NEW YORK CITY — Storage Post, an Atlanta-based self-storage owner-operator, has acquired a newly built facility located at 600 Richmond Terrace on Staten Island. The number of units was not disclosed, but the property spans approximately 148,000 square feet of net rentable climate-controlled space. The seller and sales price were also not disclosed.

Northeast

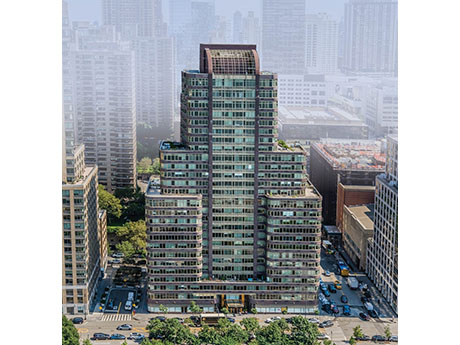

A&E Real Estate Acquires Apartment Tower in Manhattan from Equity Residential for $266M

by John Nelson

NEW YORK CITY — A&E Real Estate, a private multifamily investment and management firm based in New York City, has purchased 140 Riverside Boulevard, a luxury 354-unit apartment tower on the Upper West Side of Manhattan. Equity Residential (NYSE: EQR), a multifamily REIT based in Chicago, sold the 28-story community for $266 million. Darcy Stacom and Ryan Silber of CBRE represented Equity Residential in the sale. Built in 2002, the apartment tower features controlled access, a doorman, fitness center, interior courtyard, multiple tenant lounges, onsite management, package services, storage space and concierge services. The property is situated opposite Riverside Park South, a New York City park that fronts the Hudson River. Additionally, the community includes commercial space currently leased to New York Cat Hospital, a veterinarian’s clinic, and Dwight School, a private school catering to pre-K and kindergarten students. “140 Riverside Boulevard is a stand-out in the New York market, situated both waterfront and park-front with direct access to the Hudson River Park system,” says Stacom. “The property has been meticulously maintained and is truly excellent real estate — as this transaction validates.” Founded in 2011, A&E Real Estate began with the acquisition of a 49-unit apartment community in Brooklyn. …

FRAMINGHAM, MASS. — A joint venture between global private equity firm Taurus Investment Holdings and Kayne Anderson Real Estate has acquired Halstead Framingham, a 1,020-unit multifamily development located on the western outskirts of Boston. Halstead Framingham, which was originally built in 1976, was 98 percent occupied at the time of sale. The community’s amenity package consists of a fitness center with simulation surfing options, resident lounge with shared workspaces, a pool, pickleball court and multiple grilling areas. The joint venture plans to implement a capital improvement program focused on sustainability and rebrand the property as The Green on 9 & 90. Simon Butler, Biria St. John and John McLaughlin of CBRE represented the seller, an affiliate of Boston-based DSF Group, in the transaction.

NEW YORK CITY — Locally based firm Ekstein Tolbert Development is underway on construction of a $76 million multifamily project located at 1333 Broadway in Brooklyn’s Bushwick neighborhood. The 20-story, 107-unit building will ultimately house three levels of commercial space and a unit mix that comprises 30 percent affordable units and 70 percent market-rate apartments. Amenities will include a gym, package handling room and onsite laundry facilities. JLL arranged an undisclosed amount of construction financing through Santander Bank on behalf of Ekstein Tolbert. In addition, JLL negotiated the sale of a majority equity stake in the project to private equity firm Standard Real Estate Investments.

WESTWOOD, MASS. — A partnership between two New York City-based investment firms, Outshine Properties and Jadian Capital, has acquired a 164,695-square-foot office building in the southern Boston suburb of Westwood with plans to convert the property to a life sciences facility. The sales price was $32 million. The four-story building is currently 73 percent leased to seven tenants. Robert Griffin, Edward Maher, Matthew Pullen and Samantha Hallowell of Newmark represented the seller, L&B Realty Advisors, in the transaction. William Sleeper, also with Newmark, arranged acquisition financing for the deal through J.P. Morgan. The new ownership expects to deliver 140,000 square feet of prebuilt lab space in the second quarter of 2023.

JERSEY CITY, N.J. — Locally based financial advisory firm Progress Capital has arranged a $14 million loan for the refinancing of a 79-unit apartment building located at 253 Academy St. in the Journal Square neighborhood of Jersey City. The newly built property offers 77 studios and two larger units that were built as standalone modular residences. Amenities include a rooftop deck and grilling area, fitness center and concierge service. Kathy Anderson of Progress Capital arranged the loan, which carried a fixed interest rate and 12 months of interest-only payments, on behalf of the borrower, Pointe Developers LLC. The direct lender was not disclosed.

DELANCO, N.J. — NAI Mertz has brokered the sale of a 140,000-square-foot industrial building in Delanco, located outside of Philadelphia in Southern New Jersey. The building is currently leased to furniture maker Stylex Seating. Jonathan Klear, Roy Kardon, Jeff Licht, Jared Licht and Fred Meyer of NAI Mertz represented the undisclosed seller in the transaction. The team also represented the buyer, New Jersey-based investment firm Faropoint. The sales price was not disclosed.

SYRACUSE, N.Y. — Champion Real Estate Co. has purchased Campus Hill Apartments, a 715-bed student housing community near Syracuse University, for $65 million. The property offers fully furnished units across 51 buildings. The community will be rebranded Victory at Syracuse and is set to undergo renovations imminently. Victory House Syracuse LLC, a subsidiary of Champion, will oversee community upgrades, including fresh paint and the addition of vinyl plank flooring, new cabinetry, quartz countertops, stainless steel appliances and modern fixtures. Ken Wellar and Douglas Sitt of Rittenhouse Realty represented Champion and the undisclosed seller in the transaction.

NEW YORK CITY — Locally based investment firm Simone Development has acquired Triangle Plaza Hub, a 50,000-square-foot medical office and retail complex located in the Mott Haven neighborhood of The Bronx. The sales price was $32 million. Triangle Plaza Hub was built in 2015 and was 97 percent leased at the time of sale, with grocer Fine Fare and Sun River Health serving as the anchor tenants. Other tenants include DaVita, Dunkin’, Boston Market and VistaSite Eyecare. Steven Rutman, Rob Hinckley, Karl Brumback, Andrew Scandalios and Madison Warwick of JLL represented the seller, Triangle Equities, in the transaction.

LINDEN, N.J. — Storage Post, an Atlanta-based self-storage owner-operator, has acquired a facility located at 1051 Edward St. in the Northern New Jersey community of Linden. The number of units was not disclosed, but the property spans approximately 107,000 square feet of net rentable climate-controlled space. The seller was also not disclosed. Storage Post will assume operations of the property, which previously conducted business under the Public Storage brand.