NEW YORK CITY — Marcus & Millichap has brokered the $10.8 million sale of a 101-unit historic apartment building located in the Prospect-Lefferts Gardens neighborhood of Brooklyn. The six-story, elevator-served building at 275 Linden Blvd. was originally constructed in 1930. Information on floor plans and amenities was not disclosed. Shaun Riney and Daniel Greenblatt of Marcus & Millichap represented the undisclosed seller in the transaction. Seth Glasser, also with Marcus & Millichap, procured the buyer, a California-based family office.

Northeast

WAYNE, N.J. — Locally based brokerage firm The Goldstein Group has arranged the sale of a 68,000-square-foot retail property the Northern New Jersey community of Wayne. The property is located at 465-479 U.S. Route 46 and comprises a 50,000-square-foot space that was formerly occupied by Bloomingdale’s Furniture and an 18,000-square-foot space leased to The Suit Store. C.J. Huter, Marc Palestina and Roy Paret of The Goldstein Group represented the seller, a group of limited liability companies, in the transaction. The buyer was an entity doing business as GCL Investment LLC.

NEW YORK CITY — Queen One has signed a 29,718-square-foot office lease in Brooklyn. The technology-driven networking and communications startup has committed to a 10-year term at 25 Kent, an eight-story, 500,000-square-foot building that was designed by Gensler and HWKN Architecture. Scott Bogetti and Will Demuth of Savills represented Queen One in the lease negotiations. Ryan Gessin, Will Grover and Jordan Gosin of Newmark, along with internal agents Craig Panzirer and Alex Radmin, represented the landlord, Global Holdings.

KEENE, N.H. AND GRAND RAPIDS, MICH. — C&S Wholesale Grocers, a New Hampshire-based food supplier whose brands include Piggly Wiggly and Grand Union, has agreed to acquire Michigan-based SpartanNash (NASDAQ: SPTN), owner of brands such as Our Family and Full Circle Market, in a merger valued at nearly $1.8 billion. The figure represents a purchase price of $26.90 per share of SpartanNash common stock in cash and includes the assumption of SpartanNash’s existing debt. The price marks a 52.5 percent premium over the company’s closing price of $17.64 per share on June 20 and a premium of 42 percent over the company’s 30-day volume-weighted average stock price as of that date. The merger, which has been unanimously approved by both companies’ boards of directors, is expected to close before the end of the year. Upon closing, the new company will operate more than 200 corporate-run grocery stores and almost 60 complementary distribution centers throughout the country. The distribution centers will supply more than 10,000 independent retail locations. “For our customers, this transaction creates the necessary scale, efficiency and purchasing power needed to enable independent retailers to compete more effectively with larger big box chains,” says Tony Sarsam, president and CEO …

NEW YORK CITY — The United Nations (UN) has signed a 425,190-square-foot office lease renewal and expansion at 2 United Nations Plaza in Midtown Manhattan. The lease encompasses 425,190 square feet across 26 stories, consolidating and expanding the UN’s New York City footprint, including a two-story retail component at 1 United Nations Plaza. The UN will now occupy nearly all the office space at 2 UN Plaza, which spans levels two through 26 at the property. In addition, the lease extension brings together operations previously split between 1 and 2 UN Plaza, which are currently in the midst of a $500 million capital improvement program. Jim Saunders, Jason Perla and Roy Abernathy of Newmark represented the UN in the negotiations. Scott Gottlieb of CBRE represented the landlord, which according to Wikipedia is a partnership between the United Nations Development Corp. and Millennium & Copthorne Hotels.

BOSTON — Related Beal, the Boston office of Related Cos., has topped out construction of Leiden Center II at Innovation Square, a 345,000-square-foot life sciences project in Boston. The 1.8-acre site is located within Raymond L. Flynn Marine Park in the Seaport District, and the seven-story building, which represents Phase III of the larger Innovation Square development, is fully preleased to Vertex Pharmaceuticals. A consortium of lenders consisting of Santander Bank, Ullico, LBBW and Washington Capital provided construction financing for the project, in which Basis Investment Group is an equity investor. Completion is slated for early 2027. The project is expected to generate as many as 700 construction jobs and approximately 500 permanent jobs for the city.

WILMINGTON, MASS. — JLL has arranged $92 million in financing for the three-building, 393,911-square-foot Fordham Park Robotic and Logistics Campus in the northern Boston suburb of Wilmington. The campus spans 40.1 acres and features high-bay research and development, robotics and distribution space. The park was fully leased at the time of sale to credit tenants in the e-commerce, warehouse automation/robotics and semiconductor equipment/industrial automation industries. Tom Sullivan led the JLL team that arranged the five-year loan through M&T Bank on behalf of the borrower, Carlisle Capital Corp.

AUBURN, N.Y. — An affiliate of St. Louis-based Commercial Development Co. has purchased the 237,480-square-foot former Bombardier manufacturing plant in Auburn, located outside of Syracuse in upstate New York. The 15-acre facility was originally built in 1886 to produce diesel engines and rail transportation equipment and includes several structures that were built in the 1940s. The facility features clear heights of 45 to 60 feet and is equipped with 12 overhead crane ways. Additionally, the property is fully paved and fenced with power-ready infrastructure in place. The new ownership will evaluate the existing buildings and retain or redevelop portions of the property based on market analysis.

HOBOKEN, N.J. — Unilever (NYSE: UL) has opened its new, 111,000-square-foot office in Hoboken that will serve as the British conglomerate’s new U.S. headquarters. Unilever will occupy three full floors at 111 River Street, which is part of the three-building, 1.5 million-square-foot Waterfront Corporate Center complex. CBRE represented Unilever in the fall 2024 lease negotiations. New York City-based SJP Properties owns Waterfront Corporate Center, which is also home to tenants such as Lipton, Walmart and Newell Brands.

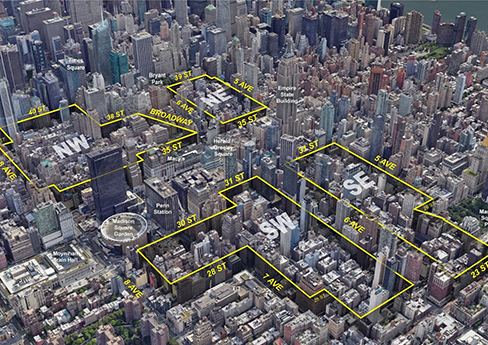

NYC Planning Commission Approves Midtown Manhattan Rezoning Proposal to Add Thousands of New Residences

by Abby Cox

NEW YORK CITY — The New York City Planning Commission has approved the Midtown South Mixed-Use Plan (MSMX), a rezoning initiative that could ultimately facilitate the creation of as many as 9,700 new residences across a 42-block section of Midtown Manhattan. The MSMX plan covers four areas centered around Herald and Greeley Square, located between West 23rd and West 40th streets, as well as Fifth and Eighth avenues. The area today is largely defined by commercial and industrial uses, with current land-use rules restricting new housing development. Midtown South is currently home to more than 7,000 businesses, 135,000 jobs and various public transportation hubs, but the neighborhood has struggled to rebound in the aftermath of the COVID-19 pandemic as hybrid work schedules have become more entrenched. In addition to these commercial vacancies, the submarket is subject to restrictive zoning rules that limit opportunities for New Yorkers to live near their jobs. “For far too long, outdated zoning policies have limited the potential of this well-resourced area to help address New York City’s urgent housing needs,” says Rachel Fee, executive director of the New York Housing Conference, nonprofit affordable housing policy and advocacy organization. “In the midst of a dire housing crisis, …