LAWRENCEVILLE, N.J. — Delaware Valley Retina Associates has signed a 5,938-square-foot healthcare lease renewal at Princess Road Office Park in Lawrenceville, a northern suburb of Trenton. Larken Associates owns the property, which comprises 47,094 square feet of office and medical office space across two buildings on a nine-acre site. Vinny DiMeglio of JLL represented the tenant in the lease negotiations.

Healthcare

HOUSTON — Partners Capital, the investment and development arm of Partners Real Estate Co., has sold the Steeplechase Professional Building, a 61,165-square-foot medical office building complex in northwest Houston. Cary Latham of NAI Partners represented Partners Capital, which originally acquired the asset in August 2017, in the transaction. The buyer was not disclosed.

GERMANTOWN, TENN. — PEBB Enterprises has sold Germantown Village Square, a 199,142-square-foot mixed-use property located at 7670 Poplar Ave. in the Memphis suburb of Germantown. Evan Halkias and Margaret Jones of Cushman & Wakefield represented PEBB in its $35.5 million sale of the property to Hendon Properties LLC. Germantown Village Square includes 138,995 square feet of ground-floor retail space and 60,147 square feet of second-floor office space occupied primarily by West Clinic, a subsidiary of Baptist Memorial Health Services. Built in 1975 and renovated in 2000, the center was 90 percent leased at the time of sale to tenants including T.J. Maxx, DSW, Ulta Beauty, Old Navy and Five Below.

FAIR LAWN, N.J. — NAI James E. Hanson has brokered the sale of a two-story, 25,944-square-foot medical office building in the Northern New Jersey community of Fair Lawn. Darren Lizzack and Randy Horning of NAI Hanson represented both the buyer, TYH Acquisitions LLC, and the seller, an entity doing business as 2300 RT 208 LLC, in the transaction. Additional terms of sale were not disclosed.

WOODBURY, N.Y. — Day-Op Center of Long Island, which provides minor outpatient surgical procedures, has signed a13,233-square-foot healthcare lease at 225 Froehlich Farm Blvd. in Woodbury. The tenant will occupy the entirety of the freestanding building, which is located just off the Long Island Expressway. Timothy Parlante of The Feil Organization internally represented the landlord, which acquired the property in 2018. Eric Launer and Dawn Mirko of JLL represented the tenant.

KINGSTON, MASS. — The American Red Cross has signed a 5,000-square-foot retail lease at Summer Hill Plaza in Kingston, a grocery-anchored center located south of Boston in Plymouth County. Don Mace and Rob Grady of locally based advisory firm KeyPoint Partners represented the undisclosed landlord in the lease negotiations. The representative of the tenant was not disclosed.

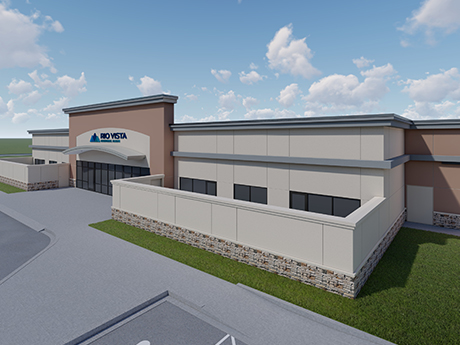

EL PASO, TEXAS — General contractor Adolfson & Peterson has topped out a 52,000-square-foot healthcare project in El Paso that is an expansion of the Rio Vista Behavioral Hospital. The project will add 40 beds, outdoor recreation spaces, an outpatient center and 14,000 square feet of parking space to the existing facilities. Full completion is slated for spring 2023. Tennessee-based Acadia Healthcare Co. Inc. owns Rio Vista Behavioral Hospital.

EDINBURG, TEXAS — Coldwell Banker Commercial has arranged the sale of a 61,000-square-foot medical office building in the Rio Grande Valley city of Edinburg. The three-story property was built on three acres in 2003 within Cornerstone Medical Park. Daniel Galvan and Michael Pacheco of Coldwell Banker Commercial represented the buyer and seller, both of which requested anonymity, in the transaction. The building was 99 percent leased at the time of sale.

NAPERVILLE, ILL. — Physician Real Estate Capital Advisors (PRECAP) has arranged the sale of a 19,900-square-foot building in Naperville for $15.2 million. Constructed in 2008 and located at 1243 Rickert Drive, the property is home to Suburban Gastroenterology and Midwest Endoscopy Center. In 2020, the endoscopy center underwent a 6,800-square-foot expansion and renovation. Scott Niedergang of PRECAP represented the seller, a physician partnership, and procured the buyer, a privately held company specializing in healthcare real estate acquisitions.

HACKETTSTOWN, N.J. — A partnership between Kayne Anderson Real Estate and Remedy Medical Properties has purchased Patriot Plaza, a 65,658-square-foot medical office building in the Northern New Jersey community of Hackettstown. Brannan Knott, J.B. Bruno and Craig Parcells of JLL represented the undisclosed seller in the transaction. The property, which also houses conventional retail space, was 95 percent leased at the time of sale.