THE WOODLANDS, TEXAS — Colliers has negotiated a 14,581-square-foot office sublease in The Woodlands. According to LoopNet Inc., the building at 1735 Hughes Landing Blvd. was built in 2015 and totals 318,170 square feet. Tom Condon Jr., Jillian Fredericks, Norman Munoz, Michael Wu and Nic Fang of Colliers represented the sublessee, Skyline Industrial Supply, in the negotiations. Lonna Jenks, Beau Bellow and Ronnie Deyo of JLL represented the sublessor, ExxonMobil. An affiliate of Howard Hughes Holdings owns the building.

Office

CHICAGO — Related Midwest and CRG have unveiled plans to co-develop the Illinois Quantum & Microelectronics Park (IQMP) at 8080 S. DuSable Lake Shore Drive in South Chicago. The quantum innovation campus marks the first phase of a broader 400-acre master plan. PsiQuantum, a quantum computing technology company, will anchor IQMP. The project site is located on the former U.S. Steel South Works site along the Lake Michigan shoreline. IQMP will occupy 128 acres on the southern end of the site. In addition to PsiQuantum, the campus will house cryo facilities and equipment labs as well as research and office spaces for private companies and universities to collaborate. The first phase, designed by Lamar Johnson Collaborative, will occupy approximately 30 acres and is scheduled for completion in 2027. Clayco will serve as the general contractor for the initial phase.

NEW YORK CITY — Blackstone (NYSE: BX) has signed a 250,644-square-foot office headquarters lease expansion and extension at 345 Park Avenue in Midtown Manhattan. The private equity giant will soon occupy more than 1 million square feet across 28 floors at the 44-story, 1.9 million-square-foot building and has added an additional five years to its term. The extension will keep Blackstone, which originally took 70,000 square feet at 345 Park Avenue in 1988, in the building through 2034. Peter Riguardi, Joe Messina, Jessica Berkey, William McGarry, Hale King, Cynthia Wasserberger and Carlee Palmer of JLL, along with Jonathan Mechanic and Jen Yashar of Fried Frank, represented Blackstone in the lease negotiations. Tom Keating, Rob Steinman and Kevin Daly represented the landlord, Rudin, on an internal basis.

Kauri Investments Buys Medical Office Building in Bellevue, Washington for 150-Room Hotel Redevelopment

by Amy Works

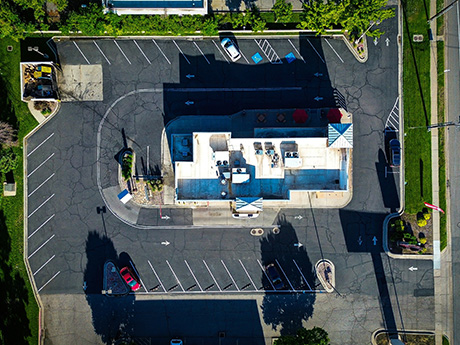

BELLEVUE, WASH. — Seattle-based Kauri Investments has acquired a freestanding medical office building, located at 1300 116th Ave. in the Seattle suburb of Bellevue, for $6.7 million. The seller and existing tenant, Eye Clinic of Bellevue, will lease back the 5,519-square-foot building until the ophthalmology practice moves into a more modern facility. Once the lease ends, Kauri plans to redevelop the asset, which is on a large parcel, into a 150-key hotel. Kauri Investments currently owns six other hotel sites Washington and Oregon. Pat Mutzel of Cushman & Wakefield’s private capital group in Seattle brokered the off-market transaction.

