NEW BRITAIN, PA. — JLL has brokered the sale of Town Center of New Britain, a 124,262-square-foot shopping center located on the northern outskirts of Philadelphia. Giant Food anchors the center, which was built in 1990 and renovated in 2002. At the time of sale, Town Center of New Britain was 91 percent leased, and other tenants include Rite Aid, Dollar Tree, Verizon Wireless and AutoZone. Christopher Munley, Jim Galbally and Colin Behr of JLL represented the seller, Federal Realty Investment Trust, in the transaction. Milbrook Properties acquired the asset for an undisclosed price.

Pennsylvania

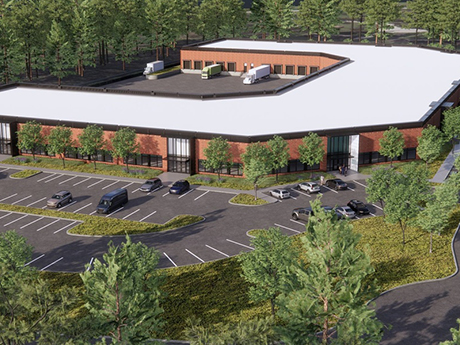

EXTON, PA. — Swiss manufacturer Früh Packaging has signed a 63,480-square-foot, full-building industrial lease in Exton, about 35 miles west of Philadelphia. According to LoopNet Inc., the property was built on 26.5 acres in 2023, totals 113,000 square feet and features a clear height of 16 feet, 40 dock doors and 128-foot truck court depths. Mike Adams and Sarah Finney Miller of NAI Summit represented the tenant in the site selection and lease negotiations. Locally based developer Hankin Group owns the property.

WARRINGTON, PA. — JLL has brokered the sale of Creekview Center, a 134,980-square-foot shopping center in Warrington, a northern suburb of Philadelphia. The grocery-anchored property is also home to tenants such as Chipotle Mexican Grill, Bank of America and Petco. Christopher Munley, Jim Galbally and Colin Behr of JLL represented the seller, locally based investment and development firm Goodman Properties, in the transaction. The buyer was not disclosed.

NEW YORK CITY — Affiliates of Centerbridge Partners LP and GIC Real Estate Inc. have entered into an agreement to acquire INDUS Realty Trust Inc. (Nasdaq: INDT) in an all-cash transaction valued at approximately $868 million. Participating members of INDUS’ board of directors have unanimously approved the deal. Under the terms of the merger agreement, INDUS stockholders will receive $67 per share in cash. That figure represents a premium of 17 percent to the company’s closing stock price on Nov. 25, the date of Centerbridge’s initial public announcement that it intended to issue a takeover offer with GIC to acquire INDUS. “The transaction delivers immediate and significant value to our stockholders, and we believe it validates the quality of the platform and portfolio we have built over INDUS’ long history,” says Michael Gamzon, president and CEO of INDUS. INDUS, a New York City-based industrial REIT, owns 42 buildings totaling roughly 6.1 million square feet in Connecticut, Pennsylvania, North Carolina, South Carolina and Florida. The deal is expected to close this summer and is subject to customary closing conditions. Upon completion of the transaction, INDUS’ common stock will no longer be listed on Nasdaq and INDUS will become a privately held …

PHILADELPHIA — JLL has arranged a $77.5 million construction loan for a 466-unit multifamily project in Philadelphia’s Northern Liberties neighborhood. Phase I of the development will deliver 279 units, a parking garage and 8,450 square feet of retail space. Amenities will include a pool, fitness center, theater, coworking space, dog run and a convenience mart. Michael Klein, Tom Didio and Ryan Ade of JLL arranged the loan through an undisclosed life insurance company on behalf of the borrower and developer, Saxum Real Estate. A construction timeline was not disclosed.

PHILADELPHIA — A partnership between two locally based firms, Odin Properties and RAM Development, has broken ground on Front Street Lofts, a 31-unit multifamily project in Philadelphia’s Norris Square neighborhood. The six-story building will house studio, one- and two-bedroom units as well as ground-floor commercial space. Completion is slated for fall 2024.

PHILADELPHIA — JLL has negotiated the sale of Aramingo Plaza, a 64,163-square-foot shopping center in Philadelphia. Apparel and accessories retailer Forman Mills anchors the center, which was originally built in 1920 and was fully leased at the time of sale. Other tenants include Citizens Bank, AT&T, Checkers and Vision Works. Christopher Munley, Jim Galbally and Colin Behr of JLL represented the seller, New Jersey-based Heidenberg Properties, in the transaction. Locally based investment firm Abrams Realty & Development acquired the asset for an undisclosed price.

PLYMOUTH MEETING, PA. — Pennsylvania Real Estate Investment Trust (PREIT) has sold a 65,155-square-foot retail property leased to Whole Foods Market in Plymouth Meeting, a northwestern suburb of Philadelphia, for $27 million. The store, which is located within Plymouth Meeting Mall, features a taco truck, rooftop patio, onsite pub and private event/meeting space. Jim Galbally, Chris Munley and Colin Behr of JLL represented PREIT in the transaction. The buyer was an undisclosed institutional investment firm.

PENNSYLVANIA — Evans Senior Investments (ESI) has arranged the $39 million sale of a portfolio of three seniors housing properties in Pennsylvania. The properties, the specific names and locations of which were not disclosed, total 395 skilled nursing beds and 32 units of private-pay seniors housing. The portfolio was approximately 64 percent occupied at the time of sale. The buyer was a regional owner-operator, and the seller was not disclosed.

ALTOONA, PA. — Commercial finance and advisory firm Axiom Capital Corp. has arranged an $11 million loan for the refinancing of a 222,139-square-foot, single-tenant retail property in Altoona, about 100 miles east of Pittsburgh. Walmart occupies the property, which houses a grocery store, auto care center, pharmacy and a hair salon. The names of the borrower, a private investment group, and direct lender, a bank, were not disclosed.