NEW YORK CITY — Marketing and media agency Canvas Worldwide has signed an 18,000-square-foot office lease at One Hudson Square, a 1 million-square-foot building in Manhattan. The building was originally constructed in 1929 and offers a newly renovated lobby, outdoor amenity terrace and a coffee shop. Nick Farmakis of Savills represented the tenant in the lease negotiations. David Falk, Pete Shimkin, Jonathan Fanuzzi, Jon Franzel and Brittany Silver of Newmark represented the landlord, Hudson Square Properties.

Office

Fulton Street Cos. Receives $233M Financing for 919 West Fulton Office Project in Chicago

by Jeff Shaw

CHICAGO — Development firm Fulton Street Cos. (FSC) has received $233 million for the financing of its 919 West Fulton office project in the Fulton Market neighborhood of downtown Chicago. Led by Shanna Khan, SNK Capital has signed on to serve as the lead equity investment partner on the project. Bank OZK and Manulife Investment Management are also providing capital. A groundbreaking ceremony is scheduled for today. Upon completion in 2025, the 11-story building will total 360,000 square feet. FSC and JDL Development will develop the property, which will feature factory-style facades, architectural masonry and large outdoor terraces on each floor. Amenities at the building will include a conference center, 24-hour health club and a tenant lounge. The ground floor will offer 40,000 square feet of retail space. Khan, who has a background in mixed-use real estate development, interior design, manufacturing, leisure and hospitality, will act as lead designer on the project. “Her creativity and vision embody the essence and unique qualities of the very unique neighborhood,” says Alex Najem, founder and chief executive officer of FSC. He adds that the “goal is to retain the character of the neighborhood while introducing a property that attracts those tenants who want …

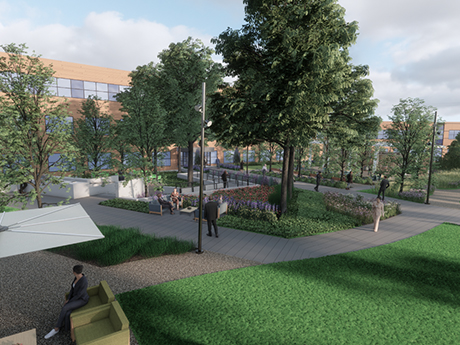

DALLAS — Rubenstein Partners is underway on the redevelopment of the 27-acre former PepsiCo office campus in Plano. The Philadelphia-based developer is currently renovating the 250,000-square-foot building at 5600 Technology Drive, which the company purchased in 2022. Capital improvements include a new lobby and entryway, along with a new tenant lounge, coffee bar and fitness center. Exterior improvements include a new façade with enhanced landscaping, as well as the addition of outdoor seating areas and pickleball courts. Dallas-based GFF is overseeing the design of the project, which is expected to be complete by the end of the year.

LOS ANGELES — Carmel Properties has announced plans for Forge at Alloy, a 1 million-square-foot mixed-use property at 530 Mateo St. in Los Angeles’ Art District. The developer has retained Mike Condon Jr., Brittany Winn, McKenna Gaskill, Pete Collins and Steven Marcussen of Cushman & Wakefield to lead leasing effort for the project, which is slated for completion in third-quarter 2024. Forge at Alloy will consist of a six-story, Class A building featuring 127,456 square feet of creative office space and 18,000 square feet of ground-floor retail space, outdoor space with seating and lounge areas, a rooftop deck and three levels of parking. The second building will be a 35-story, 475-unit residential tower. The office and residential components will be connected via a pedestrian and retail paseo, formerly a rail spur, between Mateo Street and Santa Fe Avenue. The paseo will house year-round activities and attractions, including public art installations, outdoor concerts, movies and other special events.

DALLAS — Tower Street Insurance has signed a 19,399-square-foot office lease expansion at Providence Towers, a 524,143-square-foot complex in North Dallas. The tenant is expanding from 5,000 to 24,399 square feet at the property, which is currently undergoing a multimillion-dollar capital improvement program. Kim Brooks, Justin Miller, Scott Walker and Laney Delin of Transwestern represented the landlord, California-based investment firm KBS, in the lease negotiations. Michael Griffin of Transwestern represented the tenant.