AcquisitionsContent PartnerDevelopmentFeaturesIndustrialLeasing ActivityLee & AssociatesLoansMidwestMultifamilyNortheastOfficeRetailSoutheastTexasWestern

Lee & Associates Second Quarter Report: Industrial, Office Market See Continued Challenges While Retail, Multifamily Trends Follow Region-Specific Patterns

In the first half of 2024, high interest rates led to decreased demand, higher vacancy rates, reduced construction starts and lower property sales in industrial and office, according to Lee & Associates’ 2024 Q2 North America Market Report. Meanwhile, retail saw minimal development and continued low vacancies. Retail rent growth was particularly strong in the South and Southwest. Finally, high demand for multifamily, coupled with a sudden influx of supply in the second quarter of the year, has created a market where outcomes are highly tied to region. Midwest and Northeast multifamily markets have remained stronger than their counterparts in the South and Southwest, while Western markets saw mixed growth. Lee & Associates has made their full market report available here (with complete breakdowns of cap rates by city, market rents, vacancy rates, square footage information and more). The summaries for the industrial, office, retail and multifamily sectors below provide detailed insight into the trends and trajectories likely through the end of 2024. Industrial Overview: Activity, Growth Checked by High Interest Rates Industrial market performance across North America continued to downshift in the first half of this year. Although net absorption remains positive, demand for industrial space has fallen to the lowest levels …

OKO Group, Cain International Obtain $565M Loan for 830 Brickell Office Tower in Miami

by John Nelson

MIAMI — Co-developers OKO Group and Cain International have obtained $565 million in financing for 830 Brickell, a 57-story office tower underway in Miami’s Brickell district. TYKO Capital, a joint venture between Adi Chugh and a Florida-based hedge fund that was established last year, provided the loan that pays off an existing construction loan that MSD Partners provided in 2019. Beatriz Azcuy of Sidley Austin LLP assisted the developers in the loan arrangement. Set to open this fall, 830 Brickell is fully leased to several high-profile tenants, including Microsoft, Citadel, Kirkland & Ellis, Marsh Insurance, Sidley Austin, CI Financial (Corient), Thoma Bravo, Santander Bank and A-CAP. OKO Group and Cain International are receiving temporary certificates of occupancy (TCOs) in phases for tenants, many of which are already building out their interior spaces within 830 Brickell ahead of its completion. Designed by Adrian Smith + Gordon Gill with interiors by Iosa Ghini Associati, the office tower will feature a restaurant and bar/private club on the top floor, upscale health and wellness center, conference facilities, outdoor terrace, cafés and street-level retail space.

AUSTIN, TEXAS — International law firm Foley & Lardner LLP has signed a 15,458-square-foot office lease renewal at 600 Congress Ave. in downtown Austin. The building rises 32 stories and totals approximately 544,000 rentable square feet. Amenities include an outdoor terrace with a bar and lounge, as well as a fitness center and multiple food-and-beverage options. Robert Copito, Nate Stricklen and Jay Austin of CBRE represented the tenant in the lease negotiations. JLL represented the landlord, Beacon Capital Partners.

AUSTIN, TEXAS — National general contractor JT Magen has completed the renovation of the 8,079-square-foot office space of video game developer Owlchemy Labs in Austin. Revel Architecture designed the project, which involved the creation of several areas for larger group gatherings, as well as smaller connection spaces and a space for recreational gaming. The project team also maintained private meeting rooms and added larger ground-floor windows to increase the flow of natural light.

NEW YORK CITY — Charles Schwab & Co. (NYSE: SCHW) has signed a 23,000-square-foot office lease renewal in Midtown Manhattan. The financial services and advisory giant has been a tenant at the 45-story, 1.1 million-square-foot building at 1133 Avenue of the Americas since 2014, and this deal keeps the company on the 37th floor for another 11 years. Schwab was self-represented in the lease negotiations. Tom Bow, Rocco Romeo and Nora Caliban represented the landlord, The Durst Organization, on an internal basis.

BROOMFIELD, COLO. — Mile High Labs has completed the disposition of 2555 W. Midway Boulevard, a R&D and manufacturing property within Atlas Industrial Park in Broomfield, a suburb north of Denver. ScanlanKemperBard acquired the asset for an undisclosed price. Situated on 20 acres, the 436,534-square-foot asset features a 411,034-square-foot building and a 25,500-square-foot building. The buildings offer office, manufacturing, processing, packaging, laboratory and climate-controlled warehouse areas, as well as general engineering areas and an employee cafeteria. Additionally, the buildings collectively feature nearly 12,000 amps of power. Rick Egitto of Avison Young, along with Justin Rayburn of Fountainhead Commercial, represented the seller, while the buyer was self-represented in the deal.