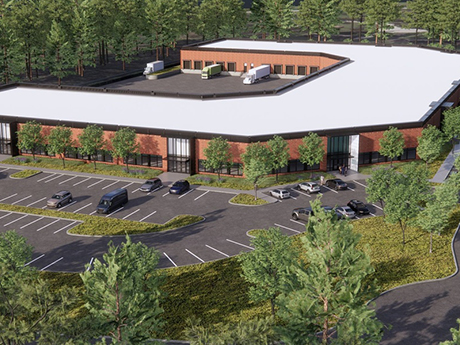

SAN ANTONO — KCI Technologies, an engineering, surveying and construction management firm, has signed a 23,000-square-foot office lease to be the anchor tenant at Inwood Village II, a 74,265-square-foot building under construction on the north side of San Antonio. David Ballard and Parker LaBarge of CBRE represented the tenant in the lease negotiations. Rob Gish and Shawn Gulley internally represented the landlord, locally based developer Worth & Associates. Completion of Inwood Village II is slated for the summer.

Office

SCHAUMBURG, ILL. — The Equitable Funds and Berger Asset Management have completed a tenant amenity center and expanded the spec suite leasing program at One Story Schaumburg in the Chicago suburb of Schaumburg. The office property consists of six single-story buildings totaling 130,000 square feet at 1340 Remington Road. The spec suite program offers businesses move-in ready spaces spanning from 630 to 3,000 square feet. The new suites are under construction and will be available this spring. The amenity center features a tenant lounge, coffee bar and vending, as well as a conference center with fully equipped Wi-Fi. Recently, FCx Performance, the Certification Board for Diabetes Care and Education, Prime Line Transportation and QPS Employment Group all signed leases at the property for a total of 11,473 square feet. Steve Chrastka and Jason Wurtz of NAI Hiffman are the leasing agents.

NORTHBROOK, ILL. — CF Industries has signed a 77,863-square-foot office lease at 1 Astellas Way in Northbrook to relocate its headquarters from 4 Parkway North in Deerfield, Ill. CF Industries is a global manufacturer of hydrogen and nitrogen products for clean energy, fertilizer, emissions abatement and other industrial activities. The company will occupy two floors in the south building before the end of the year. The 432,000-square-foot, two-building office complex will be renamed 2375 Waterview Drive in April. Amenities include a cafeteria, 400-person multipurpose meeting space, fitness center and outdoor terraces. Kyle Robbins, Andrew Davidson and David Burkards of Transwestern Real Estate Services provide office leasing services for the property. Daniel McCarthy and Sophia Spinell of JLL represented CF Industries.

IRVING, TEXAS — Newmark has brokered the sale of Crestview Tower, a 262,962-square-foot office building in Irving’s Las Colinas district. The 12-story building sits on a 10.1-acre site and was renovated in 2015. Amenities include a fitness center, conference facilities, tenant lounge and various outdoor green spaces. Robert Hill, Chris Murphy, Gary Carr and Chase Tagen of Newmark represented the seller, Austin-based CapRidge Partners, in the transaction. The buyer, a partnership between Reserve Capital Partners and Trinity Investors, has retained Stream Realty Partners to lease the building and hired Entos Design to reimagine the entryway, lobby, fitness center, tenant lounge and outdoor patio. Crestview Tower was 78 percent leased at the time of sale.

ADDISON, TEXAS — Holt Lunsford Commercial has negotiated a 20,891-square-foot office lease renewal in the northern Dallas suburb of Addison. Foundation Energy Management, which acquires, develops and enhances domestic oil and gas properties, is recommitting to Liberty Plaza, a two-building, 218,934-square-foot complex. Tyler Howarth of Holt Lunsford represented the landlord, Franklin Street Properties Corp., in the lease negotiations. The tenant representative was not disclosed

PORTLAND, ORE. — Portland-based Norris & Stevens has arranged the acquisition of 7970 Milwaukie Building, an office and retail building located at 7970 SE Milwaukie Ave. in Portland. Christ Church Sellwood acquired the property from CBA Group for $1.5 million. Classical Ballet Academy currently occupies the 5,000-square-foot facility, which includes six parking spaces. Tim Pfeiffer and Camden Muller of Norris & Stevens represented the buyer, while Jim Gillespie and Stacey Rustad-Smith of Keller Williams Realty represented the seller in the deal.

OAK BROOK, ILL. — Skender has broken ground on the transformation of the former McDonald’s corporate campus in the Chicago suburb of Oak Brook. The 250,000-square-foot buildout will serve as the new headquarters of Ace Hardware. The project at 2915 Jorie Blvd. will consist of open workstations, 150 conference rooms, 12 cafes and a variety of collaboration spaces and amenities. Originally built in the 1970s and designed by Dirk Lohan, grandson of famed architect Mies van der Rohe, the campus consists of three buildings on more than 80 acres. The campus has sat empty since 2019, when the fast food giant moved its headquarters to Chicago’s Fulton Market. The renovation project will reuse and retain many of the main building’s original architectural elements, including a large atrium in the center. The first floor of the parking garage will be converted into an amenity suite that includes a fitness center, conference center, multi-purpose room and large cafeteria. Completion is slated for mid-to-late 2023. In addition to Skender, the project team includes CBRE Design Collective as architect and Environmental Systems Design Inc. as engineer.

MINNEAPOLIS — LSE Architects has opened a new 36,000-square-foot headquarters at 1401 Glenwood Ave. in North Minneapolis. The two-story office features 60 workstations, three private offices, an enclosed garage with 10 parking stalls and an exterior lot with 50 parking spaces. Kraus-Anderson served as construction manager. LSE projects near the new office include Hennepin County’s Sumner Library, the Washburn Center for Children, North Market, the MPS North High School Career and Technology Center renovation and the V3 Sports new aquatics center.

GAITHERSBURG, MD. — Edge Commercial Real Estate has secured the $4.1 million sale of a 32,000-square-foot office building located at 811 Russell Ave. in Gaithersburg, a suburb of Washington, D.C. Joe Friedman, Joshua Norwitz and Ken Fellows of Edge represented the seller, an affiliate of Finmarc Management Inc., in the transaction. Larry Rosen of Commercial & Investment Realty Associates LLC represented the buyer, an entity doing business as Russell Plaza LLC. Built in 1997 near I-270, the three-story suburban office building was leased to both office tenants and retail businesses at the time of sale.

OAK BROOK, ILL. — Skender has broken ground on the transformation of the former McDonald’s corporate campus in the Chicago suburb of Oak Brook. The 250,000-square-foot buildout will serve as the new headquarters of Ace Hardware. The project at 2915 Jorie Blvd. will consist of open workstations, 150 conference rooms, 12 cafes and a variety of collaboration spaces and amenities. Originally built in the 1970s and designed by Dirk Lohan, grandson of famed architect Mies van der Rohe, the campus consists of three buildings on more than 80 acres. The campus has sat empty since 2019, when the fast food giant moved its headquarters to Chicago’s Fulton Market. The renovation project will reuse and retain many of the main building’s original architectural elements, including a large atrium in the center. The first floor of the parking garage will be converted into an amenity suite that includes a fitness center, conference center, multi-purpose room and large cafeteria. Completion is slated for mid-to-late 2023. In addition to Skender, the project team includes CBRE Design Collective as architect and Environmental Systems Design Inc. as engineer.