PHILADELPHIA — A joint venture between locally based investment firm BG Capital, New Jersey-based Hampshire Cos. and Saudi Arabian investment firm Arbah Capital has acquired Constitution Health Plaza, a 295,000-square-foot medical office complex in South Philadelphia, for $77 million. The seller was not disclosed. The property, which is currently undergoing a renovation, also includes a 425-space parking garage. Major tenants include the City of Philadelphia, Malvern Behavioral Health, University of Pennsylvania Medicine, Mercy Health Systems and the Kidney Center of South Philadelphia.

Pennsylvania

PHILADELPHIA — New York City-based Ready Capital has closed a $1.8 million loan for the acquisition, renovation and stabilization of a 34,000-square-foot industrial property in northeast Philadelphia. The nonrecourse, interest-only loan features a 48-month term, floating interest rate, one extension option and a facility to fund future capital improvements. The sponsor was not disclosed.

COLLEGEVILLE, PA. — JLL has arranged the $162 million sale of Providence Town Center, a 759,945-square-foot retail center located in the Philadelphia suburb of Collegeville. Regional grocer Wegmans has been the anchor store for Providence Town Center since the property was developed in 2009. Brandolini Cos. sold the asset to a partnership between Maryland-based Finmarc Management Inc. and New York City-based KPR Centers. The property is the fourth-most-visited open-air retail center in the state, according to the brokerage team that handled the sale. Nearly 65,000 vehicles drive by Providence Town Center via State Route 422 on a daily basis, and an additional 20,000 vehicles pass the site on U.S. Highway 29 each day. At the time of sale, Providence Town Center was 92 percent leased to Wegmans, Old Navy, Dick’s Sporting Goods, HomeGoods, Michaels, LA Fitness and Movie Tavern. The brokerage team also notes that the acquisition of Providence Town Center marks the largest open-air retail transaction in the Philadelphia area since the trade of East Gate Square in 2015. The property drew interest from private and institutional investors alike. James Galbally, Christopher Munley, Colin Behr and Chris Angelone of JLL represented the seller and procured the buyer in the …

PHILADELPHIA — French investment bank Natixis has provided a $162.5 million loan for the refinancing of 1600 Market, a 39-story office tower in downtown Philadelphia. The building was originally constructed in the early 1980s and spans 825,968 square feet. PNC Bank houses its regional headquarters within 1600 Market as the anchor tenant. Ryan Ade of JLL, in conjunction with Cary Abod of Abod Capital, arranged the five-year, floating-rate loan with Natixis. The borrower, American Real Estate Partners, acquired the asset in 2018 and subsequently implemented a $15 million capital improvement program.

UPPER MORELAND, PA. — NAI Mertz has brokered the sale of Huntingdon Glen Business Campus, a 180,000-square-foot industrial park in Upper Moreland, located in Bucks County. The 16.8-acre development, which was 98 percent leased to a roster of 38 tenants at the time of sale, consists of five buildings that range in size from 8,000 to 64,000 square feet. Metro Philadelphia-based Velocity Venture Partners purchased Huntingdon Glen Business Park from an undisclosed seller. Jeff Licht and Jared Licht of NAI Mertz brokered the deal.

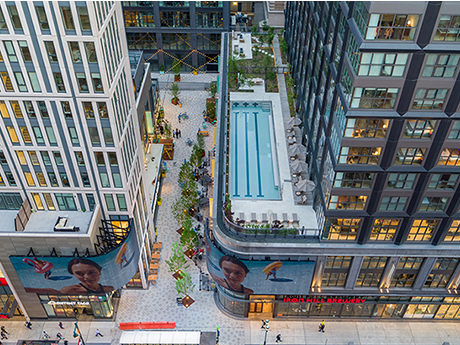

PHILADELPHIA — JLL has arranged a $260 million loan for the refinancing of East Market, a mixed-use project that spans an entire city block in Philadelphia’s Center City neighborhood. East Market consists of two apartment buildings totaling 562 units, 120,000 square feet of retail and restaurant space and a 100-year-old warehouse that has been redeveloped into creative office space. Chad Orcutt and Blaine Fleming of JLL arranged the loan through Pacific Life Insurance Co. on behalf of the borrower, a joint venture led by National Real Estate Advisors. The developer also plans to convert a traditional office building on the site into a boutique hotel and medical facility.

NEW YORK CITY — New York City-based Ready Capital has closed a $22 million loan for the acquisition, renovation and stabilization of a portfolio of six industrial properties that are located in various parts of New Jersey and Pennsylvania. The nonrecourse, interest-only loan carried a 48-month term and a floating interest rate, an extension option and a facility to fund capital improvements. The borrower was not disclosed.

PHILADELPHIA — A joint venture between Chicago-based developers Sterling Bay and Harrison Street, as well as New York City-based Botanic Properties, will develop a 310,000-square-foot life sciences facility in Philadelphia’s University City neighborhood. The 13-story building will be situated on a 33,400-square-foot parcel at 3801 Chestnut St. The facility will house lab space to accommodate cell and gene therapy users. Construction is scheduled to begin in the first quarter of 2023 and to be complete in mid-2025.

BEDFORD, PA. — Organic Snack Co., the maker of Kate’s Real Food, has purchased 82 acres in Bedford, located in the southern-central part of the state, with plans to open a new warehouse and distribution center. At full build-out, the facility will span about 750,000 square feet. The investment represents a total capital commitment of $75 million and is expected to add about 500 jobs to the local economy. Dollar Bank provided predevelopment and acquisition financing for the land.

PHILADELPHIA — Equus Capital Partners has acquired a 5.4 million-square-foot industrial portfolio located across the Sun Belt and East Coast. The properties were purchased from Prologis for $900 million, according to the Philadelphia Business Journal. The 75-property portfolio primarily comprises multi-tenant, infill, shallow-bay assets located across seven major distribution markets in Texas, Florida, Georgia, South Carolina and Virginia. The acquisition was made on behalf of the company’s sponsored value-add fund, Equus Investment Partnership XII L.P. The portfolio was 98 percent leased to 250 tenants at the time of sale, which included e-commerce, logistics providers, manufacturing, business-to-business and business-to-consumer users. Equus made headlines with another large-scale industrial acquisition in October of last year, buying a 7.3 million-square-foot industrial portfolio in Arizona for $1.1 billion. “We remain disciplined in our approach to appropriately scaling our industrial holdings across the U.S. on behalf of our investment partners,” says Kyle Turner, partner and director of investments for the Philadelphia-based firm. “This most recent investment further diversifies our platform holdings in the industrial sector and provides access to dynamic distribution locations poised to benefit from improving industrial fundamentals and sustained population growth,” he continues. Kyle Turner, Tim Feron, Laura Brestelli, Joe Felici, Scott Miller and Ryan Klancic …