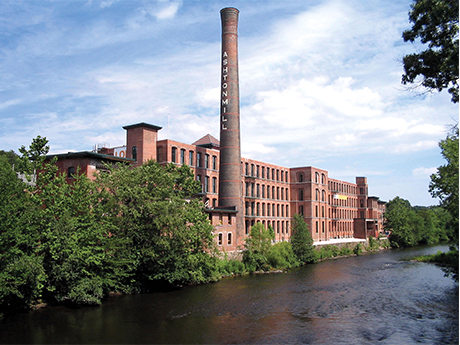

NEW HAVEN AND STRATFORD, CONN. — Illinois-based investment firm B3 Holdings LLC has acquired three multifamily properties in Connecticut and Rhode Island totaling 481 units units for $117 million. Winchester Lofts is a 158-unit complex in New Haven, and the second property is a 128-unit asset in Stratford, both of which are located in the southern coastal part of Connecticut. The third asset is River Lofts at Ashton Mills, a 195-unit community in Cumberland, R.I. Victor Nolletti, Eric Pentore and Wes Klockner of Institutional Property Advisors (IPA), a division of Marcus & Millichap, represented the seller, Brookfield Asset Management, in the transaction. The trio also procured B3 Holdings as the buyer.

Rhode Island

JOHNSTON, R.I. — Marcus & Millichap has brokered the $10.2 million sale of a 20,560-square-foot civic building in Johnston, a western suburb of Providence. The building houses offices of the U.S. Citizenship & Immigration Services. Laurie Ann Drinkwater and Seth Richard of Marcus & Millichap represented the seller, a private investment group, in the transaction. Additional terms of sale were not disclosed.

CRANSTON, R.I. — Topgolf will open a 68,000-square-foot venue at 100 Sockanosset Cross Road in Cranston. Locally based firm Carpionato Group owns the site and is leading the development of the multi-level facility, which will be the first in Rhode Island for the Dallas-based entertainment concept. Construction is underway and expected to be complete before the end of 2023. Carpionato is also working with Rhode Island Department of Transportation on infrastructural improvements associated with the project, such as the reconstruction of the eastern section of Route 37, which included a frontage road from Route 37 at Pontiac Avenue. Carpionato Group originally acquired the site in 1997.

PROVIDENCE, R.I. — Hawkins Way Capital has acquired The Edge at College Hill, a 247-unit student housing community in downtown Providence that serves students at Brown University, the Rhode Island School of Design (RISD) and Johnson & Whales University. The property consists of a 15-story building and a five-story building offering studio, one- and two-bedroom units. Shared amenities include a rooftop clubhouse, fitness center and ground-floor retail space. Following capital improvements, the community will be rebranded as FOUND Study College Hill.

NORTH KINGSTOWN, R.I. — Atlantic Capital Partners, the capital markets division of Boston-based Atlantic Retail, has brokered the sale of Frenchtown Plaza, a 123,061-square-foot shopping center located south of Providence in North Kingstown. The sales price was $9.5 million. Justin Smith, Chris Peterson, Sam Koonce and Cole Van Gelder of Atlantic Capital Partners represented the undisclosed seller and the buyer, Ocean State Job Lot, which also anchors the center, in the transaction. Other tenants at Frenchtown Plaza include Walgreens and Ace Hardware.

WESTERLY, R.I. — Marcus & Millichap has arranged the sale of Spindrift Village, a 42,200-square-foot retail property located in the coastal Rhode Island city of Westerly. The sales price was $3.4 million. The property consists of two adjacent parcels totaling four acres that house a multi-tenant strip center and a pad site. Adam Cohen and Brett Kilar of Marcus & Millichap represented the seller and procured the buyer, both of which were private investors that requested anonymity, in the transaction.

LINCOLN AND TIVERTON, R.I. — Bally’s Corp. (NYSE: BALY) has agreed to sell two of its casino resorts in Rhode Island to an affiliate of Gaming & Leisure Properties Inc. (NASDAQ: GLPI) for $1 billion. The properties in question are Bally’s Twin River Lincoln Casino Resort in Lincoln and Bally’s Tiverton Casino & Resort in Tiverton. A timeline for the closing of the sale-leaseback deal was not disclosed. Under the terms of the agreement, Rhode Island-based Bally’s will continue to operate the gaming operations and will pay a $9 million transaction fee at closing. GLP Capital, the acquiring entity of the Pennsylvania-based REIT, has agreed to pre-fund a deposit of up to $200 million that will be credited or repaid either at closing or on Dec. 31, 2023, whichever comes first. Ballly’s Twin River Lincoln features 136 hotel rooms and suites and a total of 162,000 square feet of gaming space, including 4,100 slot machines, 125 table games and a sportsbook. In addition, the resort houses four restaurants, three food courts, nine bars, three live entertainment venues, two VIP lounges and a retail store. Bally’s Tiverton comprises an 83-room hotel and 33,600 square feet of gaming space with 1,000 slot …

PROVIDENCE, R.I. — Developer EQT Exeter has begun leasing Emblem 125, a 249-unit apartment community in Providence. Designed by Torti Gallas + Partners, Emblem 125 features studio, one-, two- and three-bedroom units, and amenities include a fitness center, game area, resident lounge, concierge services and an outdoor courtyard. The building also houses 19,398 square feet of retail space. Shawmut Design & Construction served as the general contractor for the project, construction of which began in October 2020. Rents start at roughly $2,100 per month for a studio apartment. Bozzuto is the property manager.

Pebblebrook Hotel Trust Acquires Gurney’s Newport Resort & Marina in Rhode Island for $174M

by Katie Sloan

NEWPORT, R.I. — Pebblebrook Hotel Trust (NYSE: PEB) has acquired Gurney’s Newport Resort & Marina, a 10-acre waterside resort located on Narragansett Bay in Rhode Island, for $174 million. The 257-room hotel is located on Goat Island in Newport and features unobstructed views of Newport Harbor and the Newport Bridge. The hotel grounds include a historic lighthouse; 3,000-square-foot spa; coffee shop; 3,200-square-foot waterside pavilion; resort-style swimming pool with cabanas; indoor pool; fitness center; seasonal ice-skating rink; 80,000 square feet of flexible indoor and outdoor event space; and several waterside restaurants, including Showfish Newport and The Pineapple Club. The property also features a 22-slip full-service marina, which was not included in the sale, but will be available for PEB to purchase in 2027. The new ownership is evaluating a number of capital expenditures at the resort, which could include full renovations to guest rooms; upgrades to the lobby; updated landscaping; refurbishment of the property’s restaurants and bars; the addition of a new market; relocating and updating the spa; and updates to the hotel’s grand ballroom, south lawn and outdoor pavilion spaces. “Gurney’s Newport is the only resort-style property in Newport, drawing strong demand from New York, Boston and Providence,” says …

MIDDLETOWN, R.I. — CBRE has brokered the $37 million sale of Northgate Apartments, a 179-unit multifamily complex in Middletown. Built in phases between 1969 and 1972, the property offers one-, two- and three-bedroom units with an average size of 888 square feet. Amenities include a pool, fitness center and a leasing office. Simon Butler, Biria St. John and John McLaughlin of CBRE represented the seller, an affiliate of Boston-based Eden Properties, in the transaction. The team also procured the buyer.