NEW YORK CITY — Multifamily development and investment firm Beachwold Residential has signed a 12,637-square-foot office lease at 257 Park Avenue South in Manhattan’s Flatiron District. The 20-story building was constructed in 1912 and spans 226,000 square feet. Jared Stern of Savills represented the tenant in the lease negotiations. Rob Fisher represented the landlord, The Feil Organization, on an internal basis.

Northeast

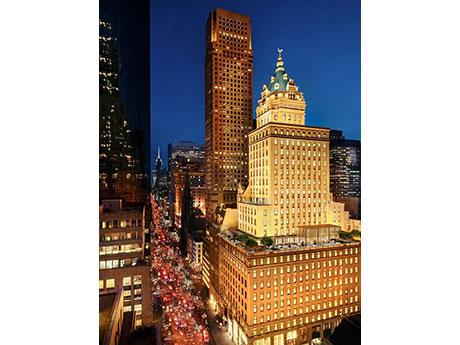

NEW YORK CITY — Walker & Dunlop Inc. has arranged $754 million in financing for Aman New York, a luxury hotel and condo development in Midtown Manhattan. Aman New York occupies the top 20 floors of the 100-year-old Crown Building at the corner of 57th Street and Fifth Avenue, across the street from Trump Tower. OKO Group was the developer. The 95,000-square-foot residential portion includes 22 units, while the 117,000-square-foot hotel section contains 83 guest rooms and suites. The rooms are among New York’s largest, and the hotel is the only one in New York to offer working fireplaces in each room. The lower floors of the building remain retail space. The hotel portion is scheduled to open on Tuesday, Aug. 2. Reservations will be available beginning Monday, July 25. The development is Aman’s first U.S. urban residence project and provides special features for owners such as private entrances, plus access to three dining venues, a jazz club, wine room and 25,000-square-foot Aman Spa. Nearly all of the condos are pre-sold, with one of the units selling for $55 million, marking one of the priciest residential transactions in New York so far this year. Originally built in 1921, the Crown …

PORT WASHINGTON, N.Y. — Cedar Realty Trust (NYSE: CDR) has sold a portfolio of 33 grocery-anchored shopping centers for $879 million, inclusive of existing debt. The names and addresses of the centers were not disclosed, but the properties are primarily located in high-density markets throughout the Northeast and Mid-Atlantic regions. The buyer was a joint venture between two New York City-based firms, DRA Advisors and KPR Centers. The sale, which was first announced in March, comes as part of the New York-based REIT’s plan to divest of its assets prior to being acquired by Virginia-based Wheeler REIT (NASDAQ: WHLR).

NEW YORK CITY — Lument has provided a $117.4 million Freddie Mac loan for the refinancing of Hope Gardens, a 949-unit affordable housing community in Brooklyn’s Bushwick neighborhood. Built between 1980 and 1987, the garden-style property comprises 60 buildings totaling 1,321 units that are all subsidized by Section 8 contracts and includes a daycare and two senior centers. The loan, which carries a fixed interest rate, 30-year term and 40-year amortization schedule, retires the construction debt attached to 47 of the buildings that house 949 units. Josh Reiss of Lument originated the loan for the sponsor, a joint venture between Pennrose Holdings, Acacia Real Estate Development and an affiliate of The New York City Housing Authority (NYCHA).

NEW YORK CITY — Locally based brokerage firm Rosewood Realty Group has arranged the $36 million sale of a 55,150-square-foot office building located at 62 W. 45th St. in Midtown Manhattan. Built in 1911, the 12-story building features a dozen office suites and one retail space. Aaron Jungreis and Ben Khakshoor of Rosewood represented the seller, Renaissance Properties, in the transaction. LSI Advisors represented the buyer, IT consulting firm Stellar Services, which plans to occupy the entirety of the building.

NEW YORK CITY — Stav Equities, a New York City-based brokerage firm, has negotiated the $5.4 million sale of a multifamily building that comprises 12 market-rate units and one vacant retail space in Brooklyn’s Crown Heights neighborhood. The buyer, Neue Urban, plans to implement a value-add program. The seller was not disclosed. Adam Traub of Curb Capital and Jacob Stavsky of Stav Equities brokered the deal.

NEW YORK CITY — British apparel designer Paul Smith has signed a 12,617-square-foot lease for its new office and showroom at 257 Park Avenue South in Manhattan’s Flatiron District. The 20-story building was constructed in 1912 and spans 226,000 square feet. Will Grover and Ben Shapiro of Newmark represented the tenant in the lease negotiations. Rob Fisher represented the landlord, The Feil Organization, on an internal basis.

BOSTON AND NEW YORK CITY — American Tower Corp. (NYSE: AMT), a multitenant communications REIT, has agreed to sell a 29 percent stake in its data center platform to Stonepeak, an alternative asset management firm based in New York City. The deal, which comprises common and preferred equity from Stonepeak’s affiliated investment vehicles and debt commitments, is valued at $2.5 billion. The AMT data center portfolio consists of 27 data centers in 10 U.S. markets. AMT purchased Denver-based CoreSite Realty Corp. in a $10.1 billion deal that was announced last November. AMT will retain managerial and operational control, as well as day-to-day oversight of its U.S. data center business, and Stonepeak will obtain certain governance rights. The transaction is expected to close in third-quarter 2022, subject to customary closing conditions. “We are pleased to partner with Stonepeak in our U.S. data center business,” says Tom Bartlett, president and CEO of American Tower. “While this transaction supports the equity financing component for our previously completed CoreSite acquisition, it also creates a platform through which growth opportunities can be strategically evaluated and financed.” Andrew Thomas, managing director and co-head of communications at Stonepeak, says that AMT’s data center platform aligns with Stonepeak’s …

MOUNT LAUREL, N.J. — Philadelphia-based investment firm Regal Ventures has sold a quintet of office buildings totaling 398,460 square feet in Mount Laurel, about 20 miles east of Philadelphia. California-based Top Terraces Inc. purchased the portfolio for $51 million. Each of the buildings totals 79,692 square feet, with four of the buildings currently occupied by affiliates of defense contractor Lockheed Martin and one currently vacant. Illinois-based brokerage firm The Boulder Group negotiated the deal. Regal Ventures originally purchased the properties in September 2021 for $35 million.

KINGSTON, MASS. — Trammell Crow Residential has opened Alexan Kingston, a 282-unit apartment community in Kingston, about 35 miles south of Boston. The property features one-, two- and three-bedroom floor plans and amenities such as a pool, fitness center, private workspaces, conference rooms, an event room, outdoor grilling areas and Amazon package lockers. Syracuse-based Pyramid Management Group is managing the property. The first move-ins began in June. Rents start at $2,350 per month for a one-bedroom unit.