen islands and individual washers and dryers. According to Apartments.com, amenities include a pool, fitness center, clubhouse, resident lounge, conference room and a pet washing station. Jose Cruz, Steve Simonelli, Kevin O’Hearn, Michael Oliver and Joseph Lembo of JLL represented the seller, an affiliate of Harbor Group International, in the transaction. The buyer was an affiliate of The DSF Group, an investment firm with offices in Boston and Washington, D.C.

PRINCETON, N.J. — U-Haul will open a 750-unit self-storage facility at an 8.8-acre undeveloped site at the intersection of U.S. Highway 380 and Boorman Lane in Princeton. U-Haul acquired the site in July. The four-story facility, which is scheduled to come on line by July 2024, will feature climate-controlled indoor storage space, outdoor drive-up buildings and a separate warehouse for U-Box portable storage containers. U-Haul will also offer truck and trailer rental services at the property and sell moving and packaging supplies as part of a retail operation.

BOSTON — TD Bank has provided a $22 million construction loan for a project in Boston’s Hyde Park neighborhood that will convert the former William Barton Rogers Middle School building to a 74-unit affordable housing complex. Residences will be specifically reserved for seniors in the LGBTQ community and will come in a mix of studio, one- and two-bedroom formats. The developer is a partnership between Pennrose and nonprofit LGBTQ Senior Housing Inc. The design plan includes the preservation of the century-old building’s auditorium, gym, cinema and front entrance. A tentative completion date was not disclosed.

PISCATAWAY AND EWING, N.J. — Atlanta-based developer IDI Logistics has acquired sites totaling 32 acres in Central New Jersey for a pair of industrial redevelopment projects. Both the 14-acre site in Piscataway and the 18-acre property in Ewing currently house office buildings. IDI Logistics plans to demolish the existing structures and replace them with Class A warehouse and distribution facilities. Construction timelines for both projects are still being finalized.

NEW YORK CITY — Law firm Kaufman Borgeest & Ryan (KBR) has signed a 27,117-square-foot office lease at 875 Third Avenue in Midtown Manhattan. The lease term is 15 years. The tenant will relocate from 120 Broadway to occupy a full floor at the 29-story building, which was originally constructed in 1982. Paul Glickman, Diana Biasotti, Kristen Morgan and Harrison Potter of JLL represented the landlord, Global Holdings Management Group, in the lease negotiations. Howard Greenberg of Howard Properties and Barry Lewen of Cresa represented KBR.

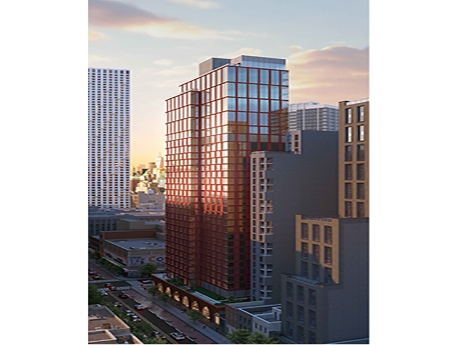

NEW YORK CITY — Cushman & Wakefield has arranged a $134 million construction loan for 15 Hanover Place, a mixed-income residential project that will be located in downtown Brooklyn. The 34-story building will house 314 units, 95 of which will be reserved as affordable housing, as well as 9,000 square feet of commercial space. Gideon Gil, Zachary Kraft and Sebastian Sanchez of Cushman & Wakefield arranged the loan through Santander Bank and City National Bank on behalf of the borrower, locally based developer Lonicera Partners. A tentative completion date has not yet been established.

NEW YORK CITY — JLL has negotiated the $33.7 million sale of a portfolio of three commercial properties in Manhattan’s Lenox Hill neighborhood. The building at 1026 Third Ave. comprises a ground-level restaurant, second-floor office space, one duplex and one residential loft. The two buildings at 1020-1024 Third Ave. total 19,375 square feet and consist of 25 residential units and three commercial spaces. Clint Olsen and Stephen Godnick of JLL represented the buyer, Kahen Properties, in the transaction. JLL also represented the seller in the $24 million disposition of 1020-1024 Third Avenue. Nick Judson of Judson CRE represented the seller of 1026 Third Avenue, which fetched a price of $9.7 million.

HAMILTON, N.J. — Newmark has brokered the $26.5 million sale of a portfolio of six office buildings totaling 237,834 square feet and two land sites totaling 12.8 acres in the Central New Jersey community of Hamilton. More specifically, the holdings comprise two office buildings with excess developable acreage, two parcels within Horizon Center North and one office building plus three office/flex buildings within Horizon Center Business Park. Steven Schultz, Stephen Tolkach, Tony Georgiev and Robert Loderstedt of Newmark represented the seller, Denholtz Properties, in the transaction. The buyer was Cammeby’s International Inc. The buildings were 71 percent leased at the time of sale.