BALA CYNWYD, PA. — Federal Realty Investment Trust (NYSE: FRT) and CBG Building Co. have topped out a 217-unit multifamily redevelopment project in Bala Cynwyd, a northwestern suburb of Philadelphia. The project, which represents the second phase of a larger redevelopment known as Bala Cynwyd on City Avenue, is a conversion of the former 120,000-square-foot Lord & Taylor department store into an apartment complex with 16,000 square feet of ground-floor retail space. Federal Realty received zoning approval for the project in February 2024 and broke ground a few months later. The company expects to complete construction of this phase next summer.

Pennsylvania

CAMP HILL, PA. — Rite Aid has filed for Chapter 11 bankruptcy in the U.S. Bankruptcy Court for the District of New Jersey and is exploring opportunities to be acquired by outside entities. The announcement marks the second time in 24 months that the Pennsylvania-based convenience and drugstore chain has filed for voluntary Chapter 11 bankruptcy protection. The previous filing in October 2023 preceded the closure of hundreds of stores across the country. The company did not explicitly say in this filing how many of its stores would be immediately impacted, only noting that it would “divest or monetize any assets that are not sold through the court-supervised process.” To facilitate a potential sale, Rite Aid has secured commitments from some of its existing lenders to access approximately $1.9 billion in new financing, which will be used to fund existing operations prior to and during a court-supervised sales process. According to USA Today, Rite Aid operated about 1,200 stores across 15 states at the time of the latest filing.

DALLAS — Newmark has arranged a $125 million loan for the refinancing of a portfolio of 19 self-storage properties that are primarily (13 facilities) located in Pennsylvania. The other six properties are scattered across Maryland, New Jersey, Indiana and Kentucky. Collectively, the portfolio totals roughly 1.2 million net rentable square feet of space across nearly 10,000 units and has maintained an average occupancy rate of 91 percent over the past decade. Jonathan Firestone, Jordan Roeschlaub, Nick Scribani, Clint Frease, John Caraviello, Aaron Swerdlin and Andrew Warin of Newmark arranged the fixed-rate loan on behalf of the borrower, Dallas-based Rosewood Property Co. PGIM Real Estate provided the debt.

LANSDALE, PA. — Locally based investment firm Equus Capital Partners has purchased Jacobs Woods, a 230-unit apartment complex located in the northern Philadelphia suburb of Lansdale, for $73.1 million. Built on 37 acres in 1996, the garden-style property offers one-, two- and three-bedroom units across 33 townhome-style buildings. Erin Miller led the Newmark team that brokered the sale of Jacobs Woods, which was 98 percent occupied at the time of sale. The seller was not disclosed. The new ownership plans to upgrade unit interiors and amenity spaces.

PITTSBURGH — JLL has arranged a $67 million construction loan for 21 West, a 291-unit project in Pittsburgh. The site at 430 W. General Robinson St. is located within Pittsburgh’s primary entertainment district, with PNC Park, Acrisure Stadium, Rivers Casino and the Andy Warhol Museum all within walking distance. The project will comprise 313,000 rentable square feet across 11 stories. Units will come in studio, one- and two-bedroom floor plans. Residents will have access to amenities such as a sky bar on the 11th floor, rooftop deck with a pool, concierge services, coworking space, fitness center and wellness suite. Nick Unkovic and Zach Barone of JLL arranged the four-year, floating rate loan through Dollar Bank on behalf of the developer, a joint venture between Oxford Development Co. and RDC.

POTTSTOWN, PA. — An affiliate of Pennsylvania-based investment firm High Real Estate Group has purchased the 154,219-square-foot Suburbia Shopping Center in Pottstown, about 40 miles northwest of Philadelphia. Built on 25.6 acres in 2003 and anchored by supermarket Giant Food, Suburbia Shopping Center was 85 percent leased at the time of sale. Other tenants include Dollar Tree, Starbucks, The UPS Store and Tower Health. Jim Galbally and Patrick Higgins of JLL represented the seller, Gambone Management Co., in the transaction.

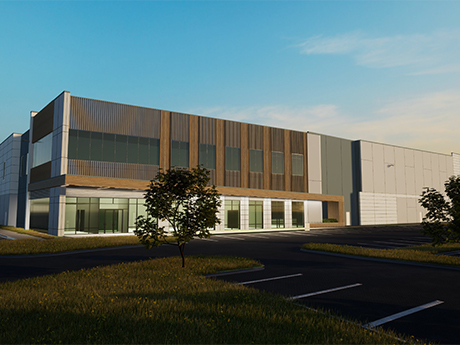

PHILADELPHIA — The RMR Group, an alternative asset management company based in metro Boston, will develop a 477,500-square-foot industrial project in southwest Philadelphia. The site at 8800 Tinicum Blvd. is located across from Philadelphia International Airport, and the development will feature a clear height of 40 feet, ample car and trailer parking and an electrical capacity of 8,000 amps. Construction is expected to begin over the summer and to last 12 to 18 months. Avison Young has been appointed as the leasing agent.

PHILADELPHIA — Fine Wine & Good Spirits has opened an approximately 4,300-square-foot store at Schuylkill Yards, a mixed-use development in the University City area of Philadelphia. The store at 315 Market St. is the company’s 48th in Philadelphia. Tim Arizin and Larry Steinberg from Colliers represented the tenant in the lease negotiations. Brandywine Realty Trust owns Schuylkill Yards.

SILVER SPRING, PA. — A joint venture between New York City-based Rockefeller Group and MBK Real Estate, a subsidiary of Japanese conglomerate Mitsui & Co., will develop a 2 million-square-foot industrial park in Silver Spring, located just west of Harrisburg. Silver Spring Logistics Park will be situated on a 182-acre site that is located about three miles from I-81 and is part of the former 451-acre Hempt Farm. The development will consist of three buildings that will total 892,620, 803,520 and 318,060 square feet and will feature clear heights of 40 feet and 185-foot truck court depths. The two larger buildings will have cross-dock configurations. CBRE has been tapped as the leasing agent and also brokered the land deal on behalf of the seller, HSS Investors LLC. Other project partners include Margulies Hoelzli Architecture, civil engineer Alpha Consulting and general contractor Penntex Construction.

KING OF PRUSSIA, PA. — Blueprint Healthcare Real Estate Advisors has negotiated the sale of a 190-unit seniors housing community located in King of Prussia, roughly 20 miles northwest of Philadelphia. The unnamed property, which according to Blueprint was not stabilized at the time of sale, opened in 2021 and offers assisted living and memory care services. Alex Florea, Kevin Lukehart, Steve Thomes and Kory Buzin of Blueprint represented the seller, an undisclosed private equity investor, in the transaction. The buyer was also not disclosed.