NEW YORK CITY — A joint venture between Broad Street Development and TPG Angelo Gordon has purchased a 56,384-square-foot self-storage facility in Manhattan’s Tribeca neighborhood for $43.5 million with plans to undertake a multifamily conversion. The 10-story building at 139 Franklin St. was originally constructed in 1915 and houses 74 units. Brendan Maddigan, Andrew Scandalios, Ethan Stanton, Hall Oster, Michael Mazzara and Vickram Jambu of JLL represented the seller, the Sofia Family, in the transaction and procured the joint venture as the buyer. A construction timeline for the conversion was not announced.

Northeast

NEW BRUNSWICK, N.J. — Israel’s Bank Hapoalim has provided a $33 million construction loan for Joyce Kilmer Logistics Center, a 195,421-square-foot industrial project that will be located in the Central New Jersey community of New Brunswick. The site is proximate to Exit 9 off the New Jersey Turnpike, and the facility will have two buildings that will feature a clear height of 36 feet and 32 loading docks. Brad Domenico, Frank Stanislaski and Jack Subers of Cushman & Wakefield arranged the loan on behalf of the borrower, a partnership between two New Jersey-based firms, Faropoint and Deugen Development.

CLIFTON, N.J. — Regional healthcare provider Hackensack Meridian has opened a four-story, 90,000-square-foot facility in the Northern New Jersey community of Clifton. Designed by Gensler, Hackensack Meridian Health & Wellness Center at Clifton is located on Prism Capital Partner’s ON3 campus, which is a redevelopment of the former Hoffmann-La Roche North American headquarters campus. Specialty practices offered at the facility include primary care, urgent care, rheumatology, gastroenterology, nephrology and orthopedics.

NEW YORK CITY — Clear Street has signed an 88,000-square-foot office lease expansion at 4 World Trade Center in Lower Manhattan. The fintech company first took space at the 72-story, 2.3 million-square-foot building in 2021 via sublease before signing a direct lease for the entire 45th floor in 2023. This deal, which includes a 10-year extension, will see the company maintain that space and also expand to the entire 46th floor. Josh Berger of Norman Bobrow & Co. represented Clear Street in the lease negotiations. Keith Cody and Gordon Hough represented the landlord, Silverstein Properties, on an internal basis.

NEW YORK CITY — Locally based financial intermediary ERG Commercial Real Estate has arranged a $3 million loan for the refinancing of a mixed-use building in Lower Manhattan. The 5,443-square-foot building is located at 79 Avenue A in the Alphabet City neighborhood and houses six apartments and two commercial spaces, both of which were occupied at the time of the loan closing. The names of the borrower and direct lender were not disclosed.

ELMWOOD PARK, N.J. — JLL has arranged a $131.1 million bridge loan for a 390-unit multifamily property in the Northern New Jersey community of Elmwood Park. The financing covers Phases III and IV of a larger development known as Riverwalk. Units feature a mix of one-, two- and three-bedroom floor plans and range in size from 772 to 2,321 square feet. Riverwalk offers amenities such as a pool, fitness center, outdoor grilling and dining areas, a dog park, riverside nature path, multiple resident lounges and coworking space. Thomas Didio, Thomas Didio Jr., Gerard Quinn, Michael Mataras and Tyler Caricato of JLL arranged the five-year, floating-rate loan through MF1 Capital. A private real estate company headed by Bernard Langan owns Riverwalk.

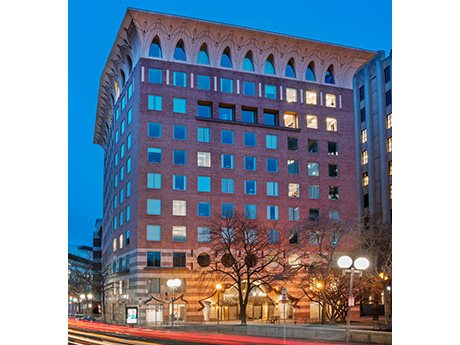

BOSTON — Newmark has brokered the $28 million sale of One Bowdoin Square, a 141,831-square-foot office building in downtown Boston. The 11-story building is home to a mix of medical and government tenants, including affiliates of Mass General Brigham and the Commonwealth of Massachusetts. Robert Griffin, Edward Maher, Matthew Pullen, James Tribble, Samantha Hallowell and William Sleeper of Newmark represented the undisclosed seller in the transaction. The team also procured the buyer, a partnership between Live Oak Real Estate Investments and Tritower Financial Group. David Douvadjian Sr., Timothy O’Donnell, David Douvadjian Jr., Bobby Alvarado and Conor Reenstierna, also with Newmark, arranged acquisition financing for the deal through Bank of New England.

ALLENWOOD, PA. — ModCorr LLC has signed a 252,282-square-foot industrial lease in Allenwood, about 70 miles north of Harrisburg. The manufacturer of modular construction products will occupy the entirety of Building 4 at PNK Park Allenwood at Great Stream Commons, which was completed last year and features a clear height of 40 feet. Lee & Associates represented the landlord, New York-based investment and development firm PNK Group, in the lease negotiations.

PAULSBORO, N.J. — New York-based investment firm PRC has acquired Paulsboro Gardens Apartments, a 150-unit affordable housing complex located outside of Philadelphia in Southern New Jersey. The property comprises 21 low-rise buildings. PRC plans to undertake accessibility upgrades, interior unit renovations and exterior improvements, as well as improve mechanical and utility systems, to extend the property’s affordability status. The seller and sales price were not disclosed.

MANSFIELD, MASS. — Chicago-based investment firm Logistics Property Co. has purchased an industrial building located at 572 West St. in Mansfield, a southern suburb of Boston, that according to LoopNet Inc. totals 35,000 square feet. The building, which was built in 2004, per LoopNet, is located within Cabot Business Park and was fully leased at the time of sale. Tony Coskren of Newmark brokered the deal. The seller and sales price were not disclosed.