SALEM, ORE. — Northmarq has arranged $12.9 million in refinancing for May’s Landing Apartments, a multifamily community in Salem. Salem-based Rushing Group, the borrower, recently constructed the garden-style, 96-unit multifamily property. The permanent refinance will allow the borrower to take out its interim bridge debt, which it utilized during the property’s lease-up, and return equity for its next multifamily development. Conor Freeman of Northmarq’s San Diego office arranged the refinancing for borrower. The transaction was structured with a 10-year term and 10 years of interest-only payments.

Northmarq

KANSAS CITY, MO. — Northmarq has arranged a $3 million loan for the refinancing of the Shops at Shoal Creek in Kansas City. The 14,238-square-foot retail center, built in 2015, is located at 8250-8260 N. Booth Ave. The property is situated near a larger shopping center that is home to Target, Sam’s Club, Walmart Supercenter and The Home Depot. Bob Harrington of Northmarq arranged the fixed-rate loan, which features a 10-year term, two years of interest-only payments and a 30-year amortization schedule. A life insurance company provided the loan for the undisclosed borrower.

MENDOTA HEIGHTS, MINN. — Northmarq has arranged a $28.8 million loan for the acquisition of Centre Pointe Business Park in Mendota Heights, a southern suburb of the Twin Cities. The eight-building office park is located at 2060 Centre Pointe Blvd. Totaling 263,279 square feet, the property was built in phases beginning in 1997. The last phase was completed in 2019. The park, which was 95 percent leased at the time of sale, is home to 18 tenants, including Permasteelisa North America Corp. and HealthPartners Inc. Bill Mork of Northmarq arranged the 10-year loan, which features a fixed interest rate and a 25-year amortization schedule. A local credit union provided the loan to the buyer, Edina-based Capital Partners. CBRE represented the undisclosed seller.

JANESVILLE, WIS. — Northmarq has arranged a $28.1 million loan for the refinancing of Village Green Apartments in Janesville, about 40 miles south of Madison. The 406-unit multifamily property is located at 3121 Village Court. Mark Ebersold of Northmarq arranged the 10-year loan, which features two years of interest-only payments and a 30-year amortization schedule. A CMBS lender provided the fixed-rate loan. The borrower was undisclosed.

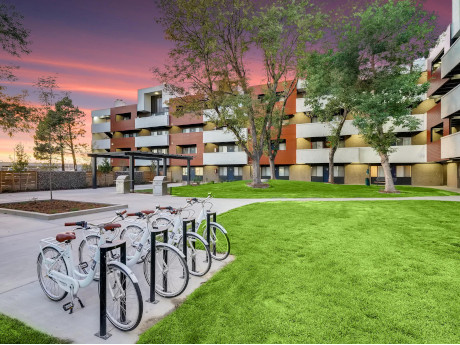

Northmarq Arranges $79.7M Sale of Towne at Glendale Apartment Complex in Glendale, California

by Amy Works

GLENDALE, CALIF. — Northmarq has brokered the sale of Towne at Glendale, a multifamily community located in the Verdugo Woodlands area of Glendale. Los Altos, Calif.-based Interstate Equities Corp. sold the asset to a public-private partnership of CSCDA Community Improvement Authority and BLVD Impact Housing for $79.7 million, or $630,000 per unit. Built in 1965, Towne at Glendale features 126 units, averaging 1,136 square feet. The property has undergone major renovations to provide luxury interior features and outstanding amenities. The buyer plans to expand upon the already completed enhancements and lease all units to renters earning between 80 percent and 120 percent of average median income. Shane Shafer and Bryan Schellinger of Northmarq’s Los Angeles investment sales team represented the seller in the transaction.

JUPITER, FLA. — Northmarq has secured $16.8 million in acquisition financing for Fresh Market Village, a 55,046-square-foot, grocery-anchored retail property in Jupiter. Daniel Karp of Northmarq arranged the financing, which included a 10-year term with three years of interest-only payments followed by a 30-year amortization schedule. Northmarq secured the permanent, fixed-rate loan on behalf of the undisclosed borrower through its relationship with an unnamed life insurance company. Built in 1989 and last renovated in 2014, the property is anchored by The Fresh Market. Located at 287 East Indiantown Road, the property is situated 19.7 miles from Palm Beach and 20.6 miles from Palm Beach International Airport.

AURORA, COLO. — Northmarq has arranged the sale of Highline Lofts Apartments, a multifamily property located at 456 S. Ironton St. in Aurora. Lowe Property Group sold the property to Summit Communities for $29.1 million, or $260,000 per unit. Built in 1972, Highline Lofts Apartments features 112 units in a mix of one-, two- and three-bedroom floor plans, ranging from 740 square feet to 1,395 square feet. Alex Possick, Rich Ritter and Seth Gallman of Northmarq’s Colorado Multifamily Investment Sales team represented the seller in the deal.

KANSAS CITY, MO. — Northmarq has arranged the sale of Centropolis on Grand, a 56-unit apartment building in Kansas City’s River Market neighborhood. The sales price was undisclosed. Gabe Tovar and Jeff Lamott of Northmarq represented the seller, KC Commercial Realty Group, which developed the property in 2016. Tovar and Lamott are also arranging permanent financing on behalf of the buyer, Minneapolis-based Oaks Properties. The transaction marks the buyer’s first investment in the Kansas City market.

OAK BROOK, ILL. — Northmarq has arranged a $19.2 million FHA loan for the refinancing of Mayslake Center II in the Chicago suburb of Oak Brook. The seniors housing property features 249 independent living units and is located within the larger Mayslake Village. Amenities include a wellness center, dining room, chapel and social services. Sue Blumberg of Northmarq arranged the fixed-rate loan, which is fully amortized over 40 years. The borrower was a nonprofit entity.

WINSTON-SALEM, N.C. — Northmarq has secured $23.2 million in acquisition financing for two multifamily properties in Winston-Salem. The lender and borrower were not disclosed. The two properties, Villas at the Vineyard and Townhomes at Little Creek, have a combined 229 units. The properties are located one mile apart from each other and are located close to downtown Winston-Salem with access to Interstate 40. The properties were renovated in 2020. Built in 1970, Villas at the Vineyard is a 134-unit apartment community located at 3401 Old Vineyard Road. Unit features include high-speed internet access, in-unit washers and dryers, ceiling fans and fireplaces. Community amenities include a pool, fitness center, laundry facilities, package service, onsite maintenance and property management, a pet play area, clubhouse, fitness center, sundeck, courtyard, grills and a picnic area. Built in 1966, Townhomes at Little Creek is a 95-unit multifamily community located at 4340 Johnsborough Court. Unit features include in-unit washers and dryers, hardwood floors and garbage disposals. Community amenities include laundry facilities, onsite maintenance and property management, a pet play area, clubhouse, pool and grills.