PHILADELPHIA — Locally based development and investment firm BG Capital will build an $85 million cold storage project on a seven-acre site in Philadelphia’s Port Richmond neighborhood. New Jersey-based cold storage operator FreezPak Logistics has committed to leasing the 170,117-square-foot facility on a triple-net basis, with the expectation of adding about 60 new permanent jobs to the local economy. Building features will include a clear height of 75 feet, an automated inventory storage and retrieval system, 20 loading docks, 30 trailer parking stalls and 60 parking spaces. Construction is scheduled to begin in the third quarter.

Pennsylvania

PHILADELPHIA — SmartLabs, a Boston-based life sciences operator, will open a new facility within Drexel University’s campus in Philadelphia. The square footage was not disclosed, but the space will span two stories within a 508,000-square-foot facility that is being developed by a partnership between Gattuso Development Partners and New York-based Vigilant Holdings. The facility, which is scheduled to open in 2025 and will include research and development, office and manufacturing space, will be SmartLabs’ seventh in the country.

PHILADELPHIA — SmartLabs, a Boston-based life sciences operator, will open a new facility within Drexel University’s campus in Philadelphia. The square footage was not disclosed, but the space will span two stories within a 508,000-square-foot facility that is being developed by a partnership between Gattuso Development Partners and New York-based Vigilant Holdings. The facility, which is scheduled to open in 2025 and will include research and development, office and manufacturing space, will be SmartLabs’ seventh in the country.

PHIILADELPHIA — JLL has brokered the sale of two apartment complexes totaling 213 units in Philadelphia. The Broderick is a 69-unit property in the Society Hill area that houses one- and two-bedroom units with an average size of 854 square feet and 5,240 square feet of ground-floor retail space. The Republic is a 144-unit complex in the Rittenhouse neighborhood with studio, one- and two-bedroom residences averaging 695 square feet. The Republic also houses 5,267 square feet of retail space. Mark Thomson, Carl Fiebig, Francis Coyne and Tyler Margraf of JLL represented the seller, a partnership between Barings Real Estate and MRP Realty, in the two separate transactions. Sentinel Real Estate Corp. acquired the assets for undisclosed prices.

PITTSBURGH — Chicago-based investment firm Syndicated Equities has sold Plaza at the Pointe, a 149,973-square-foot shopping center in Pittsburgh. At the time of sale, the property was leased to tenants such as Bed Bath & Beyond, La-Z-Boy, Party City, Old Navy, Dress Barn and Bob’s Discount Furniture. The buyer was not disclosed. Syndicated Equities originally acquired the property in partnership with Chicago-based owner-operator M & J Wilkow in 2016 for $24.5 million.

PHILADELPHIA — Pennsylvania Real Estate Investment Trust (PREIT) has added new tenants to three of its malls in the Philadelphia area. Rose & Remington, a lifestyle brand centered on mother-daughter shopping experiences, will open stores at Willow Grove Park, Capital City and Cherry Hill malls later this year. These stores will mark the retailer’s foray into greater Philadelphia. Fashion-forward jewelry concept Lovisa will also launch at Capital City Mall this fall. Lovisa opened its first store at PREIT’s Woodland Mall last year and has a third location at Springfield Town Center.

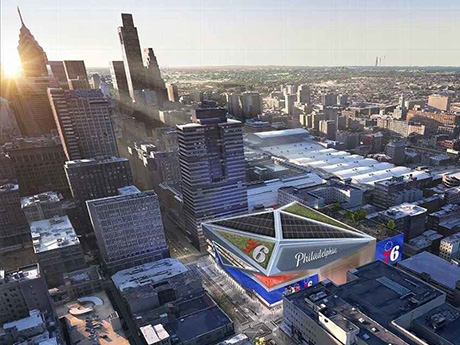

PHILADELPHIA — Josh Harris and David Blitzer, managing directors of the National Basketball Association’s Philadelphia 76ers, have formed a development corporation for construction of the team’s new arena, known as 76 Place, in Center City Philadelphia. Development costs are estimated at $1.3 billion, with plans to complete construction before the 2031-2032 NBA season. The property will be part of Fashion District Philadelphia, a 900,000-square-foot mall redevelopment that opened in September 2019. The team will partner closely with Macerich, which owns Fashion District, on the project. The transit-oriented site is located at Market Street and South 11th Street, adjacent to five SEPTA public transit lines and three blocks from city hall. The Fashion District project was once a highly regarded development with top-tier retailers, but struggled due to the COVID-19 pandemic closing the doors on many retailers just six months after opening. “The decision to repurpose part of Fashion District Philadelphia to include the new 76ers arena is a natural evolution of the site and a unique and once-in-a-lifetime opportunity for our company,” says Tom O’Hern, CEO of Macerich. Team owner Harris Blitzer Sports & Entertainment tapped local real estate magnate David Adelman, CEO of Campus Apartments, co-founder of FS Investments …

NEW YORK CITY — Cushman & Wakefield has arranged a $367.8 million in financing for a portfolio of 23 industrial properties totaling approximately 3 million square feet in the Mid-Atlantic region. Specifically, the properties are located in Pennsylvania, Maryland and New Jersey and were fully leased to 41 tenants at the time of sale. Tenant footprints range in size from 7,238 to 478,715 square feet. John Alascio, Alex Hernandez, Alex Lapidus, Chuck Kohaut, T.J. Sullivan and Jason Blankfein of Cushman & Wakefield arranged the loan through J.P. Morgan on behalf of the borrower, Ares Management.

PHILADELPHIA — Locally based brokerage firm Rittenhouse Realty Advisors has arranged the $87 million sale of Hamilton Court, a 295-bed student housing community located near the University of Pennsylvania in Philadelphia. Amenities include a pool, fitness center, outdoor grilling and dining areas and onsite laundry facilities. Hamilton Court also houses 21,400 square feet of retail space. Rittenhouse represented the seller, Post Brothers, which acquired the 103-unit property in 2015 and implemented a $21 million capital improvement program.

PHILADELPHIA — A fund managed by Ares Investment has purchased a 105,000-square-foot cold storage facility in Philadelphia. The property, which is currently leased to FreezPak Logistics, is located at 1801 N. 5th St., in between the Norris Square and Olde Kensington neighborhoods. Bob Yoshimura of Lee & Associates represented the seller, locally based investment and development firm BG Capital, and the buyer in the transaction. BG Capital originally purchased the facility as a part of a four-property portfolio deal in 2018.