FRANKLIN, MASS. — Colliers has negotiated an 81,293-square-foot industrial sublease in Franklin, located southeast of Boston in Norfolk County. Stephen Woelfel, Kevin Brawley, P.J. Foster, John Real and Glenne Bachman of Colliers represented the original tenant, medical device manufacturer Tegra Medical, in the lease negotiations. Tim Lahey, Perry Beal and John Lashar of CBRE represented the sublessee, biopharmaceutical company Lyndra Therapeutics.

Northeast

CHERRY HILL, N.J. — Pennsylvania Real Estate Investment Trust (PREIT) has announced a slate of new retailers and restaurants at Cherry Hill Mall, located outside of Philadelphia in Southern New Jersey. Upscale seafood concept Eddie V’s will open its first restaurant in the area this fall, while Marc Cain, a women’s apparel brand based in Germany, will join the lineup of soft goods retailers with a March opening. Other upcoming additions to the tenant roster include Warby Parker and Amazon 4-Star.

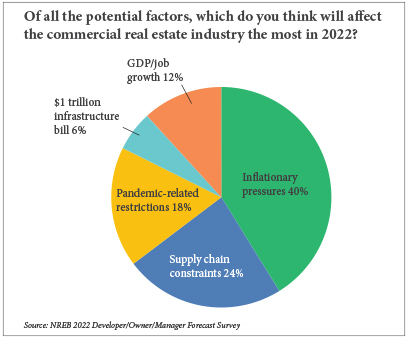

By Taylor Williams In late October of last year, Raphael Bostic, president of the Federal Reserve Bank of Atlanta, gave a virtual speech in which he carried a glass jar with the word “transitory” labeled on it. Inside the jar were wadded-up dollar bills, deposited by Bostic’s staff members each time they used the word “transitory” to describe the surge in prices of consumer goods and services. The exercise was meant to dispel the notion that the current inflationary environment would be fleeting or short-lived. Based on the results of Northeast Real Estate Business’ annual reader forecast survey, commercial brokers and developers/owners in the region aren’t likely to be contributing to that fund any time soon. Inflation Could Linger When asked to identify the macroeconomic force that was most likely to impact the commercial real estate industry in 2022, roughly a third of broker respondents selected inflationary pressures over supply chain constraints, pandemic restrictions, the $1 trillion infrastructure bill and employment/gross domestic product (GDP) growth. Concerns over pandemic-related restrictions on businesses, which adversely impact demand for space, was a close second among broker respondents. Some brokers elaborated on these views in the free-response section of the survey. “Continued inflation will …

PISCATAWAY, N.J. — Indianapolis-based Duke Realty (NYSE: DRE) has broken ground on a 216,892-square-foot speculative industrial project that is located on a 21-acre site at 1570 S. Washington Ave. in the Northern New Jersey community of Piscataway. Building features include a clear height of 40 feet, 34 dock doors, 38 trailer parking spaces and 125 car parking spaces. Completion is slated for the fall. Colliers represented Duke Realty in its site selection and acquisition of the land and has also been retained to lease the property.

CORTLANDT, N.Y. — Invesco Real Estate Income Trust Inc. has acquired Cortlandt Crossing, a 122,225-square-foot shopping center located in New York’s Westchester County. Anchored by grocer ShopRite and HomeSense, which is part of the TJX Cos.’ family of brands, the newly constructed center was 95 percent leased at the time of sale. Invesco acquired the property in conjunction with the purchase of a 95 percent stake in an industrial property near Columbus, Ohio, for a combined price of $94 million. Jeffrey Dunne, David Gavin, Steve Bardsley, Jeremy Neuer and Travis Langer of CBRE represented the owner, Acadia Realty Trust, in the transaction.

FORDS, N.J. — Marcus & Millichap has brokered the sale of King’s Road Office Center, a 37,135-square-foot building in Fords, located about 30 miles south of Manhattan. The property was 92 percent leased at the time of sale and fetched a price of roughly $4.3 million. Alan Cafiero and Brent Hyldahl of Marcus & Millichap brokered the deal on behalf of the seller, a limited liability company. Additional terms of sale were not disclosed.

MOUNTAIN LAKES, N.J. — Sunrise Senior Living has opened Sunrise of Mountain Lakes, a 99-unit assisted living and memory care facility located in the Northern New Jersey borough of Mountain Lakes. Nearby medical support is available to support care coordination and wellness though Saint Clare’s Denville Hospital and Morristown Medical Center. Information about starting rents was not disclosed.

NEW YORK CITY — Newmark has negotiated a 26,000-square-foot office lease at The Devlin Building, located at 459 Broadway in Manhattan’s SoHo District. Howard Kesseler and Alexander Kesseler of Newmark represented the landlord, The Chetrit Organization, in the lease negotiations. Sinvin Commercial Real Estate represented the tenant, F. Schumacher & Co., a designer of luxury textile products.

BOSTON — Indianapolis-based pharmaceutical giant Eli Lilly & Co. has unveiled plans for a $700 million institute for genetic medicine in Boston’s Seaport District. The opening is slated for 2024. The company has signed a 334,000-square-foot lease at 15 Necco St., a 12-story healthcare and life sciences building that Alexandria Real Estate Equities (NYSE: ARE) is developing. At the facility, Lilly will develop genetic medicines with a range of applications, including diabetes, immunology and central nervous system research. Curtis Cole, John Carroll III, Evan Gallagher, Tim Allen and Caitlin Mahoney of Colliers represented Eli Lilly in the deal. The site will also include a shared space modeled after Lilly Gateway Labs in San Francisco to support biotech startups in the Boston area. This area will afford users access to dedicated and configurable lab and office space and opportunities for collaboration with Lilly scientists. These companies are expected to generate as many as 150 additional new jobs once the space is fully occupied. The investment follows Lilly’s 2020 Prevail Therapeutics initiative, which centered on the launch of a gene therapy facility in New York City. Lilly projects that within five years, employment at the Boston facility will grow from 120 to …

PHILADELPHIA — A joint venture between locally based investment firm BG Capital, New Jersey-based Hampshire Cos. and Saudi Arabian investment firm Arbah Capital has acquired Constitution Health Plaza, a 295,000-square-foot medical office complex in South Philadelphia, for $77 million. The seller was not disclosed. The property, which is currently undergoing a renovation, also includes a 425-space parking garage. Major tenants include the City of Philadelphia, Malvern Behavioral Health, University of Pennsylvania Medicine, Mercy Health Systems and the Kidney Center of South Philadelphia.