NEW YORK CITY — A joint venture led by SL Green Realty Corp. (NYSE: SLG) has completed the redevelopment of One Madison Avenue, a 27-story, 1.4 million-square-foot office building in Midtown Manhattan. As part of the project, the development team demolished the existing office building down to the ninth floor and constructed 17 new floors above. One Madison Avenue now features oversized roof terraces with entertainment sky gardens and an 11,000-square-foot roof deck that connects to a 7,000-square-foot, tenant-only amenity space known as “The Commons.” The newly transformed office tower will also eventually house a steakhouse by Michelin-starred chef Daniel Boulud. Multiple tenants have already committed to the building, including Franklin Templeton (347,474 square feet), IBM (328,000 square feet) and Chelsea Piers Fitness (55,780 square feet).

JERSEY CITY, N.J. — American Equity Partners has acquired Harborside 6, a 200,000-square-foot office building in Jersey City, for $46 million. The building is situated within a larger waterfront development known as Harborside that was originally developed by Veris Residential (NYSE: VRE), then known as Mack-Cali Corp. The building can support traditional office tenants as well as healthcare, studio production and creative office users. A Whole Foods Market also recently opened on the building’s ground floor. American Equity Partners has appointed Newmark as the leasing agent.

MORRISTOWN, N.J. — Sanofi has signed a 16,903-square-foot office lease at 21 South St. in the Northern New Jersey community of Morristown. The 43,691-square-foot building was constructed in 1911 as a bank. The move corresponds with the global pharmaceutical company relocating its headquarters to the nearby M Station West development. That larger relocation is expected to bring about 1,900 Sanofi employees to Morristown, while about 70 people within the consumer healthcare division will work in this newly leased space. The Hampshire Cos. owns 211 South Street.

WEST HOLLYWOOD, CALIF. — HQ Development, led by Robert Herscu, has purchased a vacant property at 825 N. San Vincente Blvd. in West Hollywood. Hilldale Property Owner sold the asset for $19 million. Christopher Bonbright and Jonathan Larsen of Avison Young handled the transaction on behalf of the seller, the property’s original owner and developer. Avison Young positioned the building as an opportunity for redevelopment, as the site is located between Sunset and Santa Monica boulevards near famous and popular venues like The Comedy Store, The Viper Club, The Troubadour and Whiskey A Go Go. Built in 1984 and renovated in 2014, the three-story property features 28,512 square feet of space and parking for 135 cars. According to Avison Young, the asset satisfies West Hollywood’s parking and zoning requirements for office, medical, co-working, health club and hospitality uses, including a boutique hotel and restaurant.

CHICAGO — AmTrust RE has unveiled plans for a $50 million capital improvements program at two of its Chicago office properties, One East Wacker and 33 North Dearborn. The improvements will provide tenants with a “hospitality-inspired setting,” equipped with amenities, modern finishes and furniture, and elevated conveniences. This initiative marks the initial stage of the company’s $100 million commitment to upgrading its Chicago portfolio. Additionally, AmTrust has enlisted Stream Realty Partners to manage leasing for its Chicago office portfolio. At One East Wacker, AmTrust will upgrade the property’s exterior and entrances along both Wacker Drive and State Street, create multiple spec suites and fulfill a corridor and restroom renovation. Additional plans call for a comprehensive lobby renovation envisioned by Chicago-based Eastlake Studio; creation of a comprehensive amenity floor on the second level overseen by wellness amenities management service Lulafit; and significant renovations to the top-floor lounge on the 41st floor. The office tower spans 540,000 square feet. Improvements to the 330,000-square-foot 33 North Dearborn include renovating and expanding the fourth-floor conference center to double in size; creating an outdoor tenant roof deck; enhancing building conveniences such as expanding the bike room; new ground-floor retail offerings; aesthetic upgrades to the building …