SEATTLE — King County has purchased the Dexter Horton Building, an office building in downtown Seattle, for $36.6 million. The county worked with ING Group, a lender to the original property owner, to create a deal to transfer ownership. CIM Group acquired the asset in 2019 for $151 million. King County’s Department of Public Defense is one of nine tenants in the building and will now expand its presence at the property. The deal will save King County nearly $2 million per year in leasing costs and has the potential to be a future source of additional revenue to the county when new tenants fill the vacant space currently available in the building.

Office

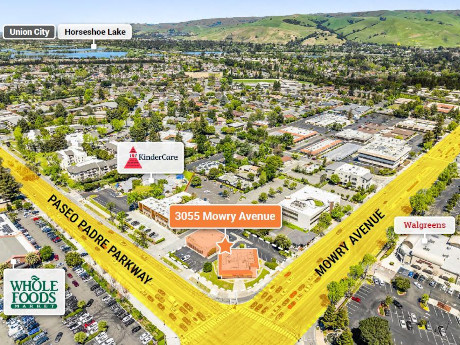

Marcus & Millichap Brokers Sale of 7,200 SF Western Dental-Occupied Properties in Fremont, California

by Amy Works

FREMONT, CALIF. — Marcus & Millichap has arranged the sale of two buildings with a combined size of 7,200 square feet in the Bay Area city of Fremont. A private investor sold the medical office assets to an undisclosed buyer for $3.7 million. Western Dental occupies the assets, located at 3055 Mowry Ave. and 38780 Paseo Padre Parkway, on a net-lease basis. Yuri Sergunin, J.J. Taughinbaugh and Eric Carrillo of Marcus & Millichap’s Palo Alto office represented the seller in the deal.

HOUSTON — Locally based brokerage firm Oxford Partners has negotiated a 22,127-square-foot office lease in Houston’s Energy Corridor. According to LoopNet Inc., the 17-story, 455,142-square-foot building at 580 Westlake Park Blvd. was built in 1982 and renovated in 2021. Ryan Hartsell of Oxford Partners represented the tenant, shipbuilder Hanwha Ocean, in the lease negotiations. Matt Asvestas, Grant Schiro and Ryan Barbles of Stream Realty Partners represented the landlord, Younan Properties.

WOODBRIDGE, N.J. — Colliers has brokered the $11.1 million sale of 900 on Nine, a 112,705-square-foot office building in the Northern New Jersey community of Woodbridge. The building was 54 percent leased at the time of sale to tenants such as NIP Group, Onyx Equities and Toshiba. Jacklene Chesler, Patrick Norris, Philippe Jomphe and Matthew Cohen of Colliers marketed the property in conjunction with auction platform Ten-X on behalf of the seller, TFE Properties. The buyer was not disclosed.

NEW YORK CITY — Hines will open a 63,000-square-foot flexible workspace in Manhattan’s Hudson Square neighborhood under its proprietary coworking brand, The Square. The space at 205 Hudson St. formerly housed a WeWork facility and will be the brand’s first in New York City. The space will feature a variety of private suites, group meeting areas and amenity spaces. The opening is scheduled for later this summer.

NEW YORK CITY — XR Extreme Reach has signed a 13,400-square-foot office lease at The Spiral in Midtown Manhattan. The digital marketing firm is relocating its headquarters from 1633 Broadway to the 21st floor of the 66-story tower. Greg Conen and Sam Brodsky internally represented the landlord, Tishman Speyer, in the lease negotiations. Joe Messina and Seth Hecht of JLL represented the tenant.

CARY, N.C. — Accesso has executed 30,000 square feet of leases at Weston I, a two-building office property located at 1001 Winstead Drive in Cary, a suburb of Raleigh. The deals include 12,000 square feet in new leases and 18,000 square feet in renewals. New tenants include K&A Engineering, a global engineering consultancy, and Contiem Inc., an international content management company. Hall & Burns Wealth Management LLC and Western & Southern Life Insurance Co. are two of the tenants that have renewed at Weston I. Brian Carr and Brad Corsmeier of CBRE represented Accesso in the lease transactions. Accesso cites the property’s recently renovated lobby, fitness center and tenant lounge as helping drive the recent leasing activity.

CHICAGO — The American Dental Association (ADA) is relocating its headquarters to 401 North Michigan Avenue in Chicago. In the first quarter of 2025, the tenant will begin occupying the top three floors of the building and a portion of the 32nd floor for a total of 69,574 square feet. ADA’s lease encompasses 9.4 percent of the building’s total rentable space, bringing the occupancy to 88.4 percent. Tenants at the property have access to an outdoor work park, direct access to University of Chicago Gleacher Center conference facilities, a tenant lounge and conference center, Pine Street Kitchen, a 7,500-square-foot professionally managed fitness center and indoor valet parking. ADA’s move comes after spending 60 years at its previous headquarters at 211 East Chicago, which was sold to Lurie Children’s Hospital. Erica Marshall of Stream Realty Partners and Howard Meyer of Zeller represented ownership, Walton Street Capital. Jeff Liljeberg and Jaime Fink of JLL represented ADA.

CHICAGO — R.M. Chin & Associates has signed a 15,473-square-foot office lease at the newly renovated Canal Station building at 801 S. Canal St. in Chicago. The tenant represents clients in the aviation, buildings and transportation environments with program management, project management, construction management, and design and public involvement services. The lease marks the first at the property. Bill Sheehy and Brady Wolfe of CBRE represented the tenant, while Jeff Dowdell and Matt Whipple of Telos represented ownership, 601W. Purchased in 2019 by 601W, the former Northern Trust building began undergoing redevelopment in 2021. The six-story, 680,000-square-foot property features new windows; a new hospitality-focused amenity center with a fitness center, tenant lounge and 8,000-square-foot terrace; and a grand entrance and lobby with a four-story media wall. Gardner Builders was the general contractor, and Solomon Cordwell Buenz was the architect.

SYRACUSE, UTAH — JLL has arranged an equity placement for the Syracuse Medical Office Building development in Syracuse, approximately 30 miles north of Salt Lake City. CJ Kodani and Mark Root of JLL Capital Markets secured the equity through Chesnut Healthcare Real Estate for the developer, Fort Street Partners. Located at 3000 W. Antelope Drive, the 20,399-square-foot medical office building is fully pre-leased by three regional physical groups. Completed is slated for 2025.