NEW YORK CITY — Lockton Re, a provider of reinsurance services, has signed a 19,326-square-foot office lease at 261 Fifth Avenue in Manhattan’s NoMad district. The company is relocating from 48 West 25th St. to the 10th floor of the 25-story, 450,000-square-foot building. Don Preate of JLL represented the tenant in the lease negotiations. Andrew Wiener, Tim Parlante and David Turino internally represented the landlord, The Feil Organization, which recently implemented a $20 million value-add program at the building.

Office

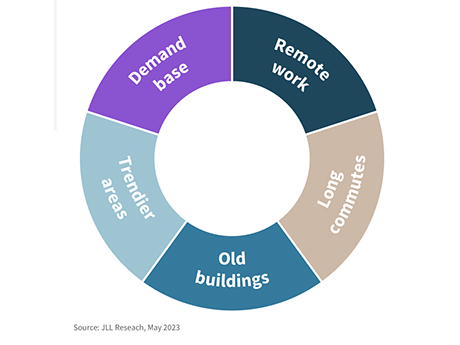

It will likely surprise no one, given the wealth of coverage on the issue of reduced office usage, that office vacancy is the top challenge currently facing central business districts (CBDs) worldwide, according to a recent report by JLL. Long and costly commutes, property obsolescence, competition from other submarkets and unstable demand are the other top hurdles for CBDs. Far from pessimistic though, the report — The Future of the Central Business District — says that CBDs can and will adapt to the new landscape, with government officials and commercial real estate players holding the power to “unlock the future potential of CBDs.” Hybrid work presents a hindrance According to research presented in the report, roughly 60 percent of workers “expect flexible arrangements” when it comes to their presence in their offices, with hybrid working arrangements (comprising schedules that are partly remote and partly in-office) becoming increasingly popular. Workers, the report states, now spend an average of 2.3 days of the week remotely, and office vacancy in the United States sits at 20.2 percent. Aside from the implications for the office sector, the woes of which are well documented, the absence of workers from offices translates to reduced foot traffic in retail …

THE WOODLANDS, TEXAS — Waste Connections US Inc. has signed an office lease renewal and expansion in The Woodlands, about 30 miles north of Houston. The publicly traded waste management company now occupies 116,817 square feet across five and a half floors at 3 Waterway Square, an 11-story building located within The Woodlands Town Center mixed-use development. Jason Whittington of Partners Real Estate represented the tenant in the lease negotiations. Robert Parsley, Norman Munoz and Jillian Fredericks with Colliers represented the landlord, The Howard Hughes Corp.

HOUSTON — General contractor Crest Builders has completed a 15,000-square-foot interior office renovation project in Houston for DECISIO Health, which provides platforms and solutions for aggregating data from electronic health records. Houston-based Griffin Partners owns the building at 520 Post Oak Blvd. Ware Malcomb designed the space. Edward Edson of Colliers represented DECISIO Health in the lease negotiations, and Jill Nesloney of Lee & Associates represented Griffin Partners.

RICHARDSON, TEXAS — Austin Circuit Design has relocated its office from the northeastern Dallas suburb of Garland to a 7,600-square-foot space in nearby Richardson. The new office is in Campbell Square, which totals 84,432 square feet and is located within Richardson IQ, a 1,200-acre innovation and tech hub. Maverick Commercial Real Estate owns Campbell Square.

AUSTIN, TEXAS — United Properties, a developer with offices in Colorado and Minnesota and Texas, has opened a new, 3,165-square-foot office on the 15th floor of Colorado Tower in downtown Austin. The company has relocated from 1617 W. Sixth St. Atlanta-based Cousins Properties owns Colorado Tower, which spans 373,000 square feet and offers amenities such as a fitness center, conference facility and onsite food-and-beverage options.

NEW YORK CITY — The Kaufman Organization has acquired 875 Avenue of the Americas, a 26-story, 265,000-square-foot office building in Manhattan’s NoMad neighborhood, for $92.5 million. The building was originally constructed in 1926. Chris Varjan of Lee & Associates led a team that represented the seller, which had owned the property since 1975, in the transaction.

CRBC to Break Ground on 26-Story Office Tower, Parking Garage in Downtown West Palm Beach

by John Nelson

WEST PALM BEACH, FLA. — Cohen Brothers Realty Corp. of Florida (CRBC) plans to soon break ground on West Palm Point, a 26-story office tower located at the intersection of Okeechobee and Quadrille boulevards in downtown West Palm Beach. Situated near the Intracoastal Waterway, the 2.4-acre development will comprise a full city block and includes an adjacent, 10-story parking structure that will feature a rooftop gathering area with a café, shaded seating and a water feature. Designed by Pelli Clarke & Partners and Nichols Brosch Wurst Wolf, the office building will have a landscaped rooftop park, 14,416 square feet of ground-floor retail space, multiple fast-casual restaurants, a fitness center and conference rooms. John Criddle, Joe Freitas and Max Pawk of CBRE will lead local marketing and leasing efforts in partnership with Marc Horowitz from Cohen Brothers in New York. CRBC plans to begin construction on West Palm Point in the fourth quarter, with expected tenant occupancy beginning in the third quarter of 2026.

HOUSTON — Method Architecture will open an 8,612-square-foot office at East River, a 150-acre mixed-use development in Houston’s Historic Fifth Ward. The tenant is relocating from a space on the east side of downtown Houston and expects to open this fall. About 60 employees will work in the office, which features an open layout with hotel-style workstations. Employees also have access to a nine-hole, par-three golf course that opened at East River in fall 2022, as well as pickleball courts, a restaurant and 15,000-square-foot music venue designed by Method. Midway owns East River.

By Anthony Armbruster, Colliers Although converting former office buildings to multifamily properties is by no means a new practice, conversions have been on the rise in recent years due to the changing work environment and office landscape. While the COVID-19 pandemic has started to fade away in many peoples’ minds, several of the changes in the work environment during that time have not. Many formerly in-office employees continue to work from home or have hybrid schedules post-pandemic. Additionally, tenants who are moving into new office spaces have shown a preference for smaller, more efficiently laid out, amenity-rich and suburban Class A office spaces. These changing consumer preferences have resulted in higher vacancies and fewer new tenants for older downtown office buildings than before the pandemic. Consequently, many of these older buildings are being converted into residential spaces, exemplifying the trend. An office building may be considered for a residential conversion when it is no longer economically feasible to continue running the building as such. However, not every office building at the end of its economically useful life is a suitable candidate for a residential conversion. Factors such as a building’s layout, location, age and cost of conversion play the most …