HOUSTON — U.S. LawShield has signed a 16,071-square-foot office lease at East River, a 150-acre mixed-use project in Houston’s Historic Fifth Ward. The national legal defense membership program will occupy the entire fifth floor of Building C. Amanda Nebel and Eric Seigrist of Cushman & Wakefield represented the landlord, Midway, in the lease negotiations. Hugh Herman, also with Cushman & Wakefield, represented U.S. LawShield.

Office

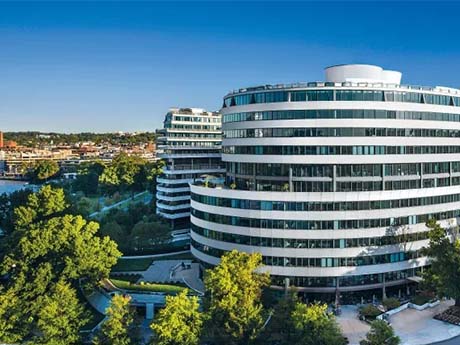

WASHINGTON, D.C. — Stream Realty Partners has arranged the sale of Watergate 600, a 12-story, 316,000-square-foot office building located at 600 New Hampshire Ave. N.W. in Washington, D.C.’s East End district. The buyer and sales price were not disclosed, but the Washington Business Journal reports that an affiliate of locally based Jetset Hospitality purchased the building for $52.5 million. Elme Communities, formerly known as Washington Real Estate Investment Trust, sold the property amid liquidating all of its assets and dissolving its business, according to the Washington Business Journal. Matt Pacinelli, Charlie Smiroldo and Lukas Stanat of Stream Realty represented Jetset in the transaction, while JLL represented the seller. The new owner has tapped Pacinelli, along with Tim McCarty, John Klinke and Josh McDonald of Stream Realty, to handle leasing at Watergate 600, which has a 125,000-square-foot top-block office space available. Amenities at the waterfront office building include a wraparound terrace on the seventh floor offering views of the Potomac River, a new lobby designed by LSM, new conference and event facilities, a modern fitness center and newly updated windows and elevators.

TAMPA, FLA. — Benderson Development has begun the transformation of 702 North Franklin Street, a 300,000-square-foot office building in downtown Tampa. The nine-story property was formerly the longtime corporate headquarters building for Tampa Electric (TECO) and Peoples Gas. Benderson has tapped CBRE to lease and market the building’s office space, while Benderson will lease the property’s 20,000 square feet of ground-level retail space. The renovations will include extensive work on the building’s façade, including new signage opportunities for future tenants, as well as interior upgrades.

West Capital Lending Acquires 104,375 SF Office Building in Irvine, California for $23.7M

by Amy Works

IRVINE, CALIF. — West Capital Lending has purchased 17911 Von Karman Avenue, a five-story Class A office building in Irvine’s Concourse submarket. John Hancock Insurance sold the asset for $23.7 million. West Capital Lending will occupy approximately half of the 104,375-square-foot building for its corporate headquarters. Two additional tenants will continue to occupy the first and second floors of the asset. Jay Nugent and Scott Read of Newmark represented the buyer in the deal.

CHICAGO — Transwestern has negotiated a 72,645-square-foot office lease at Michigan Plaza in Chicago. Mark Buth, Kathleen Bertrand and Steve Hennessy of Transwestern represented the landlord, Aegis Asset Management. Jeff Lindenmeyer, Chris O’Leary and Shannon Connerty Morris of Avison Young represented the tenant, the Illinois Housing Development Authority (IHDA). Transwestern also manages the nearly 2 million-square-foot complex. IHDA will occupy space in the 978,693-square-foot 225 N. Michigan Ave. building. The transaction marks the largest new lease in the East Loop submarket since the second quarter of 2023, according to Transwestern. Located on Michigan Avenue south of the Chicago River, Michigan Plaza offers amenities such as multiple tenant lounges, a fitness center and outdoor space. The second-floor lounge is connected to the East Plaza, an outdoor terrace with a bocce ball court and putting green. The third-floor lounge offers a kitchen and conferencing space.

NEW YORK CITY — RillaVoice Inc. has signed a 57,350-square-foot office lease in Brooklyn’s Williamsburg district. The AI-powered communications firm has committed to the entire eighth floor at 25 Kent, a 500,000-square-foot building, for a 10-year term. Cooper Weisman and Ryan Gessin of Newmark represented RillaVoice in the lease negotiations. Jordan Gosin, Will Grover and Drew Wiley, also with Newmark, along with internal agents Craig Panzirer and Alex Radmin, represented the landlord, Global Holdings.

The March 2 France Media webinar “Flood Zones & FEMA Compliance — How Developers Avoid Delays, Cut Insurance Costs & Increase Property Value,” hosted by France Media and sponsored by National Flood Experts, examined how flood zones and evolving regulatory requirements are shaping development and financing outlooks. Flood risk is often treated as a late-stage compliance issue, but it can influence site design, permitting timelines, construction costs (and cost expectations) and long-term insurance expenses. Flood maps established by federal and local authorities define development constraints such as base flood elevations and floodways. Because these maps are updated slowly and regulations vary by municipality, developers frequently encounter unexpected complications during permitting, including the need for additional engineering studies, modeling requirements and extended approval timelines. The webinar panelists emphasized ways that developers can mitigate these risks by approaching flood zones strategically and incorporating flood analysis earlier in the development lifecycle. Early collaboration can identify opportunities to cut costs and avoid delays. Watch this brief webinar to learn about common problems caused by flood zones, changes in regulatory needs and practical pathways to help reduce or eliminate flood zone requirements (to increase the value of properties). Click here to download the slide presentation. …

NEW YORK CITY — Largo Capital, a financial intermediary based in upstate New York, has arranged $76 million in construction-to-permanent financing for an office-to-residential conversion project in Lower Manhattan. The project will redevelop the historic, 21-story office building at 2 Wall St. into a 211-unit apartment complex. Jack Phillips of Largo Capital structured the debt. The direct lender was not disclosed. The borrower was also not disclosed, but the building is listed on the website of local landlord George Comfort & Sons.

NEW YORK CITY — Purple has signed a 24,000-square-foot office lease in Manhattan’s NoMad district. The global communications firm is relocating from 322 Eighth Avenue to the entire fourth floor of 16 Madison Square West, a 12-story building that was originally constructed in 1914. Jeff Buslik and Ben Levy represented the landlord, Adams & Co., in the lease negotiations on an internal basis. Simon Landmann, Harrison Potter and Graham Jameson of JLL represented Purple.

HOUSTON — Xceed Office, a provider of executive suites, has signed a 22,450-square-foot lease in Houston’s Galleria district. The space spans a full floor within 5POP, a 28-story, 566,773-square-foot building. Edward Edson and Jordan Trout of Colliers represented the tenant in the lease negotiations. Eric Anderson, Evelyn Ward and Avery McGahee of Transwestern represented the landlord, Florida-based CP Group.

Newer Posts