JERSEY CITY, N.J. — JLL has arranged the $340 million refinancing of two Jersey City apartment buildings totaling 938 units. The 36- and 48-story buildings are known as 50 and 70 Columbus and were completed in 2007 and 2015, respectively. Both buildings feature studio, one-, two- and three-bedroom units with in-unit washers and dryers, walk-in closets, hardwood floors, stone countertops and stainless steel appliances. Amenities include a heated outdoor pool, fitness center, rooftop deck with grilling spaces and a courtyard. Thomas Didio, Thomas Didio Jr., Gerard Quinn and Michael Mataras of JLL arranged the debt through Truist Financial Corp. on behalf of the owner, a joint venture between Ironstate Development Co. and Panepinto Properties.

Northeast

GREENWICH, CONN. — Hawaii-based Trinity Investments has sold a majority interest in the 374-room Hyatt Regency Greenwich hotel in southern coastal Connecticut. The percentage was not disclosed. The building served as a printing press for Condé Nast from 1921 to 1967 before being redeveloped into a hotel. Trinity bought the hotel from Hyatt in late 2022 and subsequently implemented a $35 million capital improvement program. Today, the Hyatt Regency Greenwich features an indoor pool, fitness center, salon and 35,000 square feet of meeting and event space. The buyer was an affiliate of Certares Real Estate Management LLC.

HO-HO-KUS, N.J. — Vertical Real Estate Capital has completed 619 North, a 67-unit multifamily project located in the Northern New Jersey community of Ho-Ho-Kus. The property offers one- and two-bedroom units and amenities such as a residential lounge, coffee bar, coworking center with private conference rooms, fitness center, sport simulator and a rooftop lounge. Mary Cook Associates handled interior design of the project. Jon Mikula, Max Custer and Michael Donohoe of JLL arranged permanent financing for the project through an undisclosed life insurance company. Rents start at $3,400 per month for a one-bedroom apartment.

STERLING, MASS. — Marcus & Millichap has brokered the $4.2 million sale of a 37,000-square-foot industrial flex building in Sterling, about 50 miles west of Boston. The building sits on a 6.6-acre site at 86 Leominster Road and features four loading docks, a drive-in door and 150 parking spaces. Harrison Klein of Marcus & Millichap represented the seller, which will retain occupancy of a portion of the building, in the transaction. Alan Ringuette of The Stubblebine Co. represented the buyer, which will occupy the remainder. Both parties requested anonymity.

NEW YORK CITY — Massumi + Consoli has signed a 57,988-square-foot office lease in the Bryant Park area of Midtown Manhattan. The law firm has committed to three full floors at 1133 Avenue of the Americas, a 45-story, 1.1 million-square-foot building. Jim Schoolfield and Andrew Coe of JLL represented Massumi + Consoli in the lease negotiations.Tom Bow, Rocco Romeo and Nora Caliban represented the landlord, The Durst Organization, on an internal basis.

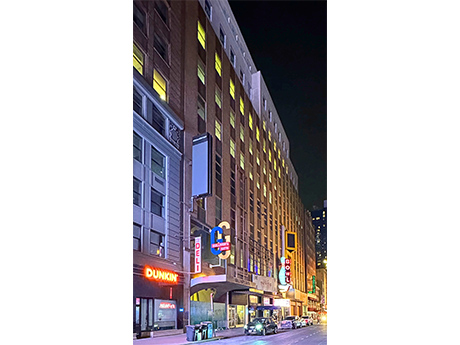

NEW YORK CITY — CBRE has negotiated the $28 million sale of the 245,419-square-foot retail space within the former New York Times building at 229 W. 43rd St. and 216-226 W. 44th St. in Midtown Manhattan. Kushner bought the space in 2015 for $296 million. The space spans the first four floors and two lower levels and was 34.5 percent leased at the time of sale to tenants such as entertainment concept Lucky Strike and restaurants Tacos No. 1 and Ra Sushi. Jay Miller and A.J. Felberbaum of BayBridge Real Estate Capital represented the buyer, a Delaware-based entity doing business as Forum at Time Square LLC, in the transaction. Jack Stillwagon and Doug Middleton of CBRE represented the seller, a trust working on behalf of CMBS bondholders that took title of the property last year via a foreclosure proceeding against Kushner.

NEW YORK CITY — Marcus & Millichap has brokered the $4.6 million sale of an apartment building located at 719 Willow Ave. in Hoboken. The building consists of nine apartments and one ground-floor commercial space that is newly renovated and is leased to a laundromat operator. Jonathan Zamora of Marcus & Millichap brokered the deal. The buyer and seller were not disclosed.

NEW YORK CITY — Tempus AI Inc., a healthcare technology firm, has signed a 39,565-square-foot office lease at 11 Madison Avenue, a 30-story building in Midtown Manhattan. The lease term is 10 years, and the space spans part of the building’s 17th floor. Peter Michailidis of JLL represented the tenant in the lease negotiations. Brian Waterman, Scott Klau, Eric Harris and Brent Ozarowski of Newmark represented the landlord, SL Green.

FARMINGTON, CONN. — Colliers has negotiated the sale of a 30,829-square-foot industrial building in Farmington, located just west of Hartford. The sales price was $1.9 million. According to LoopNet Inc., the building at 145 Hyde Road was constructed on 6.5 acres in 1966 and features a clear height of 16 feet and two dock-high loading doors. Christian Dietz of Colliers brokered the deal. The buyer and seller were not disclosed.

FORT LEE, N.J. — Locally based firm Weiss Realty has sold a multifamily development site in the Northern New Jersey community of Fort Lee for approximately $1.8 million. The 13,700-square-foot site at 2130 Center Ave. is approved for the development of 24 new units. Bruce Elia of Keller Williams represented both Weiss Realty and the buyer, local developer Scott Heagney, in the transaction